Pound exchange rates have capitulated as the UK appears to be willing to turn down Theresa May’s deal and take another run at the EU or look to dethrone the troubled leader. The PM requires the support of 320 MP’s on Tuesday evenings vote. Currently, the if estimates are accurate, it would appear that May faces an uphill task with just a few days left to sweet talk those sat on the fence. This charm offensive has not been assisted by the publishing of Brexit legal guidance which arguably renders the deal to inferior that our current EU membership and arguably doesn’t fulfil leave electorates wishes.

Brexit legal guidance in the public domain

This week the prime minister has faced humiliation in the form of parliamentary votes which deemed the house should have been made aware of the legal advice issued to the UK government on its Brexit deal.

Amongst many of the issues was the potential of the UK being locked into an Irish border stalemate which could lead to further negotiations with the UK needing approval from the EU to leave the customs union. This admission provoked accusations that May had attempted to mislead the house of parliament and will at very least not assisted with her UK wide charm offensive.

Another apparent negative of the proposed deal would be that the UK would be unable to form new trade deals with other nations before forming one with EU. Therefore, the UK could theoretically be tied in the current deal with the EU unless a new trading arrangement with the EU could be struck. Prohibiting the UK from collaborating on trade with other nations.

GB pound volatility in the coming days

The Pound is anticipated to move a lot this week and despite a few rumours in the media that the parliamentary vote could be postponed markets wait with bated breath and expect the decision late Tuesday evening. Either this marks the next stage of Brexit withdrawal or heightened political turmoil in the UK. If resignations follow the outcome the GB Pound could capitulate, some experts are anticipating the Pound to have the ability to move by up to 6%, either way, subject to the outcome.

If as anticipated May’s Deal is turned down by Parliament it could trigger a vote of no confidence, a view which has already bee voiced by the Labour leader Jeremy Corbyn. In turn, this could spark a snap general election and throw the GB Pound into further turmoil.

May has been very clear, stating her Tory party should back her deal or get ready for an election. Whilst many believe this threat will not materialise votes may sway to avoid an election and the deal could be passed. Improbable but still technically possible. GB pound exchange rates would almost certainly rally if passed and the UK would benefit from an orderly Brexit.

Pound exchange rate movements this week

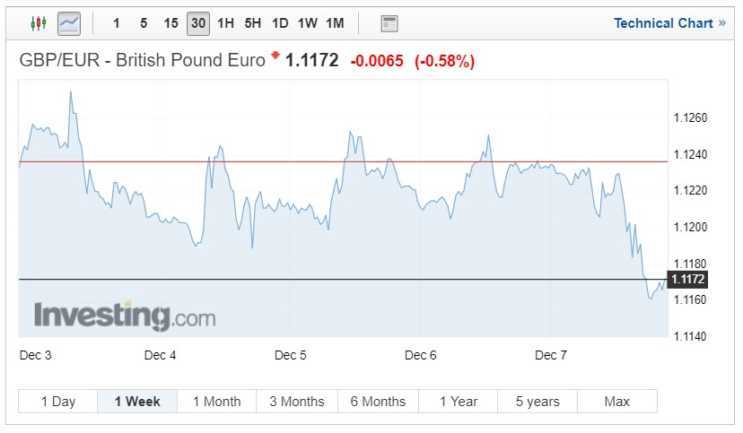

Sterling exchange rates have witnessed volatility this week which will not surprise any of our readers. GBP/EUR has traded as high as 1.1275 and as low as 1.1161.

The majority of Sterling rises can be attributed to a rhetoric of ‘No-Brexit’ outcomes rather than encouraging data. Lows, however, have been motivated by the unequivocal lack of support for May’s deal. The pair closed on Friday at 1.1172. In September Traders saw GBP/EUR fall to 1.1132 markets anticipate further drops in the coming days.

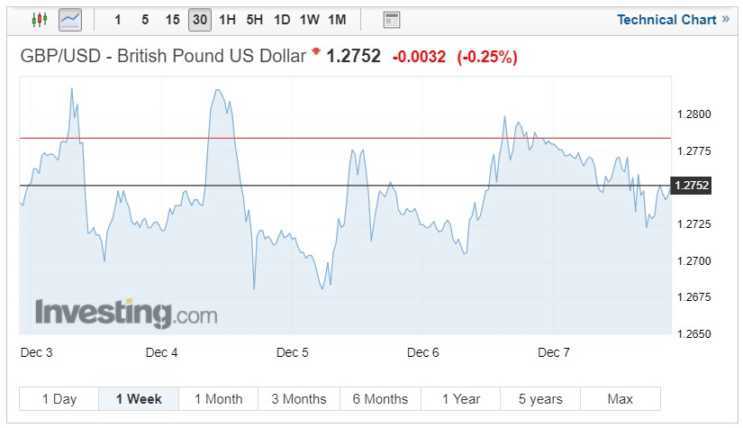

Elsewhere GBP/USD has been just as volatile as GBP/EUR with the pair seeing lows of 1.2681 and high of 1.2818 at the beginning of the week. Most of the volatility has been Brexit driven despite Trump being continually enrobed in his own scandal.

USD weakness has been seen when FED chair Jerome Powell described interest rates as approaching ‘Neutral levels’ and although Non-Farms numbers were lower than expected, wages are continuing to see growth.

GBP/USD bulls will as all market will, have all eyes on the UK parliamentary vote, this will almost certainly be the biggest motivating factor of both the GBP/EUR exchange rate and Sterling-Dollar. Playing a distant second in terms of importance will be the UK’s Jobs data and GDP report which will almost certainly have little effect on GB Pound rates.