Friday saw the release of June’s US jobs data stats including the Non-Farms payroll employment change, The unemployment rate and the average earnings.

This data will have been keenly scrutinised as many, including Janet Yellen believes the US labour market holds the keys the third US interest rate hike.

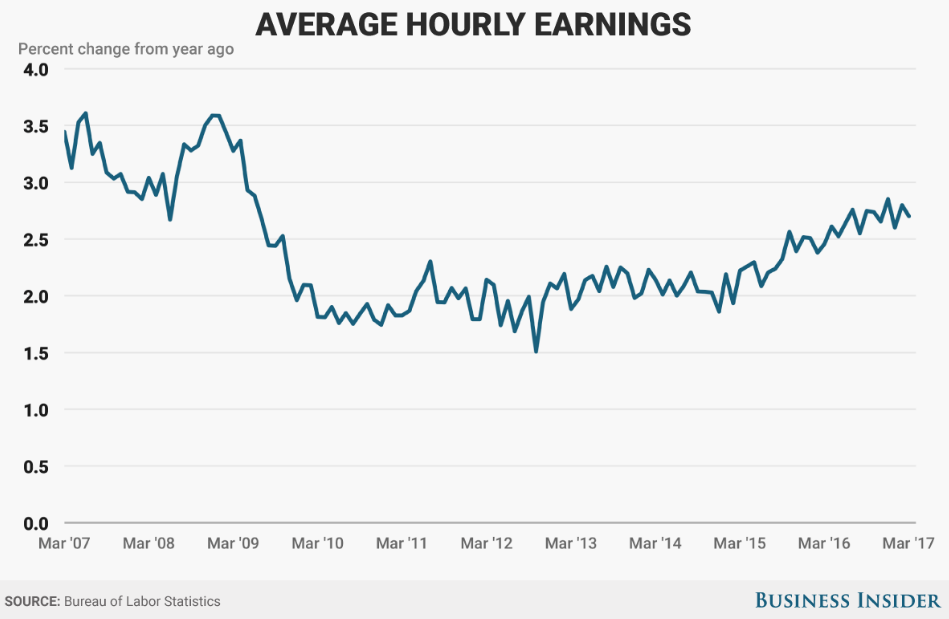

Junes Average Earnings Data

The average Earnings data was the first of a trio of key data released on Friday. The predicted level was +0.3% with the actual level reaching just +0.2%. The reason for the lack of growth being put down to lower levels of productivity and more high earning retirees.

Junes Non-Farm Payroll Employment Change

After the slight disappointment of June’s US average earnings data came the release of the US non-farms payroll data. Many had anticipated a positive number regardless of the previous days tepid ADP Non-Farm payroll data; which is normally said to mimic or imitate that of the actual Non-Farms payroll.

Fortuitously it didn’t, exceeding estimates and showing that the US work force had grown by 222,000 against a target of 175K. The figures demonstrated that the number of individuals able to work now in employment has reached 4.7M; the highest recorded since it archives began in 1990. The data will for the moment at least provide Dollar exchange rate with at minimum some stability but also something for Yellen to consider over the next few days.

Finally came the release of US unemployment rate which was anticipated to remain on par the May reading of 4.3%. June’s unemployment data crept up slightly to 4.4%. the prime reason it is believed is that many part time workers and now approaching the job market in order to secure more attractive full-time positions.

The report demonstrated that although wages aren’t growing as they have previously the labour market is still strong, in turn this should fuel future consumer spending. Although it may not quite have painted the picture Yellen had wanted.

How Dollar Exchange Rates Reacted Following Fridays Job market data

Following the release of the US non-farms data, Dollar exchange rates enjoyed a level of stability and in the case of GBP/USD strengthened slightly.

The EUR/USD fell under the 1.14 mark from Friday high of 1.1423 and closed for the weekend at around 1.1399.

Sterling which naturally at the moment continues to find itself in between a rock and a hard place also lost more than a cent following the US Jobs data. On Friday GBP/USD opened at 1.2956 before touching a day low of 1.2873. GBP/USD did manage to gain some slight composure and closed a shade higher at 1.2891.

UK and US Trade Deal?

It will also be interesting to see if reports around a new UK and US trade deal come to fruition next week, especially as Trump has claimed the deal is likely to happen shortly. Although it will be unlikely to make up for the potential loss of Brexit to the UK it could offer some short positivity.