The Venezuelan President Nicholas Maduro has taken the desperate steps to peg its currency to its oil-linked cryptocurrency. This process devalued the Bolivar enormously, meaning day to day necessities are now being paid in vast quantities of cash. The process rendering the currency worthless.

The President announced a number of changes to the Venezuelan economy over the weekend in an arguably misguided attempt to prop up the failing economy. The changes which were implemented on Monday include; Devaluing the Bolivar and replacing with an as yet unnamed replacement. Pegging the new currency to the nation’s oil-linked cryptocurrency and increasing the minimum wage dramatically. The President also plans to scrap some Gasoline subsides with an estimated saving of roughly $10 Billion a year.

Inflation rockets after currency pegging

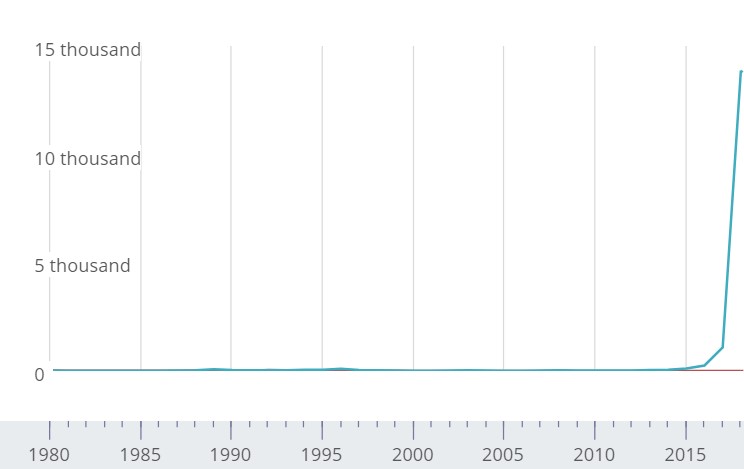

Whilst Venezuela’s inflation already stood at a staggering 108,000% on an annualised basis the economic changes implemented yesterday could see that rise to 1,000,000% according to price forecasting experts and the IMF.

This has prompted Venezuelans to flee to neighbouring countries including Ecuador and Brazil, in turn, this has created its own set of issues.

The Venezuelan Bolivar is devalued heavily

Alongside the aforementioned economic changes, President Nicholas Maduro implemented a currency devaluation of 95% which will prove challenging for the Venezuelan population. Currently, day to day item’s prices are spiralling, with a kilo of cheese of costing 7,500,000 Bolivars and 1KG of rice costing 2,500,000 Bolivars. The price rises have caused over half a million Venezuelans to flee overseas. Food and medicine are also in short supply which in turn has seen crime statistics rocket. A recent survey showed that currently, approximately 90% of Venezuelans live in poverty, 60% admitted waking up hungry because they were unable to purchase groceries.

Opposition leaders are now calling for nationwide strikes and are very sceptical about the President’s plans. Many economists have shared their thoughts and believe the project will fail. An opposition leader, Henrique Capriles dubbed the move as ‘Black Friday’. The opposition leader believes that the changes marked one of the darkest days in the nation’s economy. Capriles stated that “the government has decided to thrust us into one final disaster”.

Minimum wage increased dramatically

Although unlikely to assist the beleaguered population, Nicholas Maduro also increased Venezuela’s minimum wage by 3000%, his rationale to offset the Nations current hyperinflation. Maduro believes that the wage increase, coupled with the devaluation of the local currency will assist Venezuela to overcome its currency financial crisis.

The socialist president claimed:

“I want the country to recover and I have the formula. Trust me’’. “We are going to begin a process of recovery in the coming days, weeks and month… It’s a revolutionary formula… unique in the world!”

In July the International Monetary Fund estimated that the economy of Venezuela would contract by roughly 18%. The rise in wages is extremely unlikely to assist the average Venezuelan, once offset by the huge currency devaluation the minimum wage increase equates to roughly $30 and with hyperinflation very likely to continue, many more will almost certainly head for the border.

Immigration troubles on the border likely to get much worse

In recent months around half a million Venezuelans have left the country for a better life with many joining family in neighbouring countries such as Ecuador, Chile, Peru and Brazil. This week’s escalation has prompted many of Venezuela’s neighbours to tighten acceptance requirements. Despite this, it appears the rules aren’t being adhered to and Brazil notably has begun sending troops to the border to oversee processing and protect Venezuelan immigrants. In recent weeks there has been a bout of attacks on migrant camps along the border.

What’s known about Venezuela’s cryptocurrency?

The Petro Cryptocurrency was launched in February 2018 and is linked closely to oil prices. Which as many will know have increased significantly pushing up global inflation. The Petro was developed by the Maduro’s government and announced last year, initially to supplement the declining Bolivar it now will be issued in Venezuela by the government as the local currency. The new currency will be traded at 6M per $1.

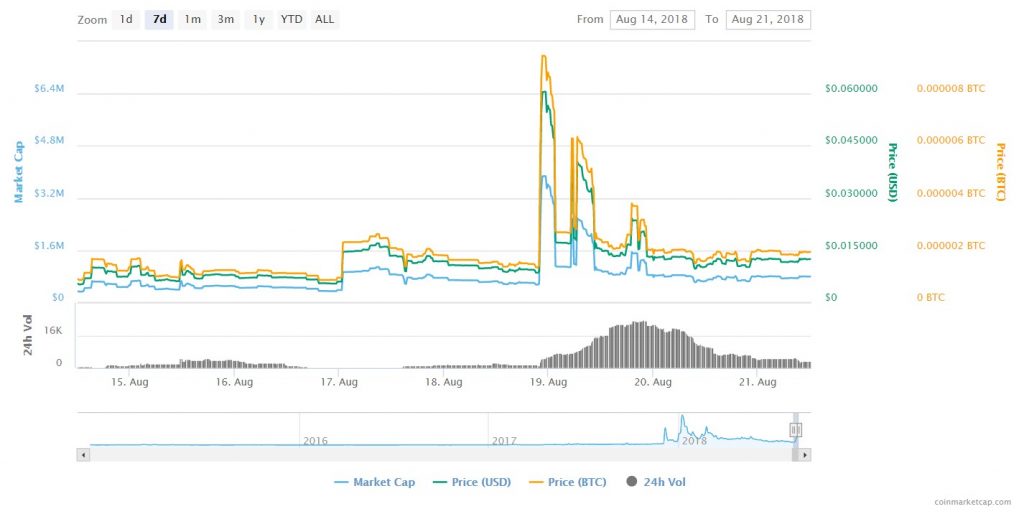

The admission from the President saw volatility in Petro pricing with the Crypto gaining against both Bitcoin and the USD.

The digital currency currently has a value of 0.01247 USD and 0.00000193 Bitcoin. Following the Venezuelan president’s announcement, prices spiked with the cryptocurrency’s market cap rocketing to $3,870,614 and it has since declined to a $799,935.

Featured image: © plysuikvv – stock.adobe.com