The Australian Dollar launched a comeback against many of the major pairs today following impressive trade surplus. This positive movement is motivated by the trade surplus, global index price performance and the rationale that the RBA’s cuts would to investors at least have now fell by the wayside.

The reserve bank of Australia implemented two 25 basis point cuts in just as many months as fears of a dwindling economy came to roost. The double rate cut marks the first since 2012 and the RBA have left the door wide open for future action, although many experts believe that the bank will let the dust settle before revising again.

Phillip Lowe on this month’s RBA rate cut

As the RBA governor made markets aware of a further 25 basis point rate drop this week, he commented on both the state of the Australian economy and provided suggestions to boost the economy- notably at government level.

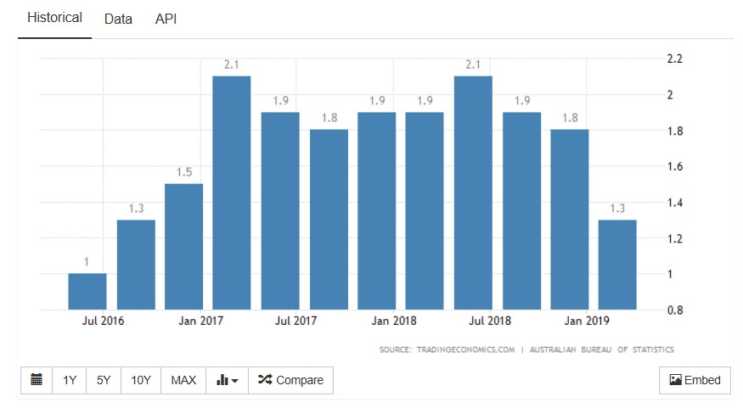

Endorsing the decision Lowe said that the two recent cuts should pave the way to a healthier economy. The Australian cash rate now officially sits at a historic low of 1% with the possibility of another rate cut before the end of the year highly probable. The cuts more likely if the current low rates have no effect on inflation, Lowe is targeting an inflation rate of 2%. Low wage growth continues to blight the Australian economy and has ensured inflation has remained low, currently sitting at 1.3% in the last quarter.

Global trade uncertainty and the cooling of the Chinese economy were also cited as key reasons for the underperforming economy by the governor who also implored the government to play its part in the growth, suggesting a lot more could be done by the way of infrastructure projects, especially as rates are now so low.

“It is appropriate to be thinking about further investments in [infrastructure], especially with interest rates at a record low, the economy having spare capacity and some of our existing infrastructure struggling to cope with ongoing population growth”.

Markets had anticipated the Reserve bank’s recent rate cuts and Lowe had suggested last month that one rate cut would unlikely be enough which has meant certainly helped the AUD’s stability against the USD with the pair trading between 0.6834 and 0.7047 in the last month despite the consecutive cuts and lack of resolution between China and the US. Many of the gains witnessed in the last few days were fuelled by the trade surplus and continually strengthening global stock markets.

Australian trade surplus dazzles

The trade in goods and services surplus surged to AU$ 5.74 in May from AU$4.82 in April as exports outstripped imports significantly propelling the AUD exchange rates against many of the majors. Markets had anticipated a rise with a forecast of AU$5.25 being suggested. The gains in the Australian dollar meaning that the currency appreciated the most of all when compared to the other G10 nations. Many investors now believe the AUD has very few downsides and are predicting the currency could make further gains in the coming weeks, subject to global scenarios remaining stable.

Global indexes including the ASX assisting in AUD strength

The Australian dollar exchange rates are also seeing the benefits from upbeat global stock market activity with exports of commodities at increased levels. In the last week, the USD/AUD pair has risen from a low of 0.6957 to a high of 0.7047 with further gains expected subject to an appetite for commodities not falling.

Whilst the strength of the AUD is dependent on reform and investment in the infrastructure and development locally, the trade war has ensured a dark cloud hovers over the economy. The US and China have appeared to break very little ground in terms of negotiations, with tariffs now priced at 25% on $250 billion on Chinese imported goods, tariffs being added to goods ranging from furniture to electronic parts. The tariff that appears to be hurting both US businesses and Chinese exporters.

Talks are expected to reconvene from as early as next week with the White houses’ economic advisor Larry Kudlow confirming they are shortly to continue again. Negotiations between the US and China broke down in May when the US accused China of turning back on previously discussed commitments. The commitments are believed to have been circled around the sharing of intellectual property between the two superpowers with the US wanting China to change laws relating to the division of IP. Both nations have imposed tariffs on each other, Trump making two significant concessions at the meeting with Xi including agreeing not putting tariffs on $300 billion in additional Chinese imports and to loosen its grip on Huawei.

Markets don’t expect an immediate fix to the current trade scenario although whilst the US stock market continues to fund middle America and investment appetite remain high as will the commodity market and the AUD should continue to follow.