2018 was the year the pump dumped

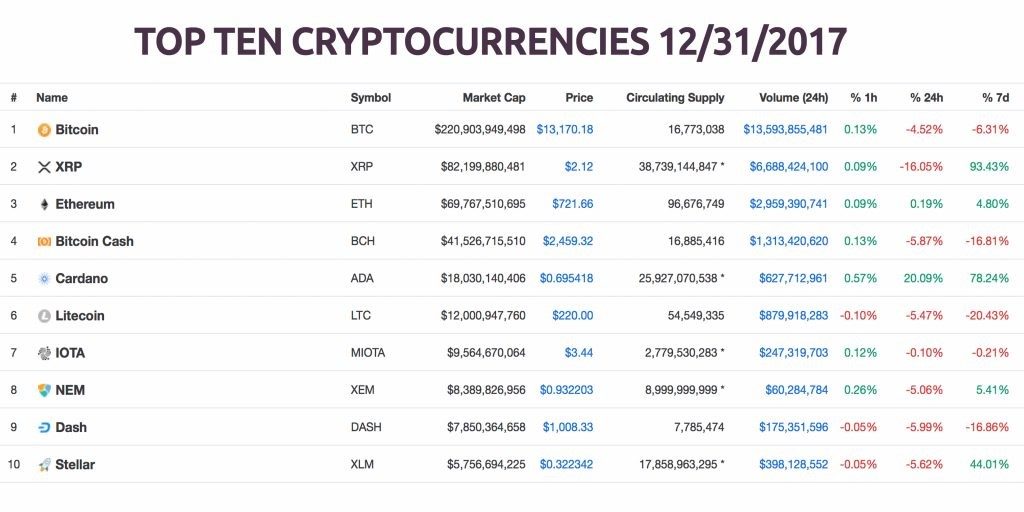

As a rule, if you were to measure each coin against itself like for like, you would be unpleasantly surprised at the drop. On Dec. 31, 2017, the top ten market capitalizations and the prices of each coin were vastly different than today. The top five coins were a lot more valuable f with Bitcoin (BTC) trading for $13,170 per coin, Ripple (XRP) $2.12, Ethereum (ETH) $721, Bitcoin cash (BCH) $2,459, and Cardano (ADA) $0.69.

Since December 2017 most have lost 75% of their peak value with some considerably more than that, if not lower than before. The entire cryptocurrency market valuation saw an all-time high of more than half a trillion dollars and today its like over $100 billion. See below the “before” and “after” shot that explains it all.

South Korean regulation

As we await the SEC to make their much-anticipated decision about regulation in this January and February of 2019, back in 2018 at the same time, talks of digital currency regulation began to grow mainly in Asia. In particular, from a fantastic start and excitement, we heard a lot of regulatory noise coming from South Korea.

Headlines deriving from Korean government officials were so frequent and very similar to the countless People’s Bank of China (PBOC) ‘ban’ announcements in the past. At the end of January 2018, a strong stance by a South Korean court ruled that bitcoin has economic value. Moreover, the country introduced a nationwide cryptocurrency account system. This essentially banned the anonymous trading of digital assets in South Korea.

Exchanges were targeted and exposed

The Japanese exchange Coincheck was compromised for $400-534 million USD worth of the cryptocurrency NEM back in January. It went unnoticed relatively and it uncharacteristically left the markets unaffected. Further afield but no less influential, another hack took place this past April when the Indian cryptocurrency exchange Coinsecure’s wallet was breached for $2.7 million worth of Bitcoin. At the time, the company pointed the finger at its CSO Amitabh Saxena but in September, Indian law enforcement investigated further and explained that an insider had helped facilitate the crime. Stay safe with our guide on minimising the potential to get exposed from hacks.

The obvious happened – ICOs fail miserably

If you don’t know what an ICO (initial coin offering) is, then it’s probably best to read our guide on them. Like any new and aspiring industry, 2018’s first few months saw the beginning of big initial coin offerings (ICOs). It didn’t last long as soon many started having lots of troubles with special agencies globally. In the US specifically, Securities Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) supported the Texas Department of Banking Commissioner as they issued a writ to close an alleged ‘decentralized cryptocurrency-bank.’

The Bitshares-connected Arise Bank was one of the first of many ICOs that started having troubles with the law. By February, 46% of all ICOs floated in 2017had already failed. All year long, there have been numerous crackdowns throughout the world specifically targeting ICO operations. Famously, the U.S. regulators charged music producer DJ Khaled and the boxer Floyd Mayweather this past November for failing to disclose payments they took for ICO promotion. ICO failure stands at 92% and probably counting further.

Venezuela’s not saved by Maduro’s Petro

This year saw the interesting potential cryptocurrency project that was the issue of the world’s first state-issued cryptocurrency in Venezuela. Nicolás Maduro, the company’s president has continually sold the benefits of the ‘oil-backed’ token but the real-world changes have yet to materialise. We applauded the innovation and ability to embrace the new technology.

In November, the Ministry for Communication and Information passed a law which established the Petro for commercial transactions inside the country. Further, Maduro inflated the Petro’s price from 3,600 to 9,000 bolivars. The entire world has been watching the Venezuelan people suffer from economic hardships for various reasons through hyperinflation, while Maduro and associated politicians play around with a so-called ‘multi-asset backed’ cryptocurrency created in secrecy. The jury is still out on this one.

Institutional investors (delayed) interest

The past 10 years had seen traditional financiers and firmed ignore and belittle crypto but 2018 for cryptocurrency saw a lot of institutional investors tentatively commit this year. It started with U.S.-based exchange-traded fund (ETF) approval in 2018 which allowed more trading and speculating on the future of the value of Bitcoin. Then in July, the Chicago Board Options Exchange (Cboe) applied for a BTC-based ETF that will be tied to the Vaneck Solidx Bitcoin Trust. Disappointingly, that same month, the SEC postponed its decision concerning five bitcoin-related ETFs filed by NYSE Arca.

SEC decisions on the future of these ETFs have continued all year leading to small dips and sell-offs all year as part of the dump. They have pledged to make a decision in February 2019. Moreover, bitcoiners have been waiting for the Bakkt bitcoin daily futures contracts offered by the Intercontinental Exchange. However, due to start in December this month – that has also seen delays.

Bitcoin Cash forked, again

The Bitcoin Cash (BCH) network had a busy year, as it underwent two forks in 2018. The first fork in the spring was relatively successful, resulting in a bunch of new features like re-enabled opcodes and a 32MB block size increase. Since the upgrade, BCH saw a huge influx of development, including many new applications. The result, in the first week of September, the Bitcoin Cash network processed millions of transactions on a daily basis during a week-long ‘stress test.’

Miners reported over 2 million transactions in 24 hours with more detailed statistics showed that the BCH chain had processed 85,835 tx per hour, and 23.8 tx per second.

However, after the stress tests, the planned hard fork for November became contentious and the fork resulted in a blockchain split.

“BCH” ticker stayed but shared presence with Bitcoin SV (BSV) across global exchanges. An iinitialdrop of $633 to down at $81 that was so heavily severe it infected the cryptocurrency world has now seen it rebound back to a value of $!73 at the time of writing and nearly 140% growth back from its technical bottom.

See our next article for our predicted trends and things to watch out for in 2019!