The Australian Dollar enjoyed a rare rally this week following the release of latest employment data and unemployment rate. AUD exchange rates have been troubled in recent months, both hampered by FED’s plans to raise interest rates and the ever-developing trades war situation, commodity currencies have been hit hard. The AUD has been one of its causalities, especially due to its collaborative nature with China.

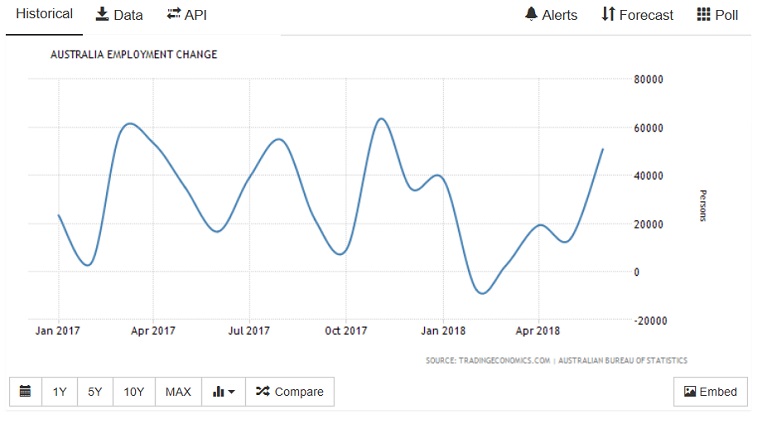

Australian employment exceeds economic forecast

This week saw the release of the latest Australian employment figures. Anticipated to show an addition of 16,000 new jobs the numbers more than delivered, showing 50,900 roles added to the Australian economy in June.

As notable as the job numbers increase was the fact that many of these roles were full-time opportunities. Full-time positions increased by 41,200 while part-time roles increased by 9,700.

Key geographies that benefitted included News South Wales which accounted for 27,300 of the new job roles and Queensland which benefited from 14,800 new job positions. One state however which saw a fall in job appetite was Victoria which reported a reduction of 6,600 roles.

Overall employment in Australia now stands at 12,573,000the highest since records began. Full-time employment has increased by 158,200 positions in the last year, whereas part-time employment surpassed that figure, reaching 180,800 this year.

The latest data will be a great indicator for the Australian economy especially due to the fact that the majority of this month roles were full-time placements.

Australian unemployment hits a 5-year low

Nearly as encouraging as Australia’s employment figures is the steady unemployment rate which sat at 5.4%. The June 2017 to June 2018 saw a decline of 0.2%, overall unemployment is at its lowest point since January 2013.

New South Wales led the way with just 4.7% of the population currently unemployed and remains the area with the lowest unemployment. NSW was closely followed by other states with Tasmania seeing a 0.7% decline in the unemployment rate and Queensland’s rate falling 0.3%. Whereas Victoria’s unemployment rate increased by 0.5%.

One point that potentially isn’t highlighted in Australia’s Bureau of Statistics reports is the amount of underutilised and overqualified workers. Essentially workers which are overqualified for their current roles and therefore should be in higher paid positions. These workers are one issue which the Reserve bank of Australia believes is prohibiting wage growth.

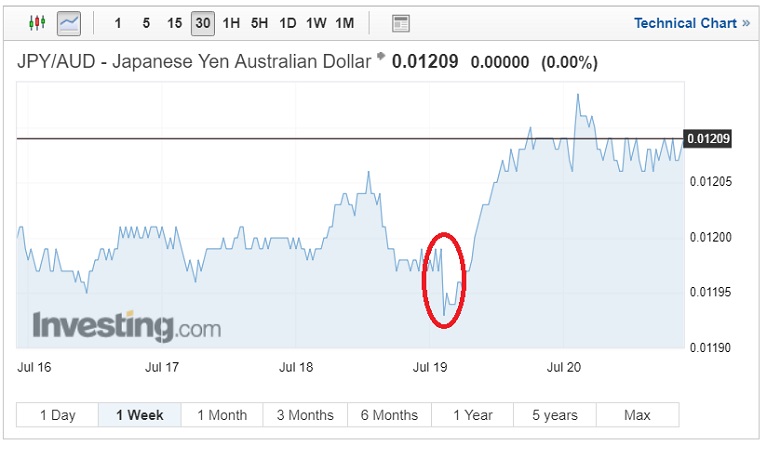

AUD exchange rates performance

The jobs data release saw the AUD exchange rates take a march against a handful of currencies. These currencies included Euro, USD and Yen.

The EUR/AUD exchange rate fell from 1.5738 to the week low of 1.5672, as has often been the case the AUD was unable to hold on to its gain and the markets closed on Friday at 1.5801. The month high for the currency pair was 1.5873. The move represented a month high for AUD against the single currency.

The JPY/AUD 1-week chart highlights a similar pattern to the EUR/AUD chart with the pair falling from 0.01199 to 0.1193. The Australian Dollar briefly touched a five-week high against the Japanese Yen.

Whilst the Australian Dollar sentiment continues to be vulnerable to the President Trump’s trade tirade AUD exchange rates could receive more support this week. There are signs that Australian inflation might be turning a corner and Wednesday sees the release of the latest CPI data. The data is anticipated to see an increase in q/q inflation, from 1.9% to 2.2%. If this was to become a reality next week, combined with the latest Jobs data we could see more notable Australian Dollar strength. The RBA would therefore almost certainly adopt a more bullish stance towards the medium-term view.