Argentina, Venezuela And Egypt reach record P2P bitcoin trading volumes

To complement what has been very successful for India, the struggling economies of Argentina, Venezuela and Egypt have also registered a huge spike in the P2P cryptocurrency trading, albeit for different reasons.

According to the report, Peer-to-peer (P2P) trading platform LocalBitcoins hit record-breaking Bitcoin trading volumes in Argentina, Venezuela and Egypt during the month of October. However, in contrast, Croatia and Switzerland amongst other jurisdictions have seen trading volumes have hit yearly lows.

86% of ICO tokens below their ICO listing price

One of the leading global professional services firms, London-headquartered Ernst & Young (EY) reported about a third of all cryptocurrencies financed via online sales in 2017 have lost “substantially all value.” Furthermore, the report found that 86% of coins sold via ICOs last year are now trading below their initial sale prices. The 372 projects analysed did little to inspire confidence, while 30% have lost substantially all the value.

As per the report, in an applied example, an investor purchasing a portfolio of The Class of 2017 ICOs on 1 January 2018 would most likely have lost 66% of their investment. Of those, only 29% have working products or prototypes, up by just 13% from the end of last year. Of those 25, seven companies accept payment in both traditional fiat currency (dollars) as well as ICO tokens, a decision that reduces the value of the tokens to the holders further.

Zebpay expands to Malta

Having had to pivot from India, Singapore-headquartered cryptocurrency exchange Zebpay has now registered its presence in Malta as well, according to Quartz. The company is currently operational in 20 countries. The move comes after emerging powerhouse economies of India and China, having restricted their market for cryptocurrencies. Malta has recently gone on to brand itself a “Blockchain Island.” Ironic, however, as the country still lacks blockchain professionals with 40% of those professionals could actually crack the government’s cryptocurrency certification exam. On the same theme, US-based cryptocurrency exchange Coinbase, which has its presence in 32 countries, has evolved into a new office in Ireland as post-Brexit strategic move.

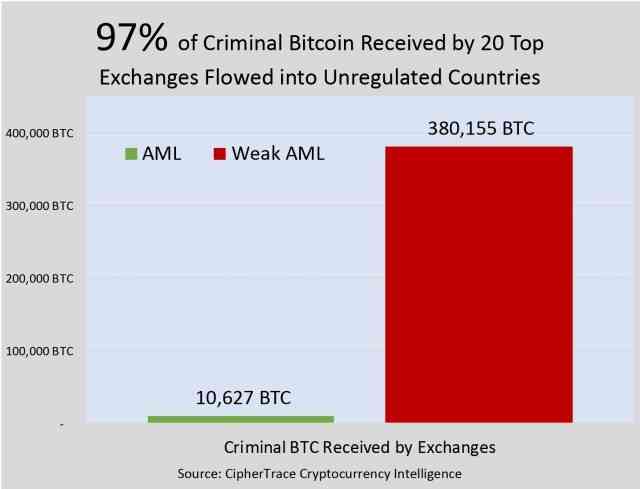

Unregulated crypto exchanges launder 97% of criminal bitcoin flow

“Most” of the illegal cryptocurrency transactions take place on exchanges which are not regulated, which lacks strong Anti-Money Laundry (AML) regulation and KYC in place reveals a research — CipherTrace 2018 Q3 Cryptocurrency Anti-Money Laundering Report. However, the definition of illegal isn’t clear as it would be different for different jurisdictions.

It one of the biggest arguments against Bitcoin and Cryptocurrency – according to the research, 97% of direct Bitcoin payments from criminals went to exchanges in countries with weak anti-money laundering laws. The report continued, 5% of all Bitcoin sent to poorly regulated exchanges originates from criminal activity pre-money movement. These exchanges have laundered a significant amount of bitcoin, totalling 380,000 BTC or $2.5 Bn at today’s prices, claims the report.

Speaking of the findings, Dave Jevans, CEO, CipherTrace and co-chair of the Cryptocurrency Working Group at the APWG.org commented, “We will see the opportunities to launder cryptocurrencies greatly reduced in the coming 18 months as cryptocurrency AML regulations are rolled out globally.”

This year alone, $1Billion worth of cryptocurrency reported as stolen from exchanges.

Cryptocurrency: Fidelity announced its Fidelity Digital Asset Services

The commitment of large financial firms took a greater leap this week with a new arm. The new company will offer custody and trade execution for solely digital assets. This is a strategic move to diversify and target institutional investors such as hedge funds and family offices.

“Our goal is to make digitally native assets, such as bitcoin, more accessible to investors,” Fidelity Investments Chairman and CEO Abigail Johnson said, as quoted by CNBC. “We expect to continue investing and experimenting, over the long-term, with ways to make this emerging asset class easier for our clients to understand and use.”

One of the steps in realizing this is to create a foundation of institutional solutions that will advance the industry. While there has been growth in retail service providers in this arena, there is a gap in support for institutions.

Fidelity could change all this – not only will the company offer client services, and trade execution, it will provide a secure, compliant storage solution. It aims to help foster growth and potential further interest among institutions and importantly, trust.

Goldman Sachs and Michael Novogratz invest in BitGo

We’ve covered before Goldman Sachs input into cryptocurrency with large effect. This week Michael Novogratz and Goldman Sachs announced they’re investing in “the world’s most secure Bitcoin wallet” (their words), BitGo. Both are investing about $15 million into BitGo’s Series B funding round.

According to CEO Mike Belshe:

This strategic investment from Goldman Sachs and Galaxy Digital Ventures validates both our market opportunity and unique position. No one is better positioned than BitGo to serve institutional investors who want to trade cryptocurrencies and digital assets. That’s why we’re focused on figuring out what it takes to secure a trillion dollars. The market’s not there yet but our job is to be ready first.

Greater institutional participation in the digital asset markets requires secure and regulated custody solutions, said Rana Yared, Managing Director of Goldman’s Principal Strategic Investments group. “We view our investment in BitGo as an exciting opportunity to contribute to the evolution of this critical market infrastructure.

Institutional investors are gradually realizing that digital assets are going to be a game changer, and they want to participate, said Michael Novogratz, Founder of Galaxy Digital Ventures LLC.