The first half-year is drawing to a close. A new half-year will begin this week. Trading is expected to be turbulent this week.

The U.S. dollar index that measures the greenback against major currencies saw a weekly loss, becoming a safe-haven asset in a weak economy.

The rising Covid-19 pandemic triggers raising concern in the market and the dollar continues to benefit from the second wave coronavirus fear.

Major currencies such as the sterling and euro continue to struggle against the greenback, closing at crucial levels on Friday.

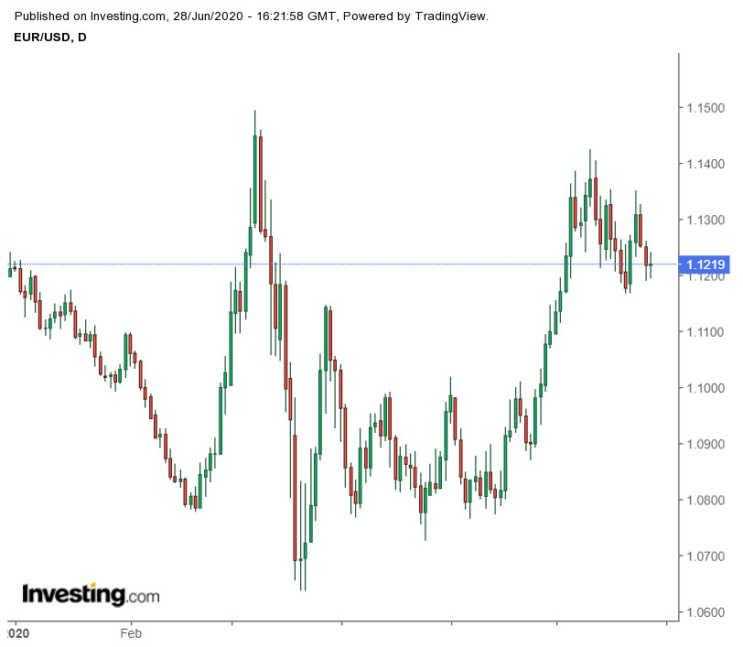

EUR/USD is at 1.1218

GBP/USD is at 1.2335

USD/JPY is at 107.23

The U.S. dollar index has fallen to 97.09, a fall by 0.07percent. Unemployment figures continue to remain high and this continues to have an impact on investor sentiment.

GBP/USD exchange rate between the British Pound and the US dollar has ended on a week note. It has strong support at 1.23 and if it breaks below this level, it may slide towards a low of 1.2086. The GBP continues to be risk-sensitive. Analysts say that the PMI data from China may impact the forex market.

Brexit Uncertainty and Coronavirus Casts Shadow over the Pound

Meanwhile, the EUR/USD pair shows worrying signs as President Lagarde of ECB sends warning signals on Friday stating that a complicated recovery is expected in the economies in the coming years. It was similar to the warning given by the Fed against bank resilience dragging the market lower.

The deadline for the UK to ask the European Union for a Brexit extension ends on June 30. If there is an extension, the GBP may benefit.

The Eurozone will receive data on unemployment and inflation in the coming week. The coronavirus has been disturbing the economies continuously. Investors do not expect much positive news and the coming data is not expected to have much impact on the EUR/USD.

The EUR/USD pair is just above crucial levels at 1.12, while resistance is found at 1.250

The pair has gone down below crucial supports at 100 Simple Moving Average. Currently, it has a support level at 1.1190 and 1.1165, when it touches low levels on June 19.

The trade dispute between the US-EU continues to unnerve investors. $3.1 billion European goods are expected to be hit by duties, according to the office of the U.S. Trade Representative. If there is an escalation, it may drag EUR/USD lower.

Euro Shows Strength

The Euro continues to become appealing to investors. The European Union has handled the coronavirus pandemic well. The Eurozone economies show signs of optimism against major currencies. Even if PMI data likely to come this week is not positive in the Eurozone, the Euro may not feel the jitters, expect analysts.

Sterling Australian Dollar exchange rate (GBP/AUD) was weak at the beginning of the week. But a positive note from the RBA Governor Philip Lowe that the COVI-19 may not be as bad as it is feared had improved market sentiment.

On Monday, trade adviser Peter Navarro at the US White House implied that the trade deal between the US and China had fallen out, which caused panic selling in the market. However, an immediate Twitter from US President Trump stated “China trade deal is fully intact”. This raised the EUR/USD pair to reach 1.1348 which was its weekly high. The agreement has to continue further on to avoid jitters in the market.

Other major currency pairs closed at the following levels this week.

