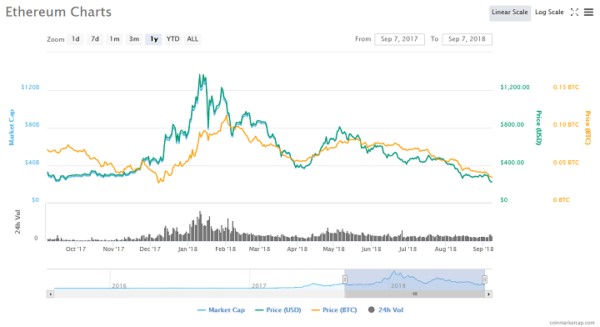

The 2nd most prominent cryptocurrency, Ethereum (ETH) was trading at $196.37 and that’s a significant recovery from the depths of $185.00 on Saturday, down 11.07% on the day. It was the largest one-day percentage loss since September 5. Ethereum has dripped lower and lower since new year highs of over $1,200.

The knee-jerk move downwards pushed Ethereum’s market cap down to $20.40B, which is 10.53% of the total cryptocurrency market cap. At its highest, Ethereum’s market cap was $135.58B.

Ethereum had traded in a range of $196.37 to $220.85 in the previous 24 hours which shows the incredible volatility the trading landscape is at the moment.

We have more statistics on the last week because, in the past seven days, Ethereum has seen a drop in value, as it lost 32.31%. The volume of Ethereum traded in the twenty-four hours to time of writing was $1.36B or 12.69% of the total volume of all cryptocurrencies. It has traded in a range of $196.37 to $299.38 in just the last week alone

At its current price, Ethereum is still down 86.20% from its all-time high of $1,423.20 set on January 13.

Why Ethereum’s such dramatic, continuous failure?

In 2017, Bitcoin was stealing the show but many technical experts predicted that Ethereum would be one of the best for 2018, we certainly did and said so here earlier in the year. We don’t like predictions here at Forex News Shop but we were slightly excused as the massive gain in BTC price in 2017 was outdone by ETH performance as it had a better annual percentage increase.

More than we care to name, many if not most, ICO projects in 2017 built their platforms in the Ethereum blockchain. These projects raked in hundreds of millions of dollars, it created positive marketing for the industry but Ethereum’s potentially and credibility alone.

One year on the projects hasn’t taken off as first thought. In fairness, the SEC has proven many of them to be fraudulent while the others have been unable to secure broad market adoption. As a result, the proportion of Ether utility that was supposed to come from the ICO token commerce has so far been minimal. The shock waves in the last week haven’t helped and merely added to the fuel to the fire of despair.

Additional market pressures

Aside from the failure of ICO projects which isn’t directly Ethereum’s fault, there have also been other market factors that have adversely affected the Ethereum price performance in 2018. First of all, from a macro price movement perspective, the new year brought with it a market correction which was still disproportionate to what was to be predicted. Across the globe, protectionist policies from several governments knocked investor confidence, and the cryptocurrency market lost more than half of its market capitalization by February 2018. Its still happening this week as we have reported.

In conjunction with the macro crypto factors, there are further economic factors out of ETH’s control. US dollar strength is something to overlook. This strength has exacerbated the negative effects of the ICO token slumps.

Despite all of these issues, Ethereum might yet recover based on the planned updates that are expected to improve the efficiency of the blockchain materially. In the interim, however, Ethereum investors are probably in the red if they bought anytime within the last year.

The founder believes 1000x days are gone

Ethereum founder, Vitalik Buterin, the co-creator of ETH, hit out hit out this week saying the days of 1000x growth as seen in 2017 in the cryptocurrency sector is gone.

Speaking to financial media giant, Bloomberg, Buterin emphasized that the awareness of cryptocurrencies and blockchain technology has already achieved its peak in Dec. 2017, when the price of major cryptocurrencies like Bitcoin, Ethereum, Ripple, and Bitcoin Cash demonstrated 10 to 300-fold returns. He commented, “The blockchain space is getting to the point where there’s a ceiling in sight. If you talk to the average educated person at this point, they probably have heard of blockchain at least once. There isn’t an opportunity for yet another 1,000-times growth in anything in the space anymore,” he said.

Featured image: © Petr Ciz – stock.adobe.com