This week both the Europe and Northern America had been focusing on deals. Europe seeing possible developments with the deal between the UK and EU and Northern America reaching their deadline to finalise the new NAFTA agreement. Whilst US officials plan to meet the Canadians next week to pursue the agreement, its understood that the US and Mexico will formalise the terms the two countries agreed this week.

The outcome followed four long days of negotiations between the US and Canada which proved less fruitful than those held by the US and Mexico. The US firmly left the ball in Canada’s court as to whether they wanted to remain part of the trade agreement.

Although the US apparently plan on reaching an agreement with Canada soon, the deal for Canada at least remains up in the air, with Canada clearly uncomfortable with the terms.

The White House’s deadline came and went on Friday with no progress reported to Congress in order to solidify a trilateral agreement before Mexico’s new left-wing President Andres Manuel Lopez Obrador starts his tenure. The uncertainty of whether Canada will be involved in a future agreement weakness in the Canadian Dollar.

White House offers Canada more

Despite the NAFTA deadline being passed without an agreement, it would appear the White House is keen to formalise an agreement. In recent months the US and Canada’s relationship has soured significantly, with comments and tweets dividing the leaders of the nations as well as the US and Mexico uncharacteristically apparently excluding Canada from negotiations.

Therefore, Canada’s negotiation team will find solace in the extension that Washington has offered in order to seal a potential deal. They did, however, state that Canada must be willing to offer the terms on offer.

Robert E. Lightizer notifying Congress stated:

“Today the president notified the Congress of his intent to sign a trade agreement with Mexico — and Canada, if it is willing — 90 days from now.”

Essentially the final decision will remain with US Congress and can only be ratified with their approval. Canada currently exports to 36 US states which has prompted concern that the no deal outcome could harm to trade within those states. It also remains a very real possibility that US Congress to decline a new trade agreement without Canada’s involvement. This, in turn, rendering a humiliating outcome for President Trump and the Republican party.

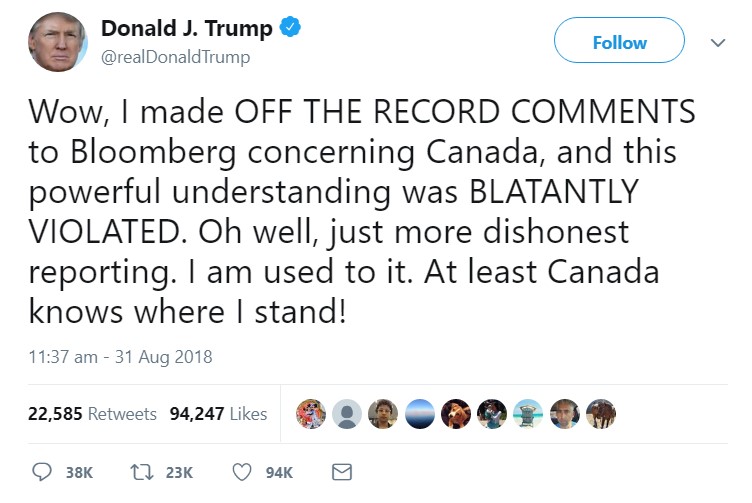

More scandal from Trump

Despite the apparent necessity for Canada’s involvement in a future pact President Trump has still leant towards the rationale that attack is the best form of defence. The Toronto Star reported recently on comments that the President issued to Bloomberg News during an oval office meeting. Essentially the president said that he planned on making zero compromises with Canada, saying that he couldn’t make the comment publicly because

“it’s going to be so insulting they’re not going to be able to make a deal.” Continuing Trump said “Here’s the problem. If I say no — the answer’s no. If I say no, then you’re going to put that and it’s going to be so insulting they’re not going to be able to make a deal … I can’t kill these people,” pointing reference to the Canadian Government and negotiation team.

Despite the supposed comments being classed as of the record to Bloomberg they are now in the public domain and will do little to assist the hostilities between the two parties.

Whilst speculation is rife as to whether this was a tactic adopted by Trump to discourage or potentially encourage Canada it has not avoided the attention of Prime Minister Trudeau whose officials have promptly challenged US officials.

Trudeau meanwhile remains resolute and stated in Oshawa yesterday that ‘’we will only sign a deal if it is a good deal for Canada.”

Why wasn’t a deal reached?

If we were able to put the schoolyard behaviour aside key issues with the deal still remain. The US is demanding that Canada opens access to US Dairy products, enhance patent protections and abolish the use of dispute panels between governments and investors.

Dairy for the US remains a critical part of the agreement, however, Prime Minister Trudeau is remaining firm and the US have stated that Canada has made no concessions on this part of a potential agreement. Currently, Canada sets quotas for milk and dairy production which in turn allows the government to manage pricing. The industry has always feared a flood of US dairy products could dramatically affect the market if Canadian Farmers were less protected.

USD/CAD steals a march

Whilst the possibility of a deal being reached remains far from implausible the deadline passing did provoke reaction, the Canadian dollar falling against its US Counterpart. USD/CAD up 0.45% on Friday following the no deal outcome. The currency pair touching an intraday high of 1.3085 having opened at 1.2971.

Dollar had its tail up as investors diverted away from the Euro and US Dollar. This week’s US Prelim GDP economic data being nothing less than a home run.

Trump’s leaked comments also did not help the CAD, causing the US Dollar to spike to 1.3085aginst CAD. Canadian monthly GDP data also flatlined missing its expectation of 0.1% growth, in turn meaning a September rate rise would equate to a very remote possibility at best.

Featured image: © M.Dörr & M.Frommherz – stock.adobe.com