The Pound enjoyed solid gains this week as parliament tied up Boris Johnson’s plans and legally took the pat of no-deal off the table. The recently elected prime minister facing and losing 4 votes in parliament this week. The Pound gaining support as the likelihood of the UK leaving the European Union without a deal. Whilst the prime minister remains steadfast in his approach promising especially as the opportunity to secure his premiership via general elect now seem remote.

Defiant Tories shown the door

A number of votes were passed including a vote to take control of parliament, to deal Brexit until after October 31st and a final vote which saw the house vote against holding a general election; the latter, the first time in UK politics that the opposition has voted down a snap election.

In a continuation of his hard line on Brexit Johnson excluded 21 tory MP’s for voting for a bill that could take No Deal Brexit off the table. Johnson also lost the majority in parliament, as now ex Tory member Phillip Lee crossed the hall and joined the Liberal Democrats while Johnson delivered his updates on the previous weeks G7 summit.

Boris considers his very limited options

Johnson has actively voiced his reluctance to a snap election, taking to TV after the G7 summit. With essentially all of his power now taken away by parliament and election may be his only option.

Whilst he will certainly attempt to find a loophole in order to push through a no-deal outcome the quickest and most morally correct way of enforcing his promise of leaving the EU by the 31st would be via election. The challenge he faces is that he needs two-thirds of MP’s to vote for an election, a vote that seems unlikely to happen.

Domic Raab stated over the weekend that the Boris Johnson would test the law to its limits and uphold the possibility of the UK exiting without a deal. Raab did admit that they would abide by the new legislation but would test it to the limits.

Johnson’s options are slim with parliament completely locked down, polls remain in his favour, but Labour are keen ensure no deal isn’t a possibility and therefore are unlikely to crumble and vote for an election until after the deadline. Requesting a deadline extension would undermine Johnson’s position significantly.

Amber Rudd resigns to go it alone

As if Johnson’s outlook wasn’t bad enough a key cabinet member has also abandoned the troubled ship citing she had no choice once her colleagues lost their jobs following supporting Hillary Benn’s bill requesting a further delay to the UK’s departure.

Rudd’s departure follows both Phillip Lee and incredibly, Joe Johnson who resigned due to a conflict between his beliefs and family values.

Rudd’s departure will be viewed by far as the most damaging especially as she explained that she found the party’s preparation for no Brexit far outweighed efforts to seek a deal. Leading her to believe that the Prime ministers only objective was to Sheppard the UK out of the EU via no deal. Incredible considering Boris Johnson’s jubilant fist-shaking following his trip to see Macron and Merkel.

Whilst Rudd didn’t want to be drawn on her political future but she did say she was considering becoming an independent conservative MP and standing if there was an election.

Pound exchange rates rocket

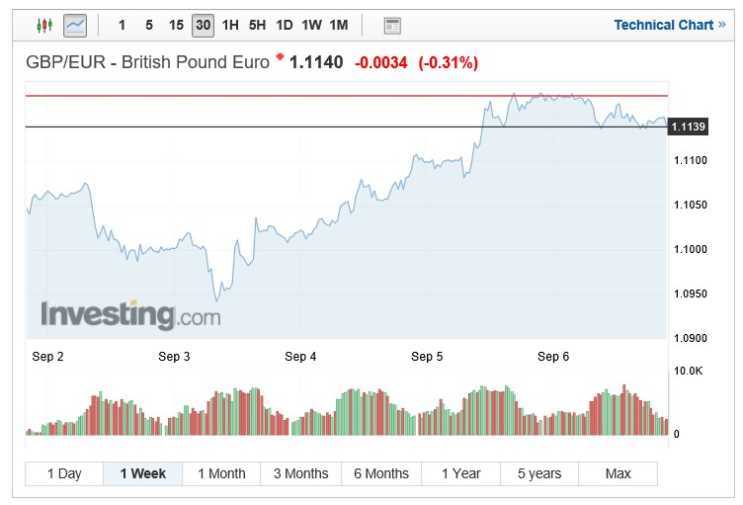

The pound has reacted positively to parliament taking the decision away from Brexiteer Tories and at its height GBP/EUR touched 1.1176 a level which has falling slightly but still has a great level of support above 1.11. Next week will be viewed keenly by investors who will await a reaction to recent departures. Rudd’s admission that she felt that the cabinet were exhausting 80-90% of their effort on no deal was damning and one that won’t be accepted by the electorate.

GBP/USD also enjoyed some aggressive gains this week with the pair appreciating over 1% in a single trading session. GBP/USD opened this week trading at around 1.21 but increased rapidly as the prospect of a no deal outcome dwindled the week high touched 1.2348, an exchange rate which followed a week low of 1.1971. The GBP/USD pair closed at 1.2280 a level which was supported in the last few days of trading despite some poor UK services data which missed the target and showed contraction on the previous month.

Whilst data for GBP is fairly scarce this coming week the data involved typically could be impactful. Monthly GDP and manufactering figures are released Monday with 0.1% growth and -0.3% contraction in the manufactering sector.

Despite this, all eyes will be on the rest of the cabinet’s reaction to Amber Rudd’s departure and it is highly likely that there could be more departures or defecters. Further sideshows would only see Johnson’s position weaken further and jeopardise his ability to negotiate with the EU or force through his agenda.