In the last few weeks, Brexit has come back in focus, providing more GBP volatility. Old issues including the Irish border have once again reappeared. There was also further speculation on whether Theresa May would receive party support in the upcoming parliamentary votes on the EU withdrawal. Furthermore, it is understood that the Brexit secretary David Davis could be or was considering resigning from his post. All the above have attributed GBP volatility and weakened the pound, despite the currency trading in tight ranges.

Speculation surrounding David Davis

It was reported on Thursday that David Davis, the Brexit secretary was considering resigning following a lack of firm date in the Brexit process. Davis is due to hold critical discussions with Prime minister Theresa May who is meeting with cabinet this coming week to finalise final points of the Irish border.

Davis’ frustrations include the speed of the decision making on Brexit by the Tory party, the continual indecision surrounding the custom arrangements and the delay of the Brexit white paper.

Davis who arguably has offered the most loyalty to May during the Brexit process so far has been urged by his fellow brexiteers to remain. Many believing his departure could destabilise the whole process and be extremely challenging for the UK and its economy.

Class clown Johnson speaks out of turn

It’s hard to cover the challenges of Brexit and the instability of the GBP without mentioning Boris Johnson. Johnson who once managed to put his foot in his mouth has caused controversy throughout the whole process; a trend which continued again this week.

Whilst delivering a speech to the ‘conservative way forward’ group discussed a range of topic from the budget, Brexit, trump and even Russian collusion.

He dismissed Phillips Hammond’s prediction on the short term financial effects of Brexit on the UK economy as ‘Mumbo Jumbo’ touted the treasury as the ‘heart of remain’.

Relating to the scenario of the Irish border Boris stated in the leak tapes that

“It’s so small and there are so few firms that actually use that border regularly, it’s just beyond belief that we’re allowing the tail to wag the dog in this way. We’re allowing the whole of our agenda to be dictated by this folly.” The border which spans roughly 500km remains one of the key hurdles for the UK to overcome in the Brexit negotiations. Johnson also ridiculed concerns around the problem that the border processing could encounter as “pure millennium bug stuff”.

More worryingly some of the worst parts of the leaked speech haven’t been scrutinised as much as Johnson’s comments on Brexit and his party members. These included comments on May proposed actions at the G7 summit. The US’s desire to use Britain’s knowledge to dismantle Kim Jong-un’s nuclear weapons.

All of which will raise questions on whether the Foreign Secretary can be trusted not to reveal state secrets and internationally sensitive information.

Previously Johnson’s indiscretions have been swept under the carpet or be laughed off as ‘Boris will be Boris’. However, if as reported his comments involve not just the UK’s national security but those of other nations May could receive more outside pressure to reprimand Johnson.

Upcoming Parliamentary vote on Brexit

The cracks in the Tory government between ‘remain’ and ‘leave’ parties will be critical this week as parliament vote on the EU withdrawal bill. Key Tory figures including Iain Duncan Smith have called for unity in the party this week in order for the EU withdrawal bill to be passed.

If enough Tory MP’s were to side with the Labour party rationale on key points such as retaining access to the customs union and to provide parliament with a voice on the final Brexit deal.

Although unimaginable that Conservative would advocate Labour’s stance continual divisions with the conservative party, speculation around Davis and Johnson could add another dynamic to MP’s thought process; especially as May must be considered as currently at one of the most vulnerable point of her tenure. Many believe if defeated she may face call to stand aside, in turn providing more GBP volatility.

GBP volatility returns following

The recent Brexit speculation has done very little to aid the pound which has enjoyed a level of stability in recent weeks. The latest news surrounding the Tory circus has once again demonstrated the political fragility within the government all of which has drive the Pound lower. This week the GBP – Eur currency pair has fallen, trading at a week high of 1.1460 the pair fell to a low of 1.1325. The pound, also driven down by comments by Michel Barnier who stated that Brussels may pursue the implementation of a customs arrangement that places a hard border between the UK and Northern Ireland. His comments driving the pound- euro to just 1.1325.

Whilst the chart above demonstrates that the comments were viewed by markets as Brexit jousting before the EU Withdrawal bill vote markets are clearly now reacting closely to sentiment from both sides.

Key UK data plus ECD could see further GBP volatility

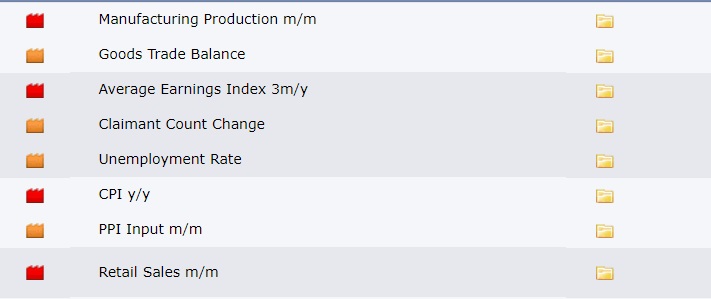

Whilst many believe GBP-Euro will continue to remain range bound, trading between 1.13 and 1.14 this week there are some key elements data for the pound. These include Manufacturing production, Average earnings data, CPI inflation and Retails sales, all of which could boost the Pound moderately if above estimate. They will also provide forward guidance for the next rate decision.

The ECB also have their will also potentially provide forward guidance on their Monetary easing on Thursday. Therefore, subject to the rhetoric the Euro could also be volatile.