USD/CHF is at 0.9481

AUD/USD is at 0.6864

USD/CAD is at 1.3687

Coronavirus Impact on Currencies

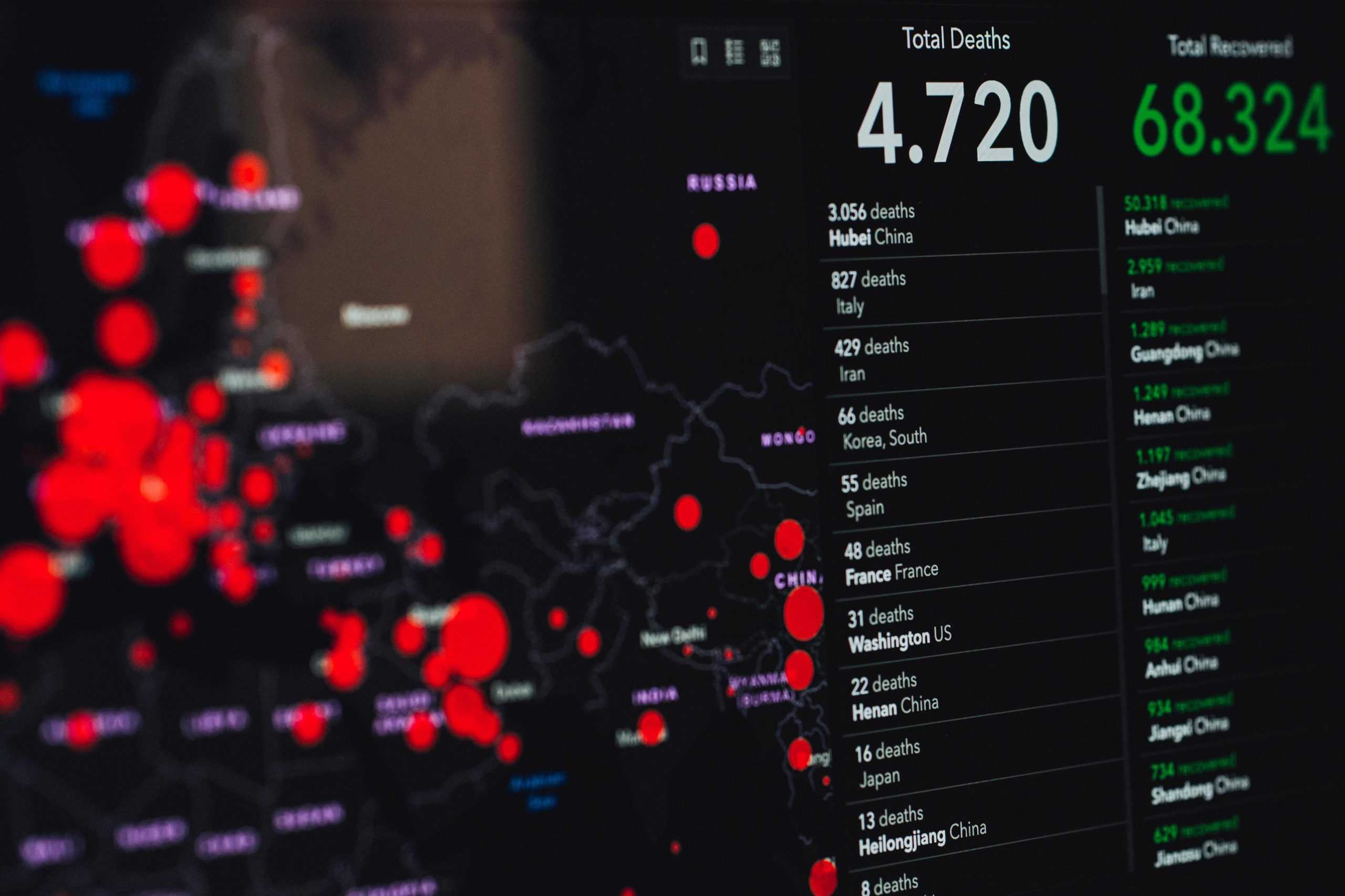

The Covid-19 pandemic may bring in further lockdown measures in many parts of the world. Investors brace for the worst to come and are quite pessimistic on the market. Increasing Covid-19 cases may be the chief driving force behind the market, say analysts. Texas has ordered bars to be closed as there is a spike in death rates. In the U.S., the greenback may lose its sheen if the pandemic does not come under control.

Death count across the globe is almost at half a million according to figures reported by JHU. Top countries affected by the virus are the US, Brazil, Russia, and India. Texas and Arizona have seen an increase in hospitalizations at 57 percent and 36 percent when compared to the previous week.

The EUR/USD has been sliding caused by the panic from the coronavirus spurt in the US, where 40,000 cases are reported every day. The EU has been seeing around 20,000 cases every day. In the US, the government is said to bring in a $1.3 billion package. The ECB has announced a EUREP which is a repo facility for central banks. Though the stimulus may not meet financial needs it is a small solution that is softening the impact in both regions.

For the upcoming week, data regarding June inflation estimates from Germany and the EU will be looked at with much expectation. The Federal Reserve will be publishing ISM Manufacturing PMI for June which is expected to be at 47.6 for the month.