The Canadian Dollar slipped to a 9-day low against its US counterpart this week following yet another drop in oil prices. US crude slipped to $52.07 a barrel on Thursday following increased US production, contributing to CAD losing further ground against USD. Although the oil price led CAD depreciation was minimal it drove the commodity currency down further.

Whilst January hasn’t been terrible in terms of raw economic data the instability in oil prices and the continual trade war issues are beginning to take effect on CAD exchange rate levels.

The end of October to early January saw the USD/CAD appreciate from a low of 1.3003 to a high in late December of 1.3685. Since however the pair has gradually slipped as oil prices began to appreciate.

Recent Canadian economic data

January’s economic data, by and large, has been positive for the Canadian economy and Canadian Dollar. Employment increased by 9.3k in December against a target of 6.8K and unemployment in Canada also fell in December falling to 5.6% from 5.7% the month before. The data was naturally interpreted as positive by markets however the challenge the Canadian economy faces is the lack of growth in wages. November and December’s year on year wage growth has remained stagnant at 1.5% falling from a high of 3.9% in May. Analysts believe that modest wage growth coupled with October’s rate hikes will equate to future economic growth and help stabilise the Canadian property market.

Another hurdle the Canadian economy also faces is getting the inflation to around 2.0% which was achieved in January. Decembers monthly CPI increasing 0.2% or 2.0% when annualised. Whilst much of the growth was seasonal, including air travel and holidays it helped in offsetting lower gas prices. The Bank of Canadas Key inflation barometers of core inflation all indicate that inflation will be sustained at 1.9% there are niggling concerns that this could be jeopardised by the slump in wage growth.

Potential trade war end could help

If the US and China were able to find a compromise to their trade contretemps Canada could almost certainly see a further increase to the upside in their economy. As a significant exporter of commodities, Canada has been affected by the US-China stalemate. Recent reports in the Wall Street Journal which explained that Trump’s government was considering lifting tariffs on China lifted the CADS. Many anticipate that if accurate the truce could pave the way to an agreement and potentially put an end to the trade war, providing the US was to get the concessions it has requested from China.

Although Canada has secured a trade deal with the US and Mexico the global uncertainty caused by the US and China has quelled sentiment.

USD/CAD exchange rate performance

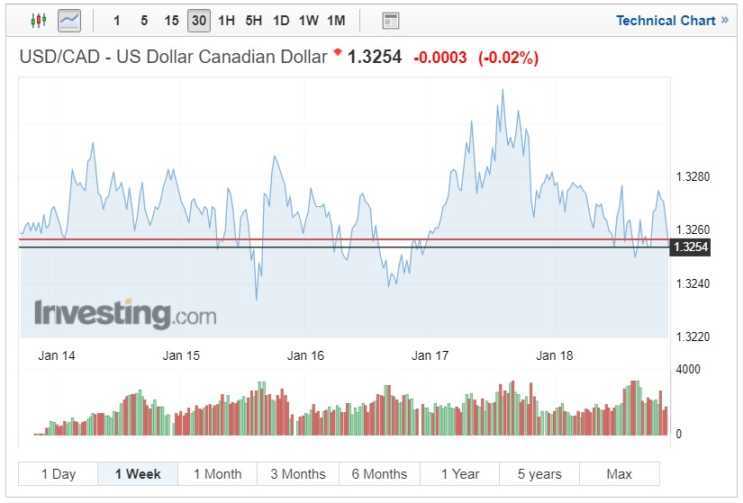

The last week has proved a volatile one for the USD/CAD pair with oil prices and trade war developments playing their part in USD/CAD exchange rate movement. The pair opened up the trading week at 1.3259, touched a high of 1.3313 and fell to a low of 1.3254.

The developments with Brexit also saw investors jump back on the Pound and Thursday’s trading session saw some significant declines in the pair as investors bet on Sterling.

The pair closed on Friday evening at 1.3254 after falling further before market close.

CAD forecast 2019

Market makers believe that the USD/CAD pair will drift lower in 2019 with the CAD expected to gain against the US Dollar and Sterling. Key drivers will be scheduled interest rate rises and the upcoming elections. Whilst typically political uncertainty is negative for the concerned currency, many believe that the upcoming election will force the government to address issues surrounding Canada’s global competitiveness. Canada remains relatively uncompetitive due to both government and federal rules and regulations. This, in turn, impedes supply chains and operations processes.

Investors believe that reform, underpinned by a healthy economy and the potential rate rise will bode well for the economy and see the Canadian Dollar gain ground against both the USD and Sterling in the coming months.