A report out this month from Greenwich Associates, a consulting firm, has revealed that 70% of financial experts do see a very definite future for cryptocurrency within the finance industry.

The new survey revealed most of the 141 institutional investment executives polled believe that a regulatory framework will develop around cryptocurrencies, leading to growth and innovation. On the flip side, most will fail but a select few will survive and will go on to be prominent in the mainstream of society. Furthermore, 10% of respondents believe that cryptocurrencies will remain a fringe asset class as it is now without mainstream with 10% feeling that a regulatory crackdown will eliminate the market altogether.

Author of the report, Richard Johnson, VP at Greenwich Associates commented:

“They’re (finance institutions) telling us that they don’t think it’s going away and that it’s here to stay.”

We’ve long supported the future of cryptocurrency and you can read our views and predictions on the future of cryptocurrency.

The report goes in to more interesting and specific detail identifying two major areas under development that could help make cryptocurrency more accessible to banks, asset managers, hedge funds, and other large organizations: financialization and Custody. Financialization refers to the development of products like futures and ETFs that allow institutions to gain more exposure (with less risk) to cryptocurrencies. Custody, however, refers specifically to how cryptocurrency is stored by its owner.

The survey indicates sustained optimism in the space. The New York Department of Financial Services continues to approve stablecoins each month and this is evidence of institutional progress in cryptocurrency. He continued “We’ve had a terrible market for crypto this year, but people are still coming out with a lot of great innovation and a lot of great ideas,” he says.

75% gearing to buy more

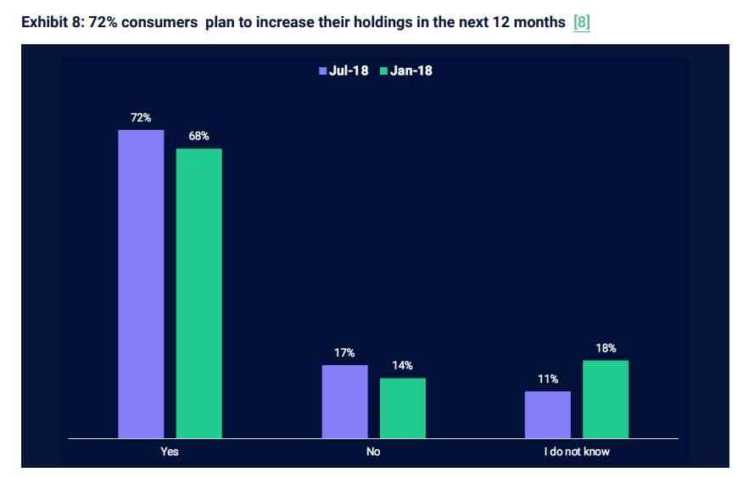

A majority of accredited cryptocurrency investors and 72% of retail investors plan to increase their cryptocurrency holdings in the next 12 months, a survey conducted by securities trading platform SharesPost in July. In total, 2,490 retail investors and 528 accredited investors, found that current cryptocurrency owners remain “highly-bullish” on the cryptocurrency, but they now expect mainstream adoption to “take longer than they had when asked earlier in the year.”

A delay in mainstream uptake by most of society has been delayed by 5 years as most surveyed put their predictions back to 2025 instead of the year 2020 when Bitcoin was riding at its all time high of $20,000. The reasons given for the delay were a lack of education and commercial use cases as one of the most pressing challenges for blockchain adoption. Trust and hacks also rated highly in feedback given to the delay in mass adoption

Statistics from the survey continue with accredited investors 59% planning to increase their holdings within the year and 57% expect to see prices rise by next summer. The positivity comes from the retail investors with a 72% and 66% split when asked the same questions. Retail investors are more emotional and bullish on investments they have made as typically it is backed and linked with their own financial wealth.

Difference weren’t just in opinions but holdings. Investment portfolios differed between accredited and retail investors, successful investors regardless favoured altcoins, while consumers were most likely to own bitcoin (BTC), followed by ether (ETH) and Litecoin (LTC), accredited investor portfolios most often held ETH, followed by BTC and Ripple (XRP).