The cryptocurrency currency market is notoriously volatile but in recent times, certainly since Brexit, the US Presidential elections, the coronavirus pandemic, and lockdown restrictions, fiat exchange rates have fluctuated as much as 5% from one week to the next. This level of currency movement does not matter what the type can have a major impact on the cash flow and profitability of businesses that trade internationally. It is all linked to the US dollar and certainly makes payments for goods and services less stable than before.

Risk management includes planning ahead. It can minimize exposure, which is why it is so important to stay up-to-date with the latest currency news.

Our guide below gives you a brief overview of what to be aware of that will have an impact on both cryptocurrency and foreign exchange market movements.

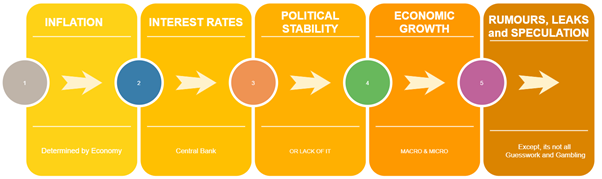

The image below summarizes the five factors that affect the currency exchange rates.

Inflation

We know it’s boring, but inflation is a major economic indicator and does cause considerable swings in exchange rates.

Various countries have a few different measurements for inflation. The Monthly Consumer Price Index (CPI) is generally seen as the preferred measure by most investors, and it applies to most countries.

Typically, a country with lower inflation rates would expect to see the value of its currency rise, indicating strong consumer spending power. Post financial crash in 2008, central banks had to slash interest rates, but now, after a general global recovery, inflation is gradually rising. A control over increasing prices will prevent inflation from running too aggressively for too long, while low inflation could lead to rate cuts back down despite them being at historic lows. The Bank of England uses monetary policy tools to control inflation to promote financial stability in the country.

- Higher inflation makes users look to bitcoin as protection against increasing costs. The crypto is used as an inflationary hedge to protect them against inflation. They are more resistant to inflation than currencies like the US dollar.

- When inflation increases, the central government prints more money. But bitcoin is a top cryptocurrency designed to resist inflation as its supply is limited. It is used as a popular hedge when there is high inflation. Bitcoin and altcoins are stable when inflation increases. Bitcoin resists inflation as it has a limited supply of 21 million bitcoin.

- Inflation affects the stable coin pegged against a fiat currency, as the reserve currency loses its value. Institutions prefer investing in cryptocurrency using it as a medium of cryptocurrency exchange.

Interest rates

The central bank of a country sets its interest rate. It is a valuable tool to manipulate or influence inflation (as above) and currency values. It acts as a link in the cryptocurrency market too. Raising interest rates encourages consumers to save their money rather than spend it, as they can get more money for it is in a savings bank, pensions and investments. Another key piece is keeping a lid on inflation and offering greater returns for lenders (financial institutions). It attracts foreign capital and prompts exchange rates to rise.

Central banks will often try and prevent any major shocks to the market by communicating their interest rate plans well ahead of time. They use their regular policy (monthly) meeting, as a way of offering some forward guidance and giving “the city” stability as best they can.

Interest rate moves are often a major catalyst for movement in exchange rates, with shifts of over 1%, fairly common after a rate hike decision. The central bank policy meetings and calls are major data releases in the financial calendar across all continents.

- To curb inflation, the Fed increases interest rates. When interest rates charged by banks increase, it leads to slow spending and reduces prices. It helps to control inflation.

- The Monetary Policy Committee (MPC) releases statements on changes in monetary policies in the UK. The cryptocurrencies are volatile during these policy announcements.

- The Bank of Japan has set negative interest rates at -0.1% to prevent economic damage from the corona pandemic. Cryptocurrencies are considered safe-haven investments during this pandemic, setting crypto prices higher.

Political stability, or lack of it

We are British, and we have Boris Johnson as our Prime Minister, so we know all about political instability and a useless cabinet and government. If you’re one of our American readers, you will also understand this (no need for details… ahem… Trump). There is nothing currency markets hate more than uncertainty, and our value of £ is evidence of this. Oh, wait, there is uncertainty involving politics or a possible change in government. We could write a whole article on this topic alone.

Currency traders typically favour currencies belonging to political and economically stable countries due to their likelihood of delivering a return on investment, such as the Swiss Franc or Japanese Yen. These safe haven currencies have a strong, popular government, sound economic plans, and infrastructure and generally, don’t entertain war or a strong, invasive foreign policy.

In the wake of the UK’s decision to break from the EU known as “Brexit”, the impact of politics on the currency market has become even more pronounced, with events like 2017’s snap election, triggering significant shifts in the pound value. Brokers and commentators see the value of a currency as the cleanest way to determine the sentiment and economic strength of the country.

- When political instability increases, inflation sets in. It increases market volatility in fiat currencies. Bitcoin becomes a safe-haven asset in such circumstances.

- Political upheaval in Europe and fears about a rise in populism has also had a detrimental impact on euro exchange rates in recent years. Remember the times when Donald Trump’s chaotic presidency caused wide swings in the US dollar.

- The political instability in Turkey caused much panic on the Turkish Lira, weakening it to record lows.

Economic growth (macro and micro)

Most causes and catalysts of the majority of day-to-day movements in the currency market are driven by the various pieces of economic data published by individual countries. One of the most important of these releases is Gross Domestic Product (GDP), which provides the broadest measure of how an economy performs. It is generally what analysts will be referring to whenever they discuss ‘growth’. It is a fundamental measure as to when an economy has entered a recession.

Economists are great at analysing the past and not great at accurately predicting the future. GDP is known as a lagging indicator, with estimates of growth usually coming months after events and trends have occurred.

- It is typically an accumulation of small parts of economic data that build into a macro picture of GDP. GDP prompts the largest reaction in the FX markets and crypto markets.

- Despite the global pandemic, the crypto market is on the rise. The market capitalization has risen to more than $1 trillion in 2021. More users are investing in the crypto market.

- Bitcoin accounts for almost 69% of the total market value. Big players and institutions are investing in cryptocurrencies.

- New technology has made cryptocurrency gain attention. Economic developments have revolutionized the crypto exchange in international trade. Ripple’s XRP is used for cross-border payments for company transactions. Prices spiked as Japan and South Korea tested XRP for the international transfer of funds. XRP is in high demand in Southeast Asia.

- During the lockdown, more users are investing in cryptocurrencies. Announcements from big institutions like PayPal and Visa have brought in fresh users in the cryptocurrency market.

Rumour, leaks and speculation

It’s not just school where this activity occurs. All the above points feed into how investors perceive (crucial word) a currency or stock will perform both in the short and long term.

Should traders believe an asset, stock, equity, or (crypto) currency is likely to increase in value, they purchase it. They buy it to sell it in the future for profit, or vice versa if they forecast that the cryptocurrency will weaken.

This “speculation” is not guesswork or gambling but a way of getting ahead of the market that can, in large volume, impact values. Cryptocurrencies usually move long before an event happens. Its demand is driven by investors looking to make a profit and act on the speculation.

Investors guess what cryptocurrency to invest in by gathering news through rumours. You can remain updated about rumours, leaks, and speculation through various sources. Traders prefer to “Buy the rumour and Sell the news”.

An example, however, when this didn’t go to plan was when analysts forecast a Hilary Clinton victory when in fact, Trump triumphed in the 2016 Presidential election. But predictions about Joe Biden as President in 2020 were on the mark. The market had factored and built in an economic forecast about the situation. But in fact, there was no chaos and immediate drop in the US dollar.

- Crypto ETF: You can keep track of the value of the cryptocurrencies and trade them on traditional market exchanges through Crypto ETF. Some of the best crypto ETFs are LEGR, BLCN, BLOK, and DAPP.

- Crypto Reddit is a discussion platform that most cryptocurrency enthusiasts enjoy. You can buy badges and use animated emojis with crypto Reddit currency. VeChain gains popularity on Reddit cryptocurrency internet forums. Tether, Polygon, Stellar, and Tron are other currencies on the Reddit Cryptocurrency list.

- At Robinhood crypto, there is no need to buy full coins. You can place an order to buy/sell cryptocurrencies in fractional quantities.

- Users can keep track of their crypto portfolio through CoinTracker and calculate taxes. Cointracker is crypto tax software that is most trusted. You can see your investment ROI, portfolio, and taxes instantly on it.

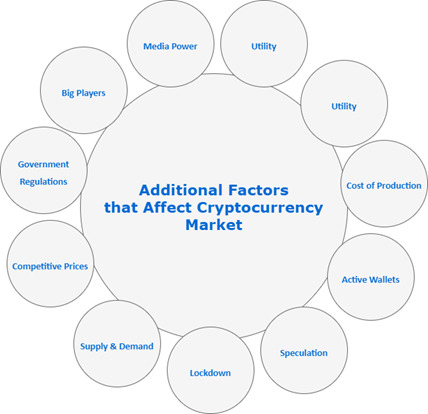

Additional Factors that Affect Cryptocurrency Market

Additional factors affect the movement of the cryptocurrency market. They play a vital role on decisions made by crypto traders and investors.

- Utility: The utility of the coin helps to determine its value. Cryptocurrencies use Blockchain technology to function. When its usage on the Blockchain manifests, it gains higher value. Payment of dividends and their exchange within the Blockchain environment are other factors that determine its value. In terms of utility, some of the best crypto exchanges in 2021 are Coinbase, Binance.US, Kraken, etc.

- Bitcoin allows users to transact in their own time with complete freedom.

- Technological developments in ether brought a rally in its prices. The Uniswap V3 introduced in May 2021 optimized Ethereum trading. The NFT or non-fungible tokens increased the market cap of NFT by almost ten times between 2018 and 2020. The nft crypto is becoming popular as a way to buy and sell cryptoartwork.

- Retail investors are becoming aware of the deflationary nature of cryptocurrencies. It makes for hedging against massive market shocks.

- Global governments are working towards the creation of their own digital currency.

- Demand for Crypto: The demand and supply for crypto determine the value of the cryptocurrency. When an imbalance occurs between the demand and supply, it increases the prices of the crypto. Bitcoin is the favourite of users, creating a higher demand for it. Its rising popularity is the reason for its price increase.

- The prices of ether surged on the launch of Ethereum 2.0. The upgrade reduced transaction fees for DeFi trading. It raised the demand for Ethereum, which brought a surge in prices.

- The emergence of decentralized finance or DeFi was another innovative launch that raised the financial interest of users into the ether.

- The launch of the sell-and-buy cryptocurrency feature in the crypto by PayPal has brought in more users. It has created more demand for digital tokens.