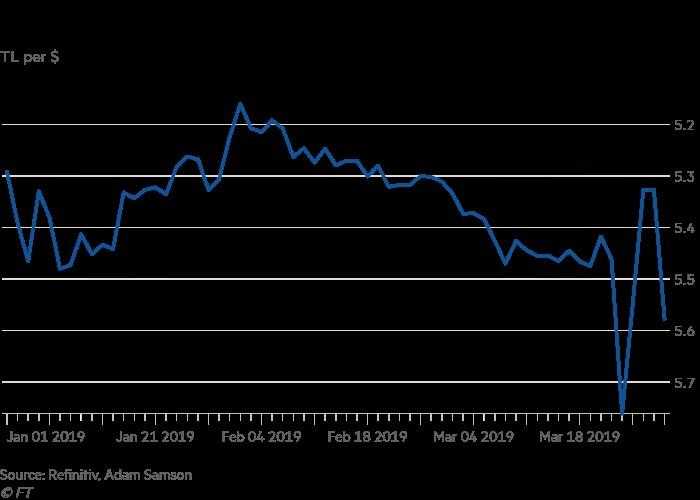

The Turkish lira plunged even further against the US dollar ($) after investors were spooked by a currency crackdown by President Recep Tayyip Erdogan ahead of elections this Sunday.

The currency suffered its second sharp slide in a week after the Turkish authorities depleted its foreign reserves to head off another crisis and stopped its own banks’ lending the currency to foreign investors. The move is aimed at preventing short selling of the currency. It has been a gradual pressure cooker over the month of March. Almost $10 billion was cut in international reserves for the first three weeks of March and new international reserves for the central bank were left at 142 billion Lira ($24.7 billion).

Turkey’s currency was down 1.8% after tanking 5% on Thursday. The weakness, following a strong rebound earlier in the week, reflected a more technical return of liquidity to a key London foreign-exchange market where investors use swaps to hedge and settle positions.

The Turkish liquidity squeeze pushed the London swap rate to a massive (and record) 1,200% on Wednesday but it has since eased back to more normal levels and was 23.75% on Friday, as lira-starved foreign investors bulls bought back in. The weekly swap rate stood at 55% but different data showed Turkey’s foreign trade deficit fell 63.1% year-on-year in February to $2.13 billion.

According to Turkish officials and in country commentators, tactics used to stabilize the situation post last Friday sell off is have the government direct banks to temporarily starve the London market of lira liquidity. Finance Minister Berat Albayrak said on Thursday that Turkish banks were “providing billions of Lira to foreign markets” and he vaguely promised Turkey would enter “a reform period” after the elections and give details soon.

Off the back of the currency reduction, Turkish stocks plunged to their lowest levels since January and yields on bonds up to October levels. Analysts in banks and brokerages have raised doubts about a quick fix for an economy for a while now, especially in the midst of a recession that could last well into this year.

“Concerns about Turkey’s economy and financial markets are unlikely to fade even once Sunday’s local elections are out of the way. If anything, we think that they will intensify,” said Jason Tuvey, senior emerging markets economist at Capital Economics.

“The tightening of financial conditions adds to the reasons to think that, even once the economy emerges from recession, the recovery will be slow-going,” he said.

The lira itself which weakened down to as little 5.6750 on Friday, stood at 5.5555 against the dollar ($) at the end of the day. In 2018, the Lira tumbled almost 30% against the U.S. currency.

Politics

Its Turkish general Elections this weekend and Erdogan is campaigning hard for his AK Party, which could lose control of Ankara and other major cities after the nationwide.

Thursday saw Erdogan blaming lira weakness on attacks by the West. A similar outburst last year had a strangely identical reaction on the markets; investors were spooked by his unorthodox economic views and with the president renewing calls for lower interest rates despite double-digit inflation the lira was only going one-way.

The negative sentiment against “the west” or mainly America is not random or unfounded per se. The currency has been hit by a lack of confidence with Turkish investors, meaning record holdings of dollars and gold have been purchased over the last 18 months. Weak relations with the United States and concerns about post-election government policy have also negatively affected investor sentiment.

The basis of some of the hate against “the west” coming from Turkish government are because Turkey plans to purchase an S-400 air defence system from Russia. A select group of US senators introduced a bill on Thursday that would prevent the US from honouring an order for 100 Lockheed Martin F-35 fighter jets from Turkey if it takes delivery of the Russian air defence system in July.

Albayrak had come out to Turkish media on Thursday and said clear reform framework may be announced in mid-April if the plan is ready. It’s been a strong run of 15 years in power across the major cities but analysts and polls suggest President Tayyip Erdogan and his AK Party could be defeated in Ankara in the upcoming local elections. Any defeat for a political leader is unwanted (ask Theresa May) but specifically defeat in Ankara would be a huge blow to the Turkish leader, according to political analyst Murat Yetkin. He said: “The psychological factor of losing the capital, losing one of the big cities in Turkey, could be perceived by voters as the beginning of the decline.”

Piotr Matys, an EM FX strategist at Rabobank, said in a note: “The response from the administration to the outcome of this crucial vote – seen by many as a referendum on President (Tayyip) Erdogan and his executive powers – will be critical for the lira and local assets.” The currency meltdown on Friday marked its worst performance since the summer of 2018 when a serious crisis took gripped and tipped Turkey’s economy into a recession. The well-known ratings agency, Fitch Ratings said on Friday that Turkish banks have a notable cushion against weaker asset quality.