The cryptocurrency market continued a sharp and intense sell-off as investors head straight to cash in their investments amid more volatility. Oil price decline, a pending bear market and the fallout from the bitcoin cash fork and are contributing to another 6% of major tokens this week.

The total market capitalization of all cryptocurrencies — which is calculated by multiplying prices by the number of tokens in circulation — had fallen to around $138.6 billion, according to CoinMarketCap data. This week signals the lowest level since September 2017 and a more than 80 % decline. For many coins, they are below the price they were before October 2017. The 80% correction translates to almost $700 billion since the peak of over $830 billion their market value reached at the start of the year.

Prices were hit with an initial downturn last week, ending months of relatively stable trading for the world’s biggest cryptocurrency, Bitcoin. The price had started to settle and trade in a tight range yet on the back of news that Bitcoin Cash (previously forked last year) which is essentially a digital ledger with no central authority overseeing it, split into two, an event known as a “hard fork.”

Huge upside predicted in the long term

Regardless of the shudder and drop in prices across the board, more and more commentators are coming out as macro, long-term bulls on cryptocurrency.

Cryptocurrency expert Lou Kerner, from CryptoOracle, discussed the latest development in bitcoin’s value. Mr Kerner said that bitcoin is the “greatest store of value ever created and it should surpass gold over time but it’s not going to happen overnight.” Of the recent plunge, he said: “Nobody likes being down like this but this is part of what investing in crypto is all about.”

This was in a week where Ripple’s XRP held firm initially and bounced back cementing 2nd spot in the list of cryptocurrencies by market cap and dominating over 10% of the total cryptocurrency market size.

It fuels the continuing debate that last year and in general, that Cryptocurrency is a bubble

“I wouldn’t compare the current state of the crypto market to the dot-com bubble,” Angel Versetti, CEO of the blockchain technology firm Ambrosus commented “While there are similarities in terms of overvalued new technology startups with unproven or unsustainable business models that were incessant in both dot-com and crypto, the sheer scale of crypto and dot-com businesses are not comparable. I do not believe we are, or were, anywhere close to a bubble with cryptocurrency.

It’s undeniable that we are experiencing a strong correction, but the bubble has not formed yet. We know financial firms and institutions are gearing up to commit to cryptocurrency in the not so distant future. Versetti continued “I think when all cryptocurrencies and tokens will be worth 15-20 trillion USD, that will be a bubble.”

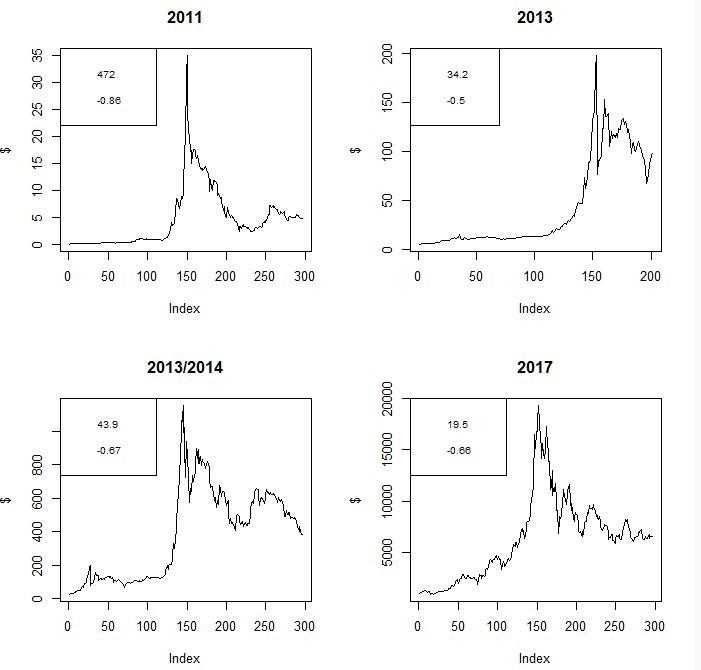

The graphs below pulled from a fellow blogger on Twitter demonstrated the price action of Bitcoin and its similarity from history.

A lot of comparisons are constantly made between the tech bubble of the early millennium and the Cryptocurrency bubble of 2017, and there are similarities. However, experts also note that one of the biggest casualties of the dot-com bubble was Amazon, which saw its shares fall from $300 in 1998 to $6 in 2000. In percentage terms, this is a lot worse to what has happened to Bitcoin on several occasions and now Amazon’s share price is now more than $1,500, having become only the second company in history to reach a market value of more than $1 trillion earlier this year.

Matthew Newton, an analyst at the online investment platform eToro commented “While this is inevitable, I’d venture to suggest it’s not particularly useful – it’s a bit like proclaiming the end of the FTSE 100 at the end of 2008. One of the benefits of a bear market is it weeds out people who are looking to make a quick buck and aren’t interested in the underlying technology. Those who understand the technology and see its benefits tend to stick around, adding value to the market.”

In order for the benefits of the underlying technology to be realised and the price of bitcoin needs to stabilise and eventually rise again. The way forward in many people’s eyes within the cryptocurrency industry is greater regulatory oversight in order to boost investor confidence.

Finance institutions and governments globally are beginning to accept that cryptocurrencies are likely to become an integral and possibly necessary part of the financial system. Putting aside short-term price fluctuations, it’s clear that the cryptocurrency community is here to stay, with institutions offering new modes of trading such as options, futures and trading on margins. The last few months have seen the beginnings of clear initiatives from the FCA and SEC to build out a coherent policy (decision still pending, it’s important to add) on reflection it’s hard to see why it’s taken 10 years for actions. Despite the short-term pain and teething problems, it still feels like we could be looking back and asking “How were prices that cheap?”