Startup CoinSwitch Kuber the online digital exchange platform for cryptocurrency raises $15 million in Series A funding, led by Ribbit Capital and Paradigm.

Startup CoinSwitch Kuber

The Indian startup cryptocurrency platform CoinSwitch Kuber has raised $15 million in funding. Ribbit Capital, a US-based fintech fund, and San-Francisco based firm, Paradigm have contributed to the amount. Coinbase co-founders Matt Huang and Fred Ehrasam are the founders of the investment fund Paradigm too.

CoinSwitch Kuber trading platform has processed more than $5 billion cryptocurrencies. The user-friendly platform is used to buy cryptocurrencies like Bitcoin, Ethereum, Ripple, and other cryptocurrencies. Various payment options are provided using a simple user interface.

Volatility has increased in cryptocurrencies like Bitcoin, which saw a 300% rally last year. On 8 January, it rose to $42,000, after which it lowered to #33,159, showing volatile movement.

Indian Crypto Firms

The CoinSwitch platform hopes to tap the Indian population. Out of the 1.3 billion people, more than 25% of the Indians are aware of cryptocurrencies, and if they utilize this facility, it would increase the volume tremendously. “We target a 10-times growth in the user-base by 2021”, says Ashish Singhal, co-founder of CoinSwitch Kuber. Funds towards Series A funding are from Kunal Shah, founder of CRED and Sequoia Capital India, Paradigm, and Ribbit Capital.

Apart from CoinSwitch Kuber, there are other crypto firms in India like CoinDCX and Vauld.

CoinDCX has a funding amount of $13.9 million with investors from Jump Capital, Block.one, Coinbase Ventures, Alex Pack and Mehta Ventures, and many more.

Vault is another Indian Startup, with a funding amount of $2 million, by funds like Pantera Capital, CMT digital, Coinbase Ventures, Robert Leshner, Robot Ventures, etc.

Leading Startup Companies in Cryptocurrency

Startup Cryptocurrency companies are emerging in recent years.

Startup companies boom but are not not very successful, as they are risky businesses that erode money easily. As they do not have proper regulations, users are quite wary of investments in cryptocurrency.

There are many cryptocurrency startups that are earning a name for themselves in the crypto world.

Coinbase is a large cryptocurrency exchange that was started in 2012. It deals mostly in a few major cryptocurrencies. The exchange, co-founded by Brian Armstrong and Fred Ehrsam has more than 13 million users and is one of the well-established start-up companies.

Cobo wallet services that offer Cobo Vault, was founded by Discus Fish from China. It has a self-destructing feature that can wipe away important keys if it falls into wrong hands. It raised 13 million in 2018.

Binance is a large cryptocurrency exchange that was founded in 2017. It trades in a wide range of cryptocurrencies and is one of the best-known cryptocurrency startups. CEO Changpeng Zhao, the founder of Binance is a leading cryptocurrency trader. Binance Coin, which is a utility coin, was also launched by Binance.

Digital Currency Group

The Digital Currency Group, founded by Barry Silbert is a leading investment cryptocurrency market. The startup company was founded in 2013 and has gained popularity with investments in more than 145 companies. It has also invested in Coinbase.

Many more start-ups are gaining importance, such as Storj, SpectroCoin, Javvy, Harbor, Finhaven, Circle, etc. These promising startups in the fintech sector use emerging technology to provide solutions in the field of finance.

Bitcoin Volatility Continues

Bitcoin rose to a record high at $42,000 on Friday, 8 January. But later shed its gains and was trading at around $32,500 within two trading days, on 12 January. UK financial regulators have warned investors over the large volatility in Bitcoin. People may lose their money, say UK regulators. Bitcoin dropped almost 15% between Friday and Monday when it fell from its all-time high. Global financial regulators have voiced their concern over the volatility as new investors may lose their money.

Cryptocurrency Require International Regulations

Cryptocurrency gains popularity when the number of users increases and more transactions make use of the crypto. The crypto gains value when liquidity increases, as it becomes easy to trade.

Meanwhile, ECB President Christine Lagarde mentioned in a speech on Wednesday that digital currencies are “funny business” that require international regulations.

However, the Financial Conduct Authority, UK, says that consumers know the risks involved in cryptocurrency investment and are aware of the volatility and risks involved.

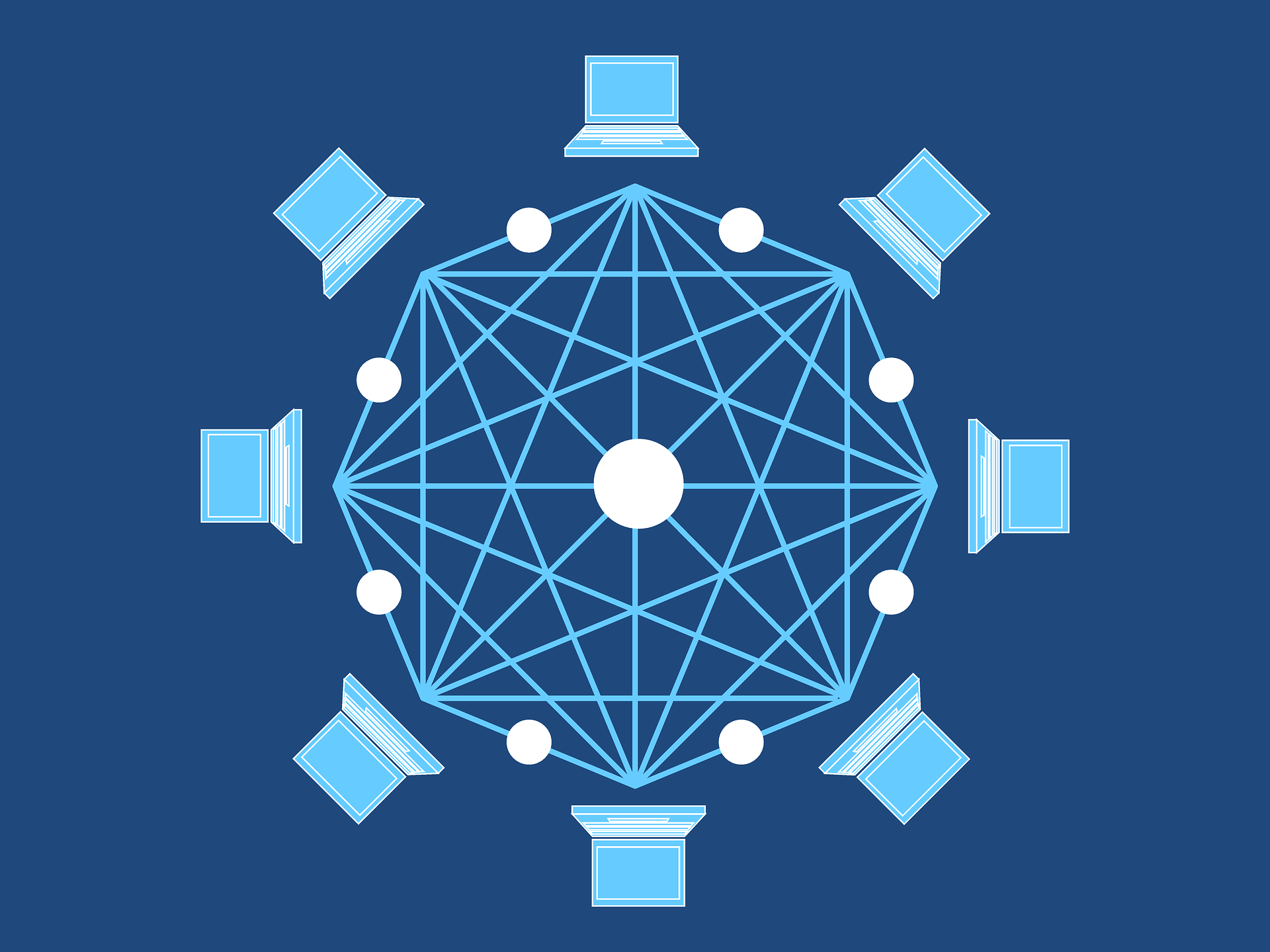

Digital banking has enabled the decentralized exchange of digital assets and cryptocurrencies. They are gaining importance in cross-border payments, as there are wide variations in the foreign exchange rates. They enable peer-to-peer transactions across the globe, called P2P transactions. As they use Blockchain technology, they are considered to be tamper-proof and secure.