The pound was propelled further this week as proactive talks were held between UK Prime minister Boris Johnson, Angela Merkel and Emmanuel Macron. Johnson began his whistle-stop tour in Berlin where he enjoyed a working lunch with Merkel. He then hot-footed his way to Paris to meet with the French President Emmanuel Macron with one objective, making progress on Brexit.

Boris left London with a clear agenda for negotiations with the German and French leaders, which included attempting to get them to dismiss the Irish backstop.

Although it would have been highly unlikely that the European leaders would have granted the dismissal of the backstop Merkel allowed Johnson 30 days to find a solution to the backstop a challenge which Johnson seemed more than happy to accept.

Macron although slightly less flexible then Merkel stated that the backstop was ‘indispensable’ but was happy to allow the prime minister time to table an alternative to the backstop. Macron confirmed that he was united with Merkel, also suggesting they could involve the EU negotiator Michel Barnier to find a solution ‘’without