As many had expected Canada increased interest rates for the first time in 7 years. Increasing from 0.5% to 0.75%. The Canadian Dollar rate as a by-product gained further ground against many of the major currency pairs especially.

Canadas outlook in recent months has been extremely positive with a raft of encouraging data, In particular this month’s Job data numbers which far surpassed expectations. Having battled against falling oil prices the economy now is benefitting from Strong exports, consumer spending and in-bound investment.

Poloz’s Optimistic Tone Also Helped Canadian Dollar rate

Following the announcement that Canadian Interest rates had increased by 0.25% Governor Poloz held a press conference citing their reasons. In a traditionally uncharacteristic tone the upbeat Governor Poloz stated that –

“The economy can handle very well this kind of move today,”

Continuing to justify the Bank of Canada’s decision he said.

“Growth is broadening across industries and regions and therefore becoming more sustainable,”

Whilst the Bank of Canada has enjoyed good steady growth in 2017, the growth is expected to moderate over the 2.8% in 2017, to 2.0% in 2018 and 1.6% in 2019. Growth however is expected to broaden into other sectors.

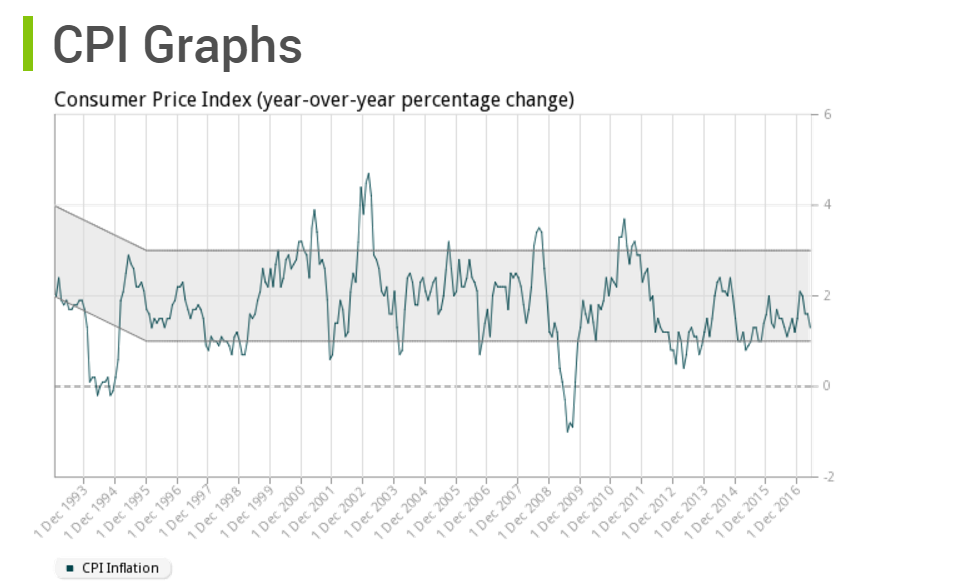

Inflation which has been slightly turbulent due to temporary factors is expected to remain around the 2% mark in 2018.

Canadian Dollar Rate Gains Ground Against Majority of Major Currencies

Whilst the Canadian interest rate rise will have come as no surprise to markets the Rhetoric from Governor Poloz may have. The was a very uncharacteristic tone from the governor who appeared to be confident in his decision describing the economy as

“approaching full capacity”.

The Loonie enjoying strong in not permanent gains against a host of major currencies including the Euro, GBP, JPY and notably the USD. The Canadian Dollar Rate has enjoyed very sustainable gains against its US counterpart. Performing well against the Dollar over the last 3 months.

Currently CAD/USD sit at around 0.7902 having rallied from 0.7735 pre-rate announcement. CAD/EUR is sitting at 0.6892 and at a month high. CAD/GBP also enjoyed solid gains moving from a pre-announcement 0.6002 and peaking just shy of 0.70, the pair currently sit at 0.6036.

Are further rate Canadian Interest rate hikes possible?

Many now surmise that the Bank of Canada will raise rise once again providing key data stays within comfortable levels. Some are predicting this could be as early as September other toward the latter part of the year. This thought process is partly due to the market reaction to the Canadian Dollar Rate. The CAD has continually strengthened despite the Interest rate hike being priced in for some time. Potentially suggesting that markets see other rises on the horizon and indicating that Canadian Dollar Rate will only get stronger…..