Early last week the ECB stepped up their warnings about the potential consequences of a disorderly Brexit and the likelihood of a no-deal Brexit. The ECB’s speech came just a day after UK parliament rejected Theresa May’s Brexit deal.

The bleak outlook was shared by the Austrian central bank governor Ewald Nowotny who warned that the continual uncertainty could upset sentiment in the Eurozone. Another ECB board member Yves Mersh dubbed the effects of the UK’s departure from the European Union as a cause for ‘’unnecessary shocks’’ to the Eurozone economy.

Whilst from the ECB’s perspective Nowotny believes the European banking system is prepared, they have concerns on how psychologically consumers may react and expect this to potentially scare consumers.

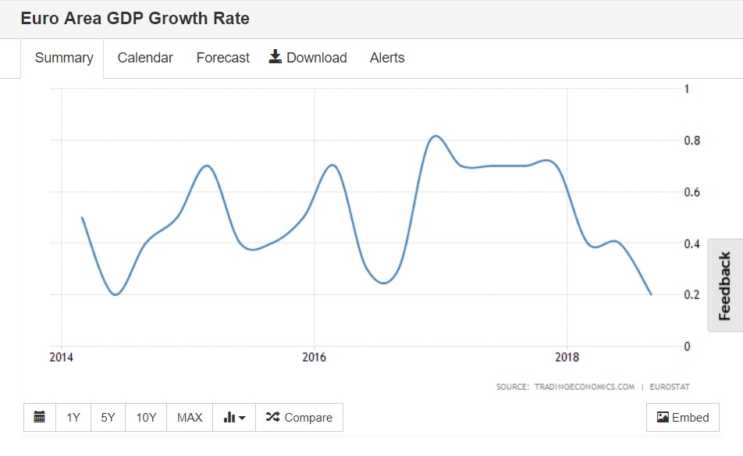

Until the devasting vote in parliament, the ECB believed that the Brexit vote would only affect the financial sector and was unlikely to affect the wider economy. It would now appear that their concerns run a lot deeper. Earlier in the week, Mario Draghi told Euro lawmakers that he believed the eurozone was heading for recession but insinuated that the euro economic slowdown could last longer than expected. Bringing the possibility that the ECB may consider further stimulus, the news provoking Euro exchange rates to trend lower.

Major fundamentals for the Eurozone have declined in the Eurozone in recent months with manufacturing and services data all underlining a significant slowdown.

The zone has emitted poor data after poor data this month and investors have shied away from the zone in recent weeks. Many now finding themselves concluding that the ECB rate rise is years away rather than months.

Threats to the Eurozone economy

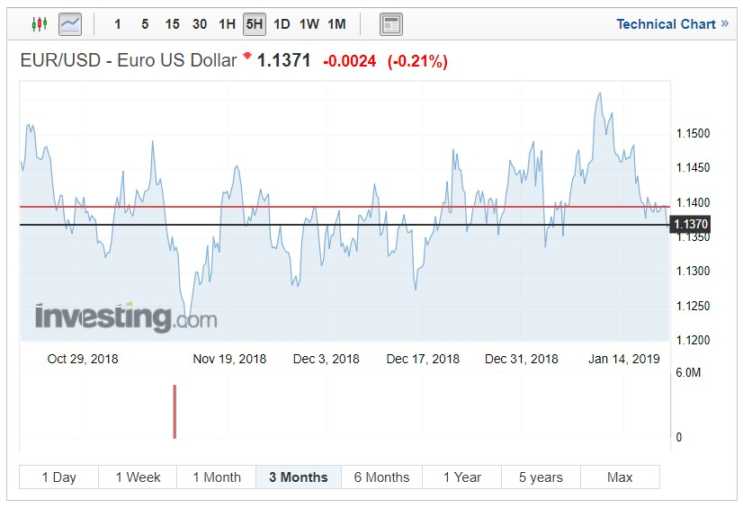

Initially, the ECB were planning to raise rates at the end of the year, and could still do so however leading economists are warning that the opportunity to do so is decreasing. Euro exchange rates have weakened 0.5% against the Dollar and a staggering 2% against the Pound with Sterling able to mount a charge against the Euro despite it’s underlying Brexit issues.

The challenge the ECB faces now is finding an opportune moment to pounce and increase interest rates, especially as the fundamentals are highlighting that life post QE is going to be more challenging than initially expected. In order for this to happen geo political issues would have to be remedied, Brexit executed under a no-deal fashion and confidence return to markets.

Despite Mario Draghi’s soothing comments, many believe that Germany, the biggest contributor in Europe is primed for recession. If Germany was to slip into recession it would be hard to envisage other nations not being pulled down with it.

Despite these factors, many have warned against an over pessimistic approach to the Eurozone economy. Many of Bloomberg’s analysts believe that the Draghi could well touch upon the possibility of pouring more liquidity into European markets in the coming months in order for Europe to overcome some of the medium challenges.

EUR/USD to weaken further?

The single bloc currency has weakened to a low of 1.1219 in recent weeks and investor confidence has diminished. This trend is expected to continue especially if the US and China can put aside differences and move forward, securing a globally beneficial arrangement. In turn, this would dramatically assist the Eurozone economy which has been caught in the crossfire of the global economic cooling caused by Trump tariff tweaks.

Despite the possibility of the US and China finding common ground and moving forward many anticipate that the Euro- USD exchange rate will revisit the lows experienced in mid-November. Put simply the economic outlook for the single currency looks as bleak if not bleaker than Brexit. Analysts are cutting their forecast for Eurozone growth further, essentially disregarding the ECB’s predictions for 2019. The first quarter of 2018 saw euro- USD appreciate roughly 4%, only for the pair to lose 5% over the rest of 2018.

The last week saw the Euro-US Dollar pair depreciate heavily as The FOMC’s Williams outlined two potential US interest rate rises in 2019, stating that:

The economy is strong; the outlook is healthy and my number one priority is using monetary policy to keep it that way.

The comments and the Williams comments leaning toward further belief in the US economy provoking the EUR/USD to fall from 1.1397 to 1.1356 on Friday, before closing at 1.1370.

Euro forecast

Despite the run of very poor data, the Euro isn’t too far from 1.14 a critical level for the EUR/USD pair

with many believing that if this mark was surpassed the next resistant level is 1.15. FX Traders expect this pair and the Euro market to remain volatile especially if growth numbers and other key fundamentals were to continue to paint a bleak picture.

In terms of Brexit volatility markets appear to be leaning toward a softer Brexit or remain, this seems unlikely in the long-term however delayed Brexit of the revoking of Article 50 seems highly likely. This would fuel Sterling strength and see the GBP/EUR pair head toward 1.15, this would only happen if May’s plan B was flatly rejected or the squabbling was to continue.

Will Europe or the UK suffer more from Brexit?

Whilst the answer to this question will only be known once the outcome of Brexit is clearer neither are likely to benefit. The lower Pound exchange rates have seen inward UK investment from overseas increase which might heighten further if the pound was to take another tumble. The timing of Brexit could not be worse for Europe and if the UK were to cut ties Germany manufacturing, in particular car production could suffer dramatically as tariffs would almost certainly be applied.

The IMF earlier this year highlighted that a no-deal Brexit would harm the UK more than Europe. However, this assessment was before the global cool down and before the height of tensions between China and the US. Therefore, the economic output drop in the UK could be easily matched by the slowing experience in Europe. Either way its clearly in the interest of both parties to find a palatable solution that works for both sides in order to cushion the effect of the current global downturn.