The British pound foreign exchange rates are weakening with a lack of clarity and uncertainty in the economy.

The €750 billion relief fund by the European authorities has restored confidence in the Euro currency. Further, the European approach towards handling the economic efforts of the pandemic has been effective.

Coronavirus continues to make the currency markets volatile and unpredictable.

The US Dollar is now below the crucial 95 levels. It closed at 94.89 last week on 24 July. Previously, it had gone below the 95 support level in early March 2020. But it bounced above this level almost immediately. Positive news will bring a rebound in the US Dollar.

The British Pound Foreign Exchanges Rate Against the Euro

The GBP/EUR foreign exchange rate saw a rise and fall against the Euro.

Health and economic damage continue to haunt Britain. Brexit is another issue that threatens the United Kingdom. There is a lack of clarity in the currency markets as the British Pound foreign exchange rates rose and fell last week. Brexit talks with the EU may help the GBP rate see a rise, providing the deadlock can be broken.

Fear of resurgence in the coronavirus and a further lockdown might bring down confidence in the GBP rate. The hope of a vaccine is the only positive news that investors could hold on to.

In Spain, COVD-19 cases have increased, and this may cause some concern in Europe. Spain is now a coronavirus hotspot. The Spanish unemployment rate, which was at 14.4% previously, is forecast to increase to 16.7%.

The Euro has been advancing to new highs of late, with the relief package agreement. It is another cause for the weakening British Pound foreign exchange rates. German unemployment change, which was at 68K, is now forecast at 45K. The unemployment rate in Europe, which was at 7.4% previously, is expected to increase to 7.7%.

German GDP quarter on quarter data will be out on Thursday. France will also publish its GDP figures on Friday. These are two critical numbers.

GB Pound Foreign Exchange Rates closed at the 1.0976 levels on Friday, 24 July. Following sound economic data, GBP is expected to strengthen. It may reach levels of 1.1016 and 1.1283. It saw a high of 1.2085 in mid-Dec 2019. But if the UK receives negative data, it may lower to levels of 1.0958 and 1.0894.

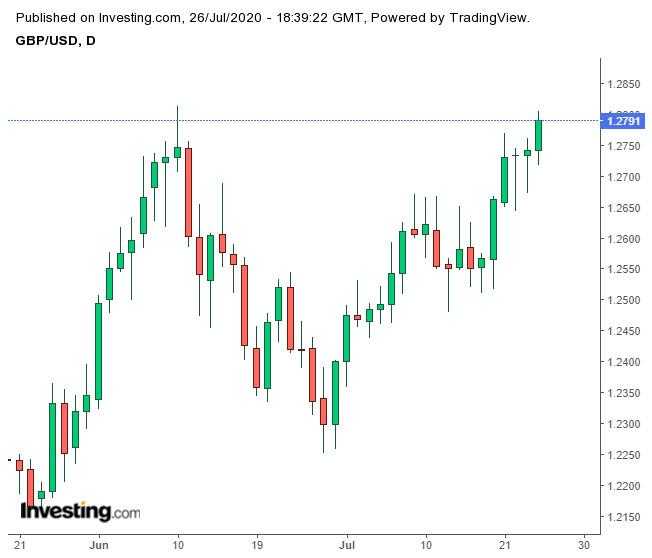

GBP/USD Volatility Fuels Uncertainty

In the US, the decision on the interest rate will play an important factor in the direction of the dollar rate. Further, the US election in November has to be factored into. President Trump has to restore confidence in the US economy to help him come back. Unemployment claims are expected to rise from 1416k to 1450k.

The coronavirus data in the US refuses to come down and is a cause of panic in the economy. The US dollar continues to weaken against the pound and the Euro.

Risk sentiment regarding the US-China tension may cause a reversal in USD selling.

The GBP foreign exchange rate saw a surge with UK retail sales bounce in June after stores opened after the lockdown. Retail sales have gone up by 13.9% in June while in May it surged by 12%, according to data from the Office of National Statistics.

The UK PMI data to be released this week may strengthen the GBP foreign exchange rate.

The GBP/USD pair closed at 1.2794 levels on Friday, 24 July. If it goes past 1.2864, it will touch levels of 1.2810. However, if it drifts lower, it may touch levels of 1.2672 and 1.2479.

GBP/AUD Pair Amid US-China Tensions

Coronavirus infections are on the increase in Hong Kong and Japan. Emerging markets are now being affected.

The Australian Dollar has been affected by US-Sino tensions. Service sector PMI has shown steady data. Though the manufacturing sector expanded, it is lesser than forecast. RBA Assistant Governor Kent will speak on crucial matters on Tuesday.

The GBP exchange rate against the Australian dollar settled at 1.8007 on Friday, 24 July. Once it crosses 1.8053, it may rise to 1.8200 level, and if it further strengthens, it may reach up to 1.8562. It saw a high of 2.0868 levels in Mar 2020. However, if it breaches 1.7905, it may touch lows of 1.7754 and 1.7690, which forms a strong supportive base, as it is a 1-year low.

The New Zealand dollar at $0.6625 was close to a 7-month high level of $0.6690.

The New Zealand dollar and the Australian dollar have fallen from multi-month peaks.

In Asia, Japan’s unemployment rate will be released on Friday. The forecast is at 3.0%, while it was 2.9% earlier. The yen is considered a safe haven with the US Dollar sliding downward. On Friday, the yen rose to a one-month high. The Sino-US tensions have been one reason for the strengthening yen.

The Chinese Yuan was at 7.0206 against the US Dollar on Friday. It has fallen to 2-months low levels.

The US fiscal rescue package will also determine the movement in the currency market in the days to come. Coronavirus and Brexit are two different scenarios that will impact the GBP exchange rate in the days to come.