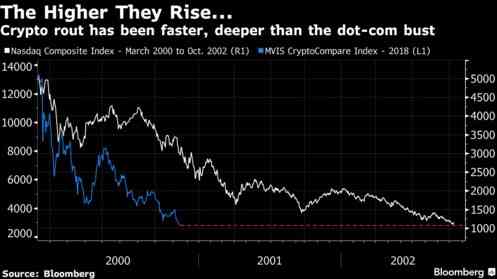

The selloff is officially now classed as bigger than the pop of the dot-com bubble back in the early 2000s. A report from Bloomberg has shown, in a bruising September, most cryptocurrencies plumbed new depths on Wednesday, the MVIS CryptoCompare Digital Assets 10 Index extended its collapse from a January high to 80%. The index tracks the 10 largest cryptocurrency companies such as Bitcoin, Dash and Litecoin. The spectacular fall from grace has now surpassed the Nasdaq Composite Index’s 78% peak-to-trough decline back when Amazon was just a baby.

The graph below shows the magnitude of what has unravelled since late 2017:

“It just shows what a massive, speculative bubble the whole crypto thing was – as many of us at the time warned,” a smug Neil Wilson, a chief market analyst in London for Markets.com, a foreign-exchange trading platform.

“It’s very likely a winner takes all market – Bitcoin currently most likely.”

Empty promises?

The Bitcoin mania of 2017 fuelled by hopes that the no1 crypto, Bitcoin would become “digital gold” and that blockchain-powered tokens would reshape every industry imaginable thanks to the underlying blockchain technology, has quickly given way to concerns about excessive hype, security flaws (hacks and thief), market manipulation, tighter regulation and slower-than-anticipated adoption globally.

But even if the optimists are proved right and cryptocurrencies eventually transform the world, this year’s selloff has at best delayed that progress and the journey, unlikely to be smooth.

We’ve covered why the cryptocurrency market has been crashing this year.

There is a stark difference between the two events, however. Gary MacFarlane is a bitcoin expert at investment platform Interactive Investor He explained the vast differences between the dot-com boom and bust and the falling value of cryptocurrencies.

“From peak to trough crypto may have fallen further but there are two crucial differences between dot-com and crypto. First the sheer difference in sizes between the two – crypto’s combined value today is under $198billion, while US tech stock valuation was as high as $3trillion – an order of magnitude greater than crypto.”

“The bursting of the tech bubble brought down the wider market. The implosion of crypto wouldn’t be much more than a rounding error when compared to the size of global equity and bond markets.”

“The other crucial difference is that we have been here before. Since 2013, Bitcoin has seen three drops of greater than 70 per cent. It keeps coming back because people continue using it. Just today we hear that Morgan Stanley is building a Bitcoin derivatives product, so expect to see more big institutions looking to get in on the action.”

He finished with a good piece of advice:

“Many in crypto have a far too optimistic view of adoption – it may be slower than they expect.”

It’s not a “no” just not a “now” reflected in the price movements.

Reason for optimism?

Wednesday’s losses or “black Wednesday” as it could be known were led by Ether, the second largest virtual currency. It fell 5.2% to US$172.41 at 6.21am in New York, extending this month’s retreat to 39%. Bitcoin was little changed, while the MVIS CryptoCompare Digital Assets index fell 2.9%. The value of all virtual currencies tracked by CoinMarketCap.com sank to $187-billion, a 10-month low.

The crypto industry’s links with the traditional financial system also remain weak. This asset class falling won’t affect the price of oil or other commodities which does have a direct link to other commodities and tangible industries linked to people’s jobs and livelihoods.

The most recent developments in the crypto market appear to have vindicated its biggest pessimists. With the aforementioned slump of 80% but optimism persists, however, and some point to Bitcoin’s bounces from similar crashes in the past as evidence that the market could pick up again. It has had the pump and dumps notably back in 2013 when it reached $1,000 and slumped back to the $200 levels. It’s all part of recent history to the purists.

One silver lining of the crypto slump to investors clinging on is that ramifications for the wider global economy are likely to be minimal. While the market has lost more than $640-billion of value since peaking in January. If we compare it again to the 2000’s crash it is a far cry from the trillions erased from Nasdaq Composite stocks during the dot-com bust. Not that to make investors feel better about their own losses knowing others have lost significantly more previously.