What Is USD Coin?

USD Coin or USDC is the largest stable coin and is an ERC-20 token. It is attached to the US Dollar.

A group of companies called “Centre” runs the USDC crypto. The group allows users to invest in stablecoins on their crypto trading platforms.

USDC runs on the Ethereum blockchain, and the Centre’s technical team ensures that it operates safely and securely.

USD Coin reduces the transaction time for international payments as it uses blockchain technology. It also reduces the cost of making cross-border payments. The crypto takes around five minutes to complete the transaction, and it performs just as other Ethereum-based coins.

You can easily convert USD Coins into US Dollars and back into crypto on exchanges supporting the ERC-20 standard. It ensures an easy and quick way of transferring money across borders.

The digital coin value is constant and, hence, used by employers to pay salaries. The elite and the affluent with ample wealth prefer to make transactions in digital crypto to keep their transactions discreet.

A unique feature of the USDC is its value of $1. It is a constant value and does not fluctuate. Other cryptocurrencies are highly volatile, where prices frequently fluctuate within large swings. It is a fiat-collateralized stable coin, while stable coins like Digix Gold are backed by gold.

History Of USD Coin

According to Coinmarketcap.com on USD Cash news, there is a circulating supply of 42.48 billion USDC, with a market cap of $42,492,240,237, as of December 2021. The sharp increase in decentralized finance usage has made USD Coin popular.

- USD Coin was launched in September 2018 with the support of Coinbase and Circle. The issue and redemption of the coins are on ERC-20 smart contracts.

- Circle was established by Jeremy Allaire and Sean Neville in 2013. Earlier, Circle claimed that USDC is “backed by US Dollars” but later reworded it as “backed by fully reserved assets” in June 2021.

- In August 2020, the updated USDC 2.0 version had advanced functionality and services that further supported the growth of stablecoins.

- Lending on the upgraded Ethereum 2.0 blockchains provides a secure, faster, and cheaper means to transfer money. USDC, which runs on Ethereum, benefits from the ETH2 upgrade.

- In March 2021, Visa announced that its payment networks would use USD Coins.

- According to a Forbes Advisor report in December 2021, US Dollar Coin ranks 8th in market cap. It enables users to make global transactions and has a target ratio of 1 US Dollar to 1 USD Coin ratio.

- Stellar is the official blockchain for USDC. It monitors the growth and expansion of the digital stablecoin.

- Grant Thornton, LLP is the accounting firm that makes verification to match the USDC Cash reserve with the tokens in circulation. It tables a report every month.

Users can convert their US Dollar investments into USDC tokens easily. The issuer creates the exact quantity of USDC out of the amount deposited through a USDC smart contract. The user receives the USDC, while the US Dollars get retained in reserve. To exchange the USDC to US Dollar is the reversal of the entire process.

Other ER-20 stablecoins, pegged to the US Dollar, are Tether (USDT), Gemini Dollar (GUSD), Dai (DAI), TrueUSD (TUSD), and Paxos Standard Token (PAX).

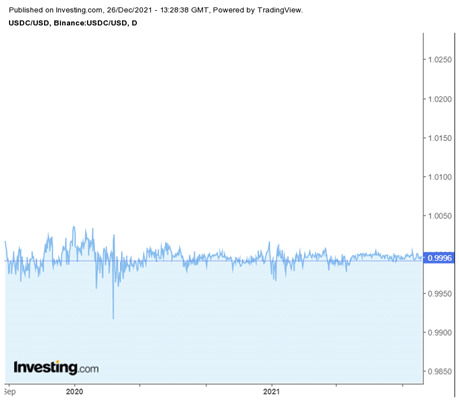

USD Coin Live Price Chart

There are around $42 billion USDC in circulation as of December 2021, while the total supply is 42.4billion. It is the second-largest stablecoin after Tether.

The USD Coin price as of December 2021 is $0.9983. You can get the updated USDC price news in real-time on CoinMarketCap.

(Chart)

What Makes USD Coin Price Move

USDC plays a vital role in linking traditional finance systems and blockchain-powered financial systems.

USD Coin Price Falling

Stable coin prices have a tendency to decline during bullish market cycles. The USDC is Dollar-based and moves along with the price movement of US Dollars.

There are many stable coins in the market, and there is stiff competition in this sector. USDC is still a new coin, and investors remain wary about its future prospects.

As blockchain technology grows, the number of transactions on it is growing. However, it results in high gas fees.

USD Coin Price Rising

USDC became most popular in 2020 due to the increased usage of the DeFi protocol. The Decentralized finance sector (DeFi) shows remarkable growth with various developments taking place on it. The best cryptocurrency trading platforms to buy USD Coins are Crypto.com and Coinbase. They provide a digital wallet and allow users to buy, sell and trade crypto assets.

It has a wide range of uses.

- USDC is a stablecoin that allows liquidity into the mainstream.

- It is available for crypto trading in more than 80 countries, making it more popular than its competitors.

- It facilitates cheaper and faster payment than traditional payments.

- You can send money even without a bank account.

- Lending of USDC is possible through decentralized finance applications known as DeFi apps.

- You can earn rewards on your crypto in top crypto exchanges like the Coinbase account.

- It does not see volatile price movements, typical of cryptocurrencies like Bitcoin and Ethereum.

Ways To Invest In USD Coin

- You can purchase USD Coins by exchanging leading cryptocurrency Bitcoin.

- You can also make a direct purchase from a reputed exchange. You can also buy USDC from an issuer. After the purchase, you have to store it safely in a digital wallet. The wallet should support ERC-20 technology. You can even hold it as a fraction, such as 0.000001.

- Top cryptocurrency exchange Coinbase rewards USD Coin customers. If you have a USDC balance in your account on Coinbase, you will earn rewards.

- Other top cryptocurrency exchanges are Binance, Crypto.com, Kraken, Bitfines, and Uniswap. Keep in touch with the best USDC news websites to understand the latest market movement.

- You can open an account on the best US crypto exchanges like Binance and select “Register Now” and “Create a Free Account”. You can register with your email id or your mobile number. You have to undergo a Security Validation and Account Verification, after which you can purchase or trade on the USDC.

- You can deposit crypto funds from a wallet to invest in USDC. You can use Bitcoin, Ethereum, BNB, or Tether as deposit funds to buy the crypto.

- You can deposit fiat currencies of any amount. The transaction fee gets deducted from the deposited amount.

- You can get the USDC from a crypto broker authorized by an issuer. You should have a digital wallet to store your USDC as an investment or to make a purchase of goods and services.

- Many users do not have bank accounts. USD Coins allow such users to hold their USDC in crypto in digital wallets by installing the best crypto trading apps on their mobile phones.

How To Open A USD Coin Wallet

There are many software and hardware wallets to store the USDC. As the USD Coin operates on the Ethereum network, many wallets support it. Beginners can avail the Exodus and Coinbase Wallets, which are software wallets. For higher safety, Ledger hardware wallets are best.

Earlier, investors had to pay a gas fee to use the platform. However, wallet developers may pay commissions on behalf of the wallet users. They may also pay direct fees in USDC tokens.

USD Coin Funds

Best Performing USD Coin Funds

USD Coins are not mined. However, when a user buys USDC or converts cash to obtain the coin, a coin is produced. Fresh dollars get deposited into the USDC bank account.

Biggest USD Coin Funds

Transactions on the Ethereum blockchain require Ethereum gas. Gas prices fluctuate regularly according to usage.

Best USD Coin Trading News Sources

As per USD cash news, USDC, backed by cash and US Treasuries, are redeemed for US Dollars on a 1:1 ratio. Best USDC news websites are coindesk.com and coinmarketcap.com for real-time charts, USD coin prices, and videos.

Is USD Coin A Good Investment (Chart And Summary)

The USD Coin has the backing of fiat assets in US Dollars. It is the first crypto to be entirely collateralized by US Dollars. It strives to maintain a 1:1 value with the Dollar. Each USD Coin is an ERC-20 token and is redeemable for $1 from the Centre. To get the latest stories from the best USDC news websites onto your computer or mobile phone, you can install an app to remain updated on current events.

Stablecoins like USD Coins enable businesses to transact in a familiar currency. It allows users to enjoy crypto trading without risks like high volatility.

The USDC will not show a high price variation because it reflects the US Dollar and will remain at $1.

On January 8, 2021, USDC prices slid to $0.9966, which remains the lowest point of 2021. As of December 2021, prices are at $0.9996. On December 29, 2021, prices were at $1.0018.

USD Coin dropped to its lowest levels in March 2020, at the start of the Covid-19 pandemic to $0.9934 price levels.

Is USD Coin In A Genuine Investment?

The USD Coin has US institutional support that is transparent and secure. There are many companies and products that support the USDC cryptocurrency payment system. It plays a major role in savings, lending digital wallets, and exchanges. You can also make purchases in crypto dApps.

USD Coin is striving to become the largest stablecoin industry in the world. It ranks second after stablecoin Tether. However, it faces heavy competition from other stablecoins with similar features and utilities.

You can trade it on the Poloniex, Bittrex crypto, and OKEx exchanges by following USDC cash news and breaking news on these exchanges.

USD Coin Links With The Dark Web

Cyberattacks affect the USD Coin on the Ethereum blockchain. Dark web services are usually associated with cryptocurrencies, as there are many illicit vendors selling illegal wares on the crypto market. Stolen documents, pharmaceutical drugs are popular products sold here.

Hacking and other online crime services such as counterfeit goods and pornography are some activities that regulators are trying to control. Bitcoin and Litecoin emerge as the most popular cryptocurrencies for e-commerce transactions on the dark web. But, inexpensive coins like the USDC do not play a major role in the dark web.

Trading USD Coin Crypto

The top cryptocurrency exchange for trading USD Coin is Binance, CoinTiger, Huobi Global, KuCoin, and OKEx. Coinbase is the best cryptocurrency exchange that provides an ease of use facility. It also offers insured custodial wallets so that traders and investors can store their investments.

How To Trade USD Coin

Top crypto brokers for trading USD Coins are AvaTrade, BlackstoneFutures, Markets.com, and CMTrading.

Some of the top crypto platforms are Binance, Luno, and gate.io. Binance is one of the lowest fees crypto exchanges, with charges at 0.02% to 0.19% as purchase and trade fees. For debit card purchases, users are charged a fee of 3% to 4.5%. You can watch the most recent USDC price news on various cryptocurrencies at Binance.

USD Coin is the first stablecoin listed on the largest crypto trading platform Coinbase. Coinbase is the best USDC news website that investors prefer, as they can gain more knowledge about crypto USD Coin.

- Once you make a deposit into your account, you have to choose the “Markets” section to start your crypto trade. You can buy, sell or trade cryptocurrencies at the best prices. The crypto frenzy captures the attention of new investors in the crypto market with the latest updates on USDC price news.

- You can lend your USDC to other users on loan platforms for interest. Beginners find it easy to trade USDC, as they can exchange it easily with US Dollars. Holdanut is the best US crypto exchange for trading crypto USDC, as it serves as a savings and lending platform. You can earn up to 12.73% on your holdings.

- You can trade other cryptocurrencies such as Bitcoin using your USDC holding to benefit from their volatile movements. Get updated USDC cash news to know more about crypto movements every day.

- eToroX crypto is the best US crypto exchange that offers a secure way of trading crypto. It is the blockchain arm of eToro crypto, regulated by the GFSC (Gibraltar Financial Services Commission).

Ensuring My USD Coin Trading Is Profitable

USDC is pegged to the USD. Whenever the US Dollar appreciates, the value of the USDC rises, and whenever the US Dollar depreciates, the USDC value falls.

Beginners in crypto can profit from free crypto trading on BlockCard. You can send stablecoins on it fast and without a fee. You can install an app to get updated USDC price news to make profits.

Buying USD Coin Beginners Vs. Professionals

Beginners prefer to use the crypto market to make quick money as an additional income to their regular jobs. Professionals take up trading on cryptocurrencies as a career.

Beginners research the best crypto to invest in and refer to USDC Cash news before making their investment.

A beginner undergoes heavy losses while learning the basics of the crypto trade. Professionals are much wiser while making crypto trading decisions, as experience is a great teacher.

Best Way For Beginners To Buy USD Coin

Beginners should invest in USD Coin as it is not subject to volatility and is not high-priced. Beginners prefer stablecoin USDC as they are back by the US Dollar. They must refer to the best USDC news websites before starting to trade.

As a beginner, you can link your bank account and transfer US Dollars into it. Before starting to crypto trade, you should complete initial procedures, such as the KYC process. You can easily convert digital assets back into your account in US Dollars.

Unifimoney is the best app for crypto trading as it allows you to buy and sell stablecoins like the USD Coin and TrueUSD. You can track prices and view the latest developments and news on your stablecoin watchlist.

Binance is the best app for crypto trading. It accepts fiat currencies to buy crypto, such as the US Dollar, EUR, AUD. CNY, and INR. You can also use Coinbase USD Coins and Binance USD to invest in crypto. It is one of the best crypto trading platforms, supporting almost 150 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and stablecoins like the USDC.

Professionals prefer crypto exchanges with the lowest fees like the FixedFloat as it offers tools for crypto trading. Its automated processing facilitates crypto exchange with a lightning network.

Voyager is the best cryptocurrency broker that allows users to earn interest on their USDC Coins. They are app-driven and provide commission-free trading.

Crypto.com is the best crypto trading platform that rewards traders with higher trade volume.

How Pros Buy And Invest In USD Coin

Professionals prefer the best crypto exchanges like Coinbase as they charge a fee of 0.50% spread for every trade. They offer more than 100 currencies and have a two-step verification process to ensure safety.

Solana, Stellar, and Avalanche are cryptocurrency platforms that run the USD Coins. Professionals prefer the best crypto platforms like Tron, Ethereum, and Algorand to trade USDC. USDC cash news is updated so that users benefit from price movements.

Professionals follow a variety of crypto trading strategies. The crypto market is volatile, and you need an intuitive platform to trade effectively. Popular strategies are day trading, swing trading, trading bots, scalping, etc.

Day trading crypto is a strategy by which you can take a position and exit trade on the same day. You make profits by intraday price movements in the USDC. While crypto day trading, you need to follow technical indicators to identify entry and exit points on day trading cryptocurrency. However, the USDC does not see volatile movement, as its price movement depends on the US Dollar value. You can maximize profits through margin trading. You have to follow the best USDC news websites to know the best time to enter a trade.

Cryptocurrency futures trading are another way of making profits. You do not require possession of the crypto in futures trading, but you need to follow USDC price news.

Crypto trading bots are smart tools on 3commas trading platforms that allow you to conduct transactions according to preset parameters. You can follow orders placed by experienced traders in crypto currency trading to be profitable.

Tax Liabilities On USD Coin

Stablecoins are cryptocurrencies and are liable for taxes.

Tax On USD Coin US

The IRS treats USD Coins as intangible property, subject to capital gains tax.

- If you pay for goods and services, it is subject to tax. But as the USD Coin is pegged to the Dollar on a 1:1 ratio, there is no tax owed as the capital gains tax is 0. But you have to record the transactions and keep track of records.

- If you convert cryptocurrencies into stablecoins like the USDC or vice versa, they are subject to capital gains tax.

Tax On USD Coin UK

Stablecoins like the USDC are similar to other cryptocurrencies. The HMRC claims that crypto comes under the capital gains tax or income tax, depending on your investment. It is viewed as a capital asset and not as a real currency.

If you convert bitcoin to USD Coins or vice versa, you have to pay capital gains tax.

If you sell, trade, or convert one crypto for another or convert your crypto for fiat currency, it comes under the capital gains tax regulations.

If you buy crypto with fiat currencies, it will not be a capital gains event.

How Much Do You Need To Start Investing In USD Coin

People must follow the 5% rule on their crypto investments. It is best to protect your portfolio by not exposing more than 5% of your investments to crypto.

You must be OK with losing your invested amount on crypto. Make investments only after paying off debts and providing for your retirement.

USD Coin Investors Summary

USDC is a stablecoin released by Circle in collaboration with Coinbase, forming a consortium. It is a fiat-collateralized and centralized coin. Its guaranteed value attracts investors into crypto. Top crypto exchanges like Luna list it as the most popular and user-friendly crypto.

USDC enjoys all the benefits of blockchain, and it plays a major role in the DeFi sector, creating great value to the blockchain ecosystem.

USDC is the equivalent of one US Dollar. It ensures that prices remain stable, unlike other cryptocurrencies that face excess volatility and drastic drop or rise in prices.

It is the best way for quick remittance and payments for cross-border payments. USD Coin provides for a low-cost transfer that is secure.

The crypto market is known for its high volatility and lack of regulations. Stablecoins such as the USDC is changing this ideology. Well-established institutions prefer to invest in USDC.

USDC is a stable digital currency. Users can get a level of certainty on USD Coin, as it gets backing by the US Dollar. It has an advantage over others stablecoins like Tether and is available on popular exchanges like Coinbase.

USDC is the best investment for investors in the crypto space looking for a low-beta investment and maximum returns.