The pound sterling fell before clawing its way back following Brexit supreme court case outcome.

The Brexit courtroom drama played out immediately following the outcome on pound sterling price seeing the currency initially lose out against the majors before levels earlier seen earlier in the session were recovered.

Outcome of the Brexit Hearing

A Judgement was passed today at the supreme court confirming that the government will indeed have to seek parliament’s approval to begin the Brexit process and notably the triggering of article 50.

A bill is expected to be with parliament shortly. However, the outcome means that negotiations with the EU cannot begin until the approval is granted.

The court hearing was initially started by a number of campaigners who protested that denying Parliament the ability to vote was by default undemocratic. The main propagandist Gina Miller led the case against the government insisting the leave campaign had exasperated and played on the worries of the UK public, she also felt passionately that some MP’s were unconscious to the real risks of Brexit.

Although the hearing’s outcome was 8 – 3 in favour of the parliamentary vote the supreme court dismissed the idea that other nations including Ireland, wales and Scotland could indeed the decision sparking fears of a second Scottish referendum. This dismissal attributed in part to the Pounds initial losses due to their lack of ability to vote or contribute to Brexit negotiations.

Brexit White Paper

Just a day later from the court outcome and David Davis’s admission the Conservative government appeared to refrain from the preparation of a White paper, essentially outlining the Governments Brexit plans in full. Seen by many as a token gesture to opposing MP’s it will no doubt provide more needed clarity than the previously debated 12-point plan and potentially sway any remainers-on. The admission providing more buoyancy for the Pound as many have criticised Theresa Mays apparent lack of a detailed plan.

Home Nations Lack of Vote to be Discussed at JMC

Following the court’s and announcement of the much awaited White paper Scottish first minister Nicola Strurgeon warned Theresa may to ‘heed the voice of Scotland’. Her wish to have further clarity on the PM’s plan before the recently announced joint ministerial committee which will be hosted in Cardiff this week. The meeting whose attendee’s include governments from Scotland, Wales and Northern Ireland are looking to use the meeting as a way of having a voice on future Brexit talk and Scotland and wales are expected to present plans for them to remain within the single market.

How and Why the Pound Sterling Fell Before Clawing its Way Back

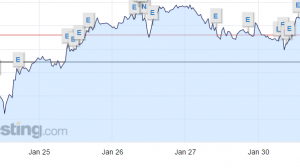

Initially, during the build up to the court case GBP/EUR fell to a low of 1.1561 however with the announcement of the Supreme court’s ruling and the Conservative government announcing the request to parliament within 48hrs and clarification of the publication of a white paper the GBP has recovered.

The GBP/EUR high saw the pound sterling briefly breach 1.1804 on Thursday the 26th.

Cable combined with a steady USD weakening due to worries over Trump’s policies also saw gain following the supreme court ruling seeing the GBP/USD moving from 1.2497 to 1.2591 in just a few hours. The GBP/USD continued to gain during the following days hitting a high of 1.2673.

Currently, the GBP/EUR sits around the 1.177 mark with GBP/USD hovering around the 1.251.

Many envisage that the pound will remain fairly range bound until either the official triggering of Article 50, approval or rejection of Brexit from Parliament or the publication of the Brexit White Paper.

If you are looking to navigate your international transfers around political rhetoric or fundamental data and require some guidance, please feel free to contact us on [email protected].