The pound exchange rate ground to a two week low following the release of the latest services PMI which demonstrated the predicament the UK economy finds itself in, with much speculation around trade deals and a post Brexit services industry, notably financial services the latest figure will do little to inspire.

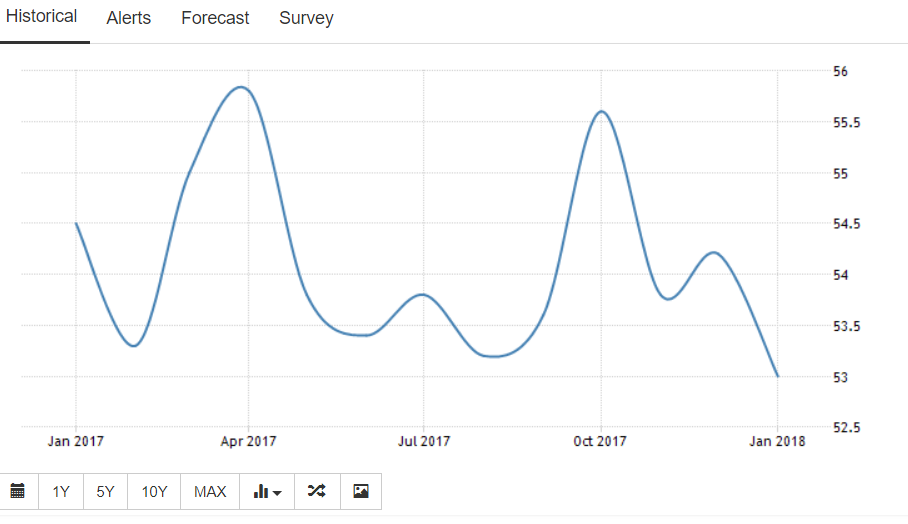

UK services PMI performance

The UK service PMI which is used to essentially gauge the level of business conditions in the services sector, the largest part of the UK GDP. Over the last six months, UK services data has fallen short on two occasions, matched the forecast estimate twice and exceeded target twice. By contrast, the Eurozone services data releases have met their forecasts in the last 6 months posting on target or slightly above estimate in the last 6 readings.

The services PMI reading highlighted that growth in the services sector growth has now slowed to the slowest pace in 16 months. Sectors which have faltered included restaurants and hotels. Whilst the sluggish January services data will do little to enthuse economists, they will be aware that January slowdowns do occur. Services growth rates can, however, be erratic and arguably should be viewed over a quarter rather than a single month.

What will the UK services industry look like in a post Brexit era?

Much uncertainty surrounds the condition the UK services sector will find itself in a post Brexit era due to the lack of clarity surrounding any levies applied to services industries or amendment to the VAT to services offered outside the UK.

In particular, the financial services sector which could find itself at a complete standstill if the UK government weren’t able to negotiate the necessary passporting and licensing for the UK to legally participate in the financial services sector.

Fundamentally the UK wrapped up phase one of the Brexit negotiations a few months ago and has been offered the choice of having a Norway style access to the single market of a Canada plus agreement. The model Norway adopted provides them access to the single market, but critically also allows the free movement of people in the EU. There is a deeper issue which is that Norway could look to renegotiate terms if the UK were allowed to select the pro and forego the cons.

The Canada style arrangement would allow to the UK to trade with the EU, retain control over its borders. However, the UK wouldn’t receive access to the single market, this regrettably would mean that services and the trade of goods would still be subject to taxation or levies.

The effects of the UK services PMI on pound exchange rates

Following the release of the latest services PMI data, the pound dipped from 1.1343 to below 1.13 hitting a low of 1.1280 Sterling’s losses have continued since with a raft of positive data from the eurozone retail sales figures. There also remains an undermining threat to Theresa Mays tenure with many conservative pro-Brexit MP’s calling for a tougher stance on negotiations which would lead the UK more towards a hard Brexit. The pro-Brexit MP such a Jacob Rees-Mogg threaten to, therefore, derail the slow progress which is being made and there are fears that a leadership challenge could be mounted.

GBP to US dollar exchange rates have also slipped under the physiological of 1.40 this week with the UK poor data, political wrangling weighing just as heavily on the GBP to US dollar exchange rates are the Euro. Following the services PMI data release the GBP/USD slipped from 1.4146 to 1.4043. Sterling’s losses have been compounded by the slump in the stock market and increasing treasury bond yields.

Pound exchange rates could also face another challenging week. Brexit talks reconvene in Brussels’s and the Bank of England is due to release its inflation report, they also vote on interest rate decision and provide the minutes that follow. Whilst highly unlikely that there will be any diversion from the UK’s 0.5% interest rate, investors will look for indications of inflation and the likely hood or future triggers for a UK interest rate rise.

Updates from Brussels will also be keenly awaited and will probably be of most assistance or detriment to pound exchange rates in the short term.