The downtrodden Pound had a moment to gather its thoughts and dust itself off this week as it enjoyed decent gains against some majors. Sterling rode the wave of poor Eurozone economic data, a parliamentary reprieve and a successful chain of positive UK economic data.

Whilst markets will almost certainly ease off the Pound on Monday in anticipation of the Tory party leader and prime ministerial election, this week by and large, was more positive than previous ones.

Solid UK economic data

The beginning of the week appeared to have a Groundhog Day feeling. GBP continued to be sold off with the Pound dropping to 1.1061 against the Euro and 1.2403 against the Dollar, continuing the challenges of the previous week which saw Sterling fall to lows last seen in 2017.

Tuesday, however, was the day that sparked a change in Sterling desirability with the release of the average earnings data which showed a solid rise in quarterly wage growth compared to the previous year. With earnings growth jumping to 3.4% against the projected 3.1%, although it did little to stem the GBP sell-off, it indicated to markets that potentially Sterling shouldn’t be written off completely. Earnings in the last quarter growing at the fastest rate in over a decade and demonstrating, for now at least a certain resilience to Brexit. The data did indicate some signs that the UK’s strong labour market could be slowing, with 28000 positions created in the last quarter, full-time positions falling by 58,000 and part-time employment increasing by 86,000.

Whilst the data will be interpreted in many ways the UK unemployment remains at a near-record low of 3.8% and wages have outstripped inflation for 16 months in a row, whilst female employment is at joint-record levels.

Parliament thwarts No Deal Brexit

Whilst most bookmakers anticipate a comfortable Tory part victory for Boris Johnson next week Parliament haven’t exactly provided the warmest of welcomes. Boris who has long advocated the route of no-deal if more palatable terms aren’t offered by the EU could now find himself unable to take the UK out of Europe via a no-deal exit. Voting in the commons, MP’s voted against the prime minister being able to suspend parliament in order to push through a no-deal Brexit. The new amendment circles around Northern Irish legislation which states that Brexit will now have to be debated in the commons until the end of October. Whilst the recent amendment will do little to encourage the exasperated UK public it at least ensures that the government is made to provide fortnightly reports and updates on the progress of talks with the EU.

The vote on the Northern Irish amendment was 315 v 274 in favour of, embarrassingly for the Tories many MP’s including Jeremy hunt didn’t vote, potentially assisting the commons victory.

The amendment more critically allows parliament to add clauses to essentially rule out the UK leaving the EU on no-deal terms. Therefore, leaving the wantaway prime ministers hands tied.

Boris Johnson the anticipated victor, if elected, hasn’t ruled out approaching the queen for prorogation, allowing him to essentially lock the doors to the house of commons on those that might block a no-deal Brexit.

Hammond makes a stand

In a further plot twist, Philip Hammond announced on BBC news that he would resign if Boris Johnson was elected. Hammond who has always stood firm against the UK leaving without a deal, stating the new prime minister and his chancellor should be ‘aligned’ and leaving the EU on no-deal terms was something he couldn’t ‘sign up to’. He confirmed he would step down before PM questions and before Theresa Mays departure.

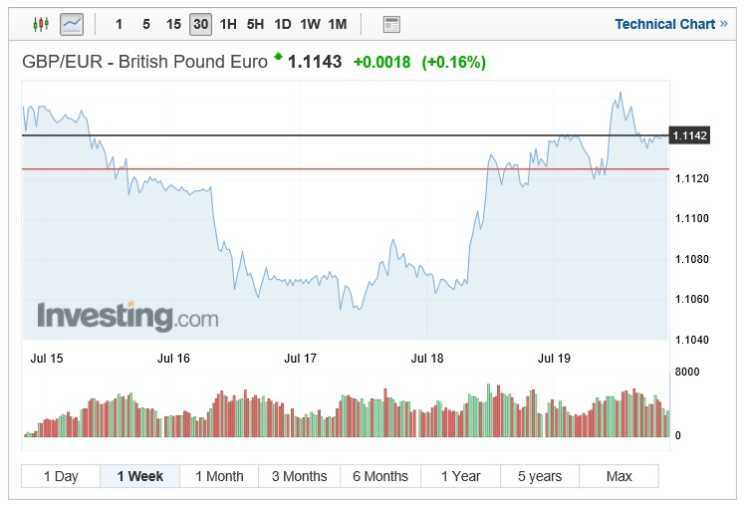

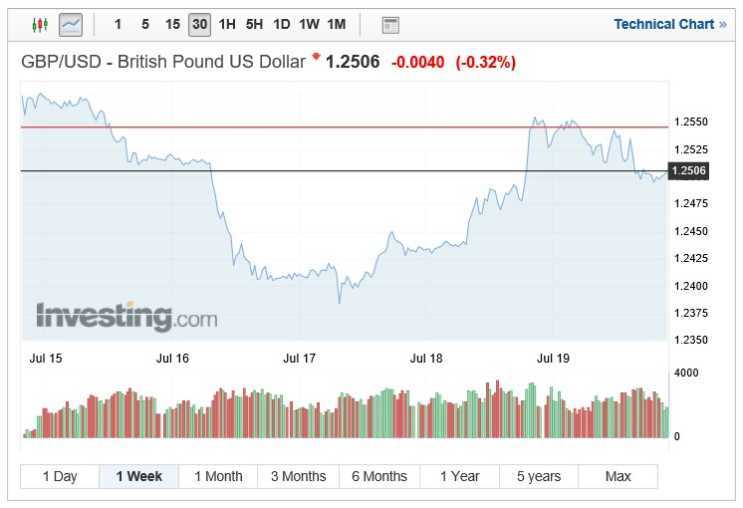

GBP/EUR and GBP/USD exchange rates

Whilst continual uncertainty will only intensify this week as the new prime minister is officially announced, Sterling has managed to gain ground from the lows last seen in 2017. GBP/EUR strengthening from a low of 1.1055 to Fridays high of 1.1163. Before the trading window closed at 1.1142.

Elsewhere GBP/USD also enjoyed gains later in the week, capitalising on markets inability to decide on the size of the next US interest rate cut, due shortly. Cable rising from a week low of 1.2384 following a sharp decline at the start of the week. The GBP/USD eventually recovering the majority of the week’s losses and touching 1.2555 on Thursday following John Williams comments FED’s low interest rate and inflation.

Sterling bulls shouldn’t expect these gains to continue over the next week especially, if as expected, Johnson is elected and continues to attempt to find a way of passing a no-deal Brexit. Hunt although more moderate isn’t expected to win, however, if as polls recently have, are proved inaccurate expect a modest lift in Sterling.