If Mark Carney has become known as the ‘unreliable boyfriend’ you can pretty much bet your mortgage on what Mario Draghi at the ECB will do. There had been a few concerns around the eurozone inflation and growth rates with markets wanting answers and potentially a clue or two as to when the ECB would be prepared to raise interest rates as the Eurozone economy.

The key to the eurozone’s recovery is still based upon the prudent reduction of their asset-buying program which over the last months has seen purchase been reduced to €30 billion a pace which will run to at least September, or until inflation gets closer to the banks optimal rate of 2%.

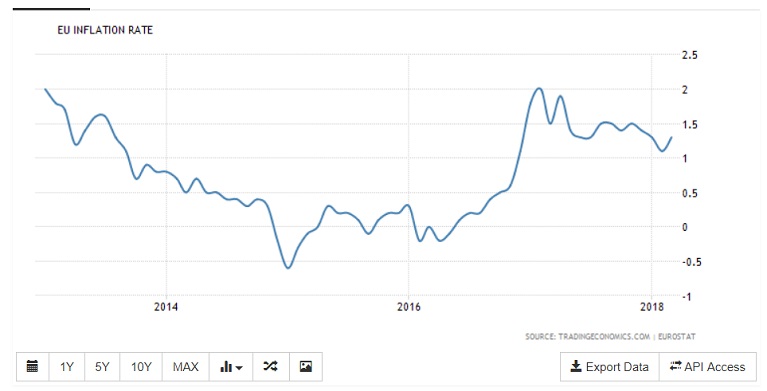

Inflation has dogged the economy despite the asset purchasing program, which should have helped inflation along more. There has however been slightly more upbeat news with the zone inflation touching 1.4%.

The European inflation issues

This month saw the Eurozone’s inflation tick up to 1.4%, despite core inflation remaining unchanged the move from 1.1% to 1.4 this month demonstrates slow progress. The upward motion comes after three years of 0% interest rates and the asset purchasing program.

The improved levels of inflation will motivate those ECB members who have been calling for a more aggressive reduction in the asset purchasing program. One member who sides with this rationale is president of the Bundesbank, Jens Weidmann who stated last month that asset purchases should be halted soon and that a mid-2019 interest rate hike was:

“probably not entirely unrealistic.”

Weidmann’s thought process has received support from others including the Dutch central bank governor Klass Know who has stated that monetary policy normalisation should be a top priority.

Highlighting that many influential central bankers are now calling for a prompt conclusion to the monetary easing policy, naturally, this will be defined by the improvement in inflation and the important nearing of the magic 2% mark.

Optimistic on growth despite slowdown

During his speech and central bank decision, Draghi emphasised his optimism on the Eurozone’s moderate growth despite a run of negative data which indicates a potential cooling. Despite this the ECB remain steadfast and believe the diversion can be explained away with poor weather, Easter being early and strikes having hampered growth plus better than expected recent growth figures which he now expects to return to the status quo.

Draghi also covered the very real threat of protectionism and the possibility of the US and Chinese trade war. Stating that:

“However, risks related to global factors, including the threat of increased protectionism, have become more prominent.”

Continuing, Draghi said:

“What is known is that these events have a profound and rapid effect on business, on exporters’ confidence . . . and confidence can, in turn, affect growth.”

Investors had anticipated that the ECB would wind up its asset purchasing before the end of the year, however with little forward guidance, which is now expected in July’s minutes. The door has been left wide open especially as Draghi has explained the growth away, insisting it will return to a steady norm and putting the spike in inflation down to elevated food cost.

When might the ECB raise interest rates?

Draghi’s statement diverted little from his last making the open-ended nature of the asset purchases hard to read. Very few believe that the easing will come to an abrupt end in September and the European Central Bank has always held the joker card that they would implement the strategy until needed. They have also clearly stated that an interest rate rise is highly unlikely to take place before the bond-buying program’s conclusion.

Experts still envisage a conclusion that European asset purchases will continue well on into 2018 and the recent weak economic data will arguably support this plan. The domino effect will, therefore, be that interest rate rises will also be delayed by the recent run of weaker economic data and investor are now concluding that a Eurozone interest rate rise will happen until late 2019.

Sterling temporarily get the upper hand

Despite sterling’s recent ‘seasonal’ run of weak data, the pound was able to capitalise on the ECB’s tone with the GBP- EUR exchange rates clawing back some of the recent losses. The pair has fallen as low as 1.1360 a rate that markets closed at following the UK’s dismal GDP figure.

Before the release of UK GBP data, the GBP-EUR exchange rate had benefitted from the ECB press conference comments, the pair rising from 1.1433 to 1.1502.

EUR-USD exchange rate performance this week

The lack of direction or commitment from the European central bank was also played out in EUR-USD exchange rates which fell at the greatest rate this week since January.

Friday saw a low of 1.2066 falling from a week high of 1.2284 before a rapid decline as markets prepared for Draghi’s speech. EUR showed some resistance and the pair closed at 1.2131.