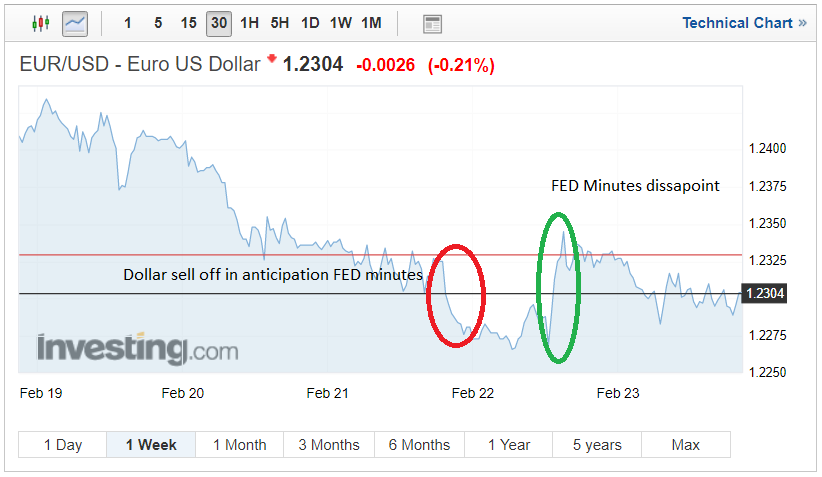

The Dollar had enjoyed gains against a host of currencies in the lead up to this months FED minutes. However, the gains weren’t all retained after the FED minutes; a great example of this was Euro-Dollar exchange rate. The FED minutes which were the last chaired by Yellen signalled the beginning of Powell tenure and potentially a new style and approach to monetary policy.

Condition of the US economy

The FED minutes illustrated in depth the state of the US economy which continues to provide cause for great optimism. The triggers for the more optimistic overview including the December’s tax cuts and the continued strengthening of the global economy. All indicators supporting the argument for short-term rate hikes and further monetary policy action.

The FED also predicted that Decembers tax rate cuts will assist in correcting the US economy’s low inflation. The Tax cuts are predicted to increase consumer spending although the FED remain unsure of how the tax cuts will affect real wages.

US hourly wages are currently increased at a rate of 2.9% this month, this was combined with a 0.5% increase in the consumer price index.

Gradual approach to be adopted with US interest rate rises

The Federal reserve bank are sticking to their theory of slow and steady wins the race. The FED confirmed again that a gradual approach will be adopted in order to ensure hikes are sustainable. The FED stated:

“They judged (FED members) that a gradual approach to raising the target range would sustain the economic expansion and balance the risks to the outlook for inflation and unemployment.”

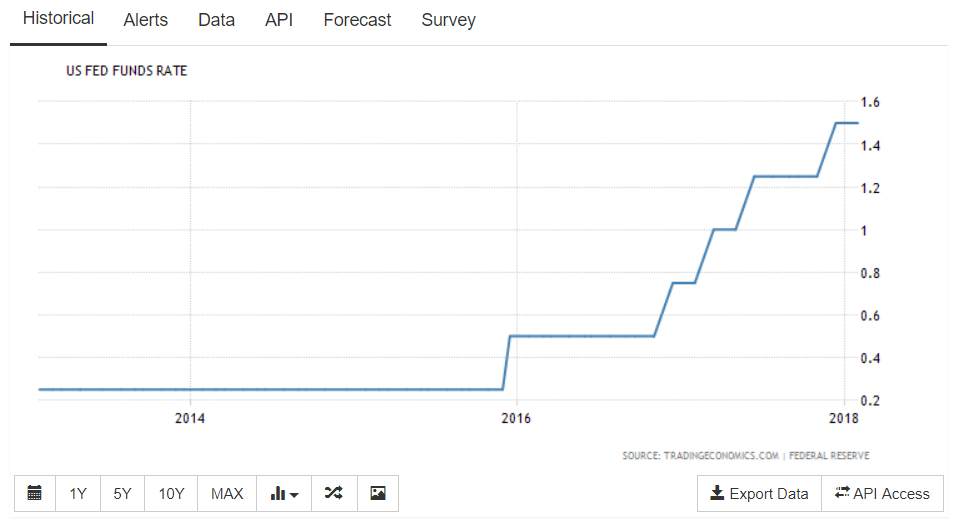

Once again, US interest rates remained unchanged this month however pressure and reasons to hike continue to be piled on the FED and some experts are now predicting four rather than three interest rate hikes, against three implemented last year.

Whilst a rate hike from 1.5% to 1.75% is almost a certainty in March. A key focus for the FED will also be to continue reducing their mounting balance sheet.

The next US economic projections revised up

The US economic outlook would appear to look healthier still but unemployment remains low, the job market is buoyant and it would appear that wages are on the rise. Whilst the FED is currently unable to quantify the effects of the recent tax cuts a potential $1.5 trillion in the pockets of consumers should contribute greatly to consumer spending. Middle America will also feel slightly more confident in the stock market which appears for the moment to have weathered recent large swings and appears to be on slightly sturdier ground that seen in recent months. The FED’s confidence on inflation will also bode well for investors with the FOMC confident that inflation will slowly make its way to the ideal of 2%.

FED meeting effects on other aspects of financial markets

The FED minutes provoked a reaction from both US Treasuries and US stock markets. The Dow Jones, S&P and Nasdaq all rose between 0.95 and 1.3%. Bond markets had a more varied reaction, 2-year Treasuries rose before correcting to 2.246. Ten-year Treasuries rose in anticipation of the FED minutes before flatlining at 2.8914%.

Euro – Dollar Fed minutes reaction

In anticipation of the FED minutes, the Euro-Dollar exchange rates slipped as investors got behind the Dollar. Arguably investors and market makers had sought more aggressive rhetoric rather than a slow and sure approach to future interest rate hikes. The FED tones ensured that the gains made against the EURO were almost immediately erased.

The Euro-Dollar has been able to keep hold of the majority of its gains undoubtedly because of the measured approach from the FED. Expect further pressure on the dollar this week with a positive Euro-Dollar trend expected move step up a gear. The Eurozone and Germany’s key economic data includes preliminary inflation figures and the US is to release its Quarterly preliminary GDP. However, the majority of potential Euro-Dollar movement will probably be instigated by US CPE inflation figures which are released Thursday and activity of US Bonds and Indices.