The end of the week saw the Canadian Dollar gain further ground against the US dollar with oil prices and the gap between Canadian marketable bond and US treasury’s yields narrowing. The combination spurred the CAD/USD pair to a 3-month high.

Despite recent warnings from Canadian economic data that demonstrated the economy had slowed in the final part of 2018 the oil driven currency has prospered with some thinking there could be further possible gains against the US Dollar.

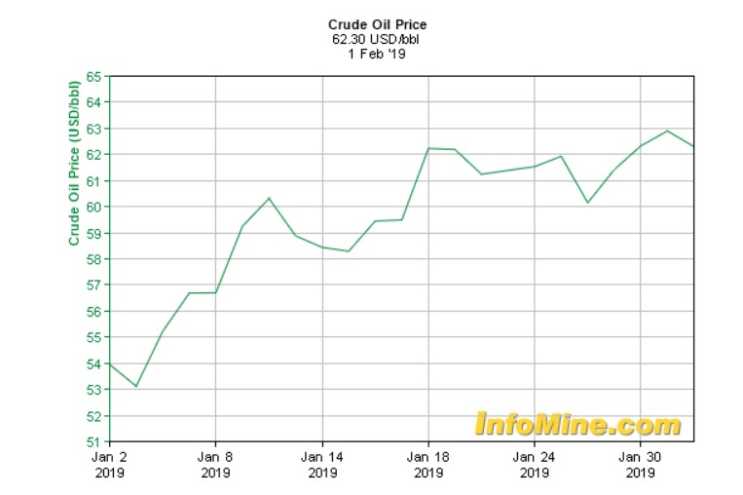

Crude oil prices touch $62.75

Crude oil futures began trading higher on Friday reaching highs last traded in November. The oil market pricing is being supported OPEC initiated supply cuts and new optimism surrounding US and Chinese trade talks.

Recent sanctions on Venezuela alongside the OPEC supply tightening could see oil prices spike higher with the CAD likely to follow.

On Wednesday China announced the 2 super powers had made ‘’important progress ‘’. The two-day meeting held in Washington has been reported as being fruitful with President Trump sharing China’s sentiment, claiming ‘’We have made tremendous progress’’.

During the talks China agreed to purchase more US soybeans helping with good will. Both parties anticipate an agreement will be reached by March 1st in order to avert further tariffs.

Canadian and US treasury yields narrow

The spread on 10-year Canadian bond yields and US treasuries shrank by 2.6 basis points on Friday afternoon, narrowing to just 73 bp in the US treasuries favour. The decline being caused by the positive talks between China and the US in Washington which could lead to a deal by March. The reduction in spread being the smallest since January 7th.

The US 10-year treasury yield has increased significantly over the last few days with the US labour market growth, trade talks and rise in oil prices all instigating a more upbeat market sentiment despite inflation still sitting at far from ideal levels. Currently 10-year treasury notes sit at 2.684.

Canadian Dollar crowned G10 currency leader

Whilst the Canadian Dollar endured a challenging 2018, falling by 7.8% against the Dollar the last quarter has seen the Loonie gain over 4% against its US counterpart year to date. The recent gains allowed the CAD currency to hang on to first place on the G10 league table.

Despite the Canadian economy demonstrating a contraction of -0.1% in November the USD/CAD has slumped to a week low of 1.3073, closing in on a 3-month low.

Canadian growth has decline in 2 out of 4 months, while other economic indicators have also underwhelmed markets. Investors believe that future BOC interest rate rises will remain on ice for at least 6 months. The Canadian economy has faced a number of challenges recently including successive interest rate rises, lower oil prices and limited inbound investment due to competitiveness. Regardless of this week’s movements ensured that CAD was the biggest winner of 2019 against the US Dollar so far this year.

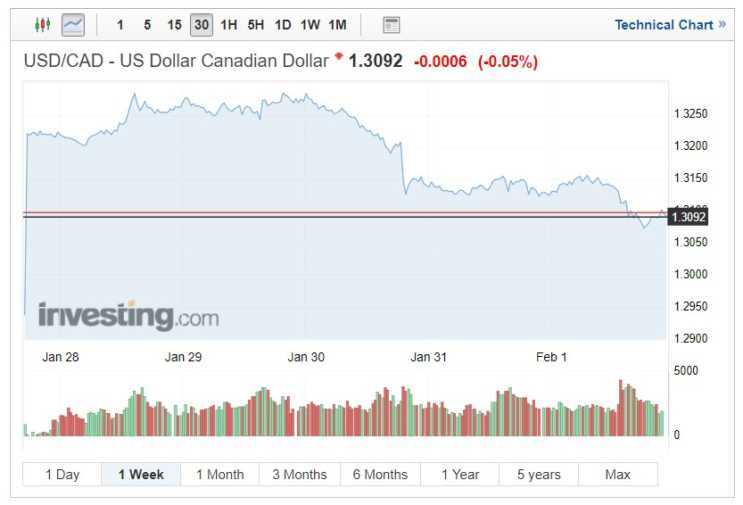

US Dollar Canadian Dollar movement this week

Friday’s Canadian Dollar appreciation saw the USD/CAD trading pair fall from 1.3207 on Wednesday to a closing rate of 1.3092 touching a low of 1.3073 along the way. The US Dollar regaining some ground following the positive labour market numbers. The downward trend being assisted a much more dovish rhetoric to future US interest rate hikes.

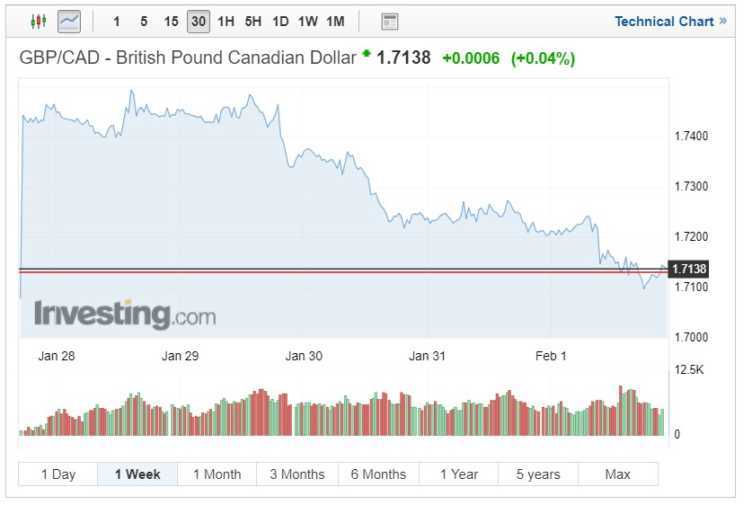

Sterling exchange rates were also challenged by the Canadian Dollar with Sterling falling over the trading week. The most significant depreciation seen in the GBP/CAD pair followed the release of the UK’s manufacturing data which showed decline. Estimated to reach 53.5 it reached just 52.8. Manufacturing has felt the brunt of Brexit and this was reflected in last months PMI figures.

The pair fell from 1.7199 to 1.7147 following the PMI data release, on the way touching a week low of 1.7098 and closing on Friday at 1.7138.

US Dollar – Canadian Dollar forecast

Investors believe the USD/CAD is approaching a critical level of 1.3037 and markets are looking for a reaction to the price drop. Experts believe that the CAD will weaken in February, the Loonie will now be viewed as overpriced. Particularly as elections are around the corner and economic data has far from dazzled. Regardless of data a breakthrough in the US and Chinese trade talks could support further oil prices rises, in turn positive for the Canadian Dollar. One would anticipate much of the potential benefit has now been factored in, hence the aggressive gain over the last quarter.