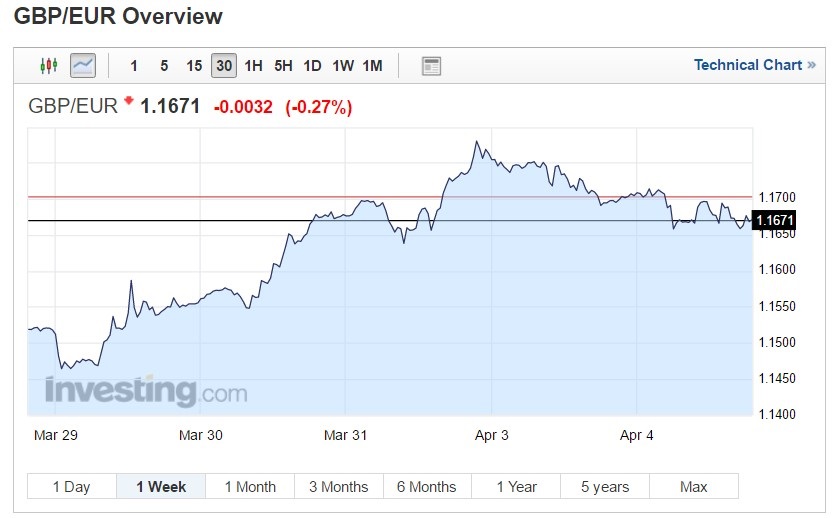

GBP had started to get into a positive following the official triggering of article 50 last Wednesday. The UK officially requesting to leave the European Union saw GBP strengthen against many of the major currencies. GBP strength was especially noticeable against the Euro, seeing the pound strengthen to 1.1780 during US trading hours on Friday.

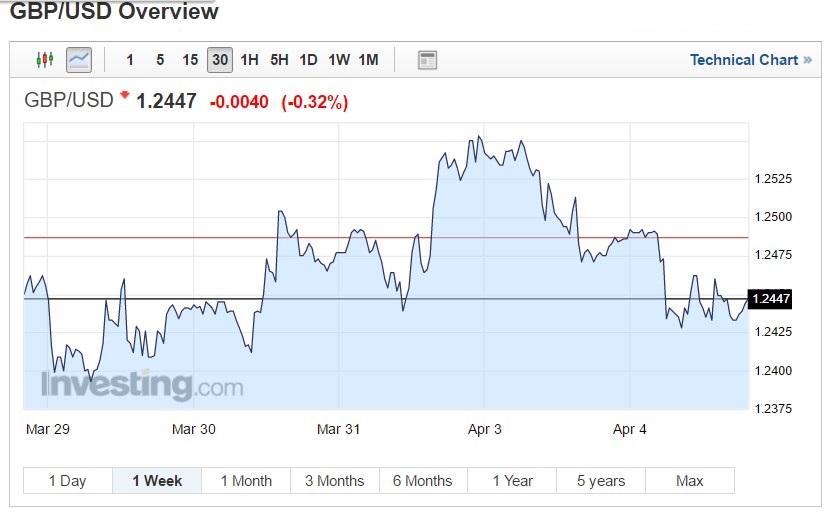

GBP strength against the Dollar also suffered the same fate with cable seeing good gains early in the week before halting. At points GBP USD comfortably breaking the 1.2550 mark before retreating.

Manufacturing PMI

However, the pounds lucky run lost steam following the release of the monthly manufacturing PMI figures. The figures had indicated the sector had indeed expanded reaching over the 50 mark. However, the anticipated level of 54.2 showing a slight contraction on Februarys figures which yielded a better result of 54.5, therefore falling short of the anticipated 55.1.

The bigger issue is that this Manufacturing PMI has declined continuously over the last three months. This will no doubt be concerning markets who may have anticipated that manufacturing would have been fuelled by a lower GBP.

Construction PMI

Sterling woes were eased ever so slightly with the release of the monthly construction PMI figures which were close to their target of 52.2 against a forecast of 52.5. This sector makes up a very modest part of the UK’s economy, therefore the pound was unable to reverse any losses.

Tomorrow will be an interesting day for the pound as the monthly services PMI are released. This sector makes up the most significant part of the UK’s GDP and a number higher than 53.5 would surely see GBP strength increase. However, this sector has missed its forecast two of the last 3 occasions and markets will surely look to sell the pound if the figure was to miss expectations.

This being said GBP strength would certainly be likely if it was to exceed the anticipated 53.5 or even better replicate/exceed January reading of 56.2.

Towards the end of the week, the UK had some lower tier data including Halifax house price index figures and more importantly manufacturing production followed by a speech from Carney.