This week provided a batch of key data releases for the Australian dollar providing AUD/USD volatility. These included a statement from the Reserve bank of Australia, quarterly GDP figures and Australian trade balance.

Reserve Bank of Australia – Cash Rate Decision

As expected the Reserve Bank of Australia kept cash or interest rates at 1.5%. Although markets hadn’t anticipated any movement in cash rates the rational and key points were under the magnifying glass.

Governor Philip Lowes Statement

Philip Lowe Governor of the Reserve bank underlined that the labour market in Australia had tightened. As a key commodity trading partner with China, Australia is also benefiting from infrastructure development in China with commodity prices which are generally higher than last year.

Core inflation he advised remains low as does long term bond yields.

Lowe also outlined that Employment figures had strengthened although Australian wage growth had remained low.

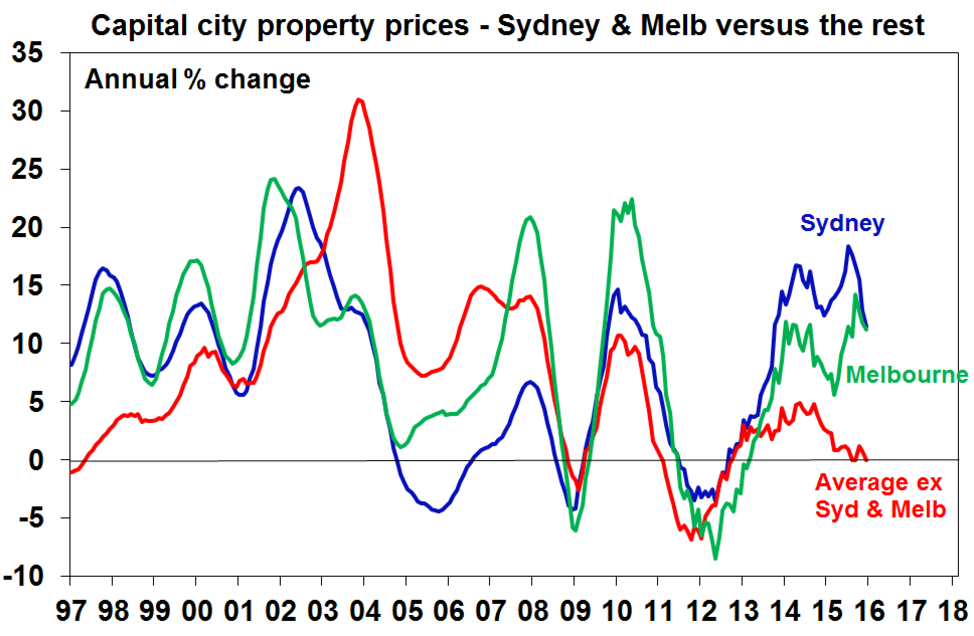

Property wise prices have been rising across Australia although there are a few indicators that insinuated that the market could ease. This can be explained by increased property supply in some eastern cities.

Lowe also highlighted that lower AUD exchange rates had supported the economy and interest rates remaining low would support the medium-term outlook.

Quarterly GDP figures

The AUD/USD enjoyed further gains on the announcement that growth had exceeded its target of 0.2% reaching 0.3%. Markets had expected a negative number.

The figures however demonstrated a slowing of Australia’s economy. The decline in growth not seen since 2009 showing an annualised growth figure of just 1.7%

On a more positive note Australian good consumption grew 0.5% driven predominantly by rent, gas and fuel prices.

Australian trade balance

Australia’s trade surplus missed target in dramatic fashion reaching just 555M against a target of 1.91BN. In a nutshell the weakest result since October. The shortfall was put down to a weakening in coal exports. Imports however remained steady.

AUD/USD 6 week high

The AUD/USD has been trading in a range of 0.7375 (low) and 0.7566 (High) enjoying a comfortable ascent. The USD remains in precarious scenario currently with almost daily controversy from President Trump. Today sees Ex FBI Chief Covey testify in front of senate.

The AUD/USD is down ever so slightly at the moment and we are trading at around 0.7541.

GBP/AUD reaction

Likewise, the GBP/AUD has come under unavoidable pressure in recent weeks. What began as a walk in the park for Theresa May has become a dog fight with polls depicting a much-reduced lead.

GBP/AUD is currently trading at 1.7157 with Sterling being sold off the close the election has approached. The UK is currently voting and has seen slight gains against Euro.