With increasing pressure being heaped on the Dollar many had correctly anticipated that a third rate-hike would have been deferred once again. With the FED looking less and less likely to provide tools for the USD to recover or strengthen. With many experts expecting delays of more than 5 months before the next interest rate hike.

What The FOMC Announced

As covered above The FED left rates on hold at 1.25% therefore delaying the rate hike for what many estimates will be around 5 months or more. However, the meeting wasn’t all doom and gloom for the USD and despite months of continual Dollar Weakness some respite was found.

Comfort came in the form of confirmation that The Fed would soon be progressively winding down its $4.5 BN Bond portfolio announcing that the selloff would begin shortly.

The FOMC had drawn up a plan to taper to taper its bond holding program

Reasoning Behind the Decision To Keep Interest Rates On Hold

The reason behind the rate hold was outlined in the FED meeting minutes, published after the two-day meeting. In the FED Meeting minutes, the FOMC acknowledged that the US’s Labour market had been encouraging the committee some FOMC members had concerns surrounding inflation. However, the committee remained very confident that US economy would consider prospering.

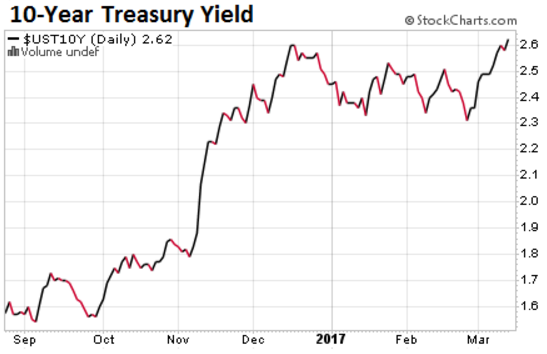

US Bond Yields Following The Announcement

The announcement saw US year bond yields fall to 2.289 percent and a 30-year government treasury slip to 2.894 percent. However, in the latter part of the week bond both terms managed to recover some of the loses.

How The Announcement Effected US Dollar Rates

After the FOMC delivered its announcement, expectedly US Dollar Rates weakened against the majority of the majors.

This year so far, US Dollar Rates have weakened to the tune of 8% and the FEDS delay in increasing interest rates has only served to compound its misery.

In the aftermath of the FED meeting GBP/USD found a familiar haven above 1.31 reaching a 6-month high of 1.3151.

EUR/USD fared well, the pair rising from 1.634 to a week high of 1.1761 which was without doubt helped along the way by a raft of positive Euro data which included Spanish unemployment and Preliminary German CPI figures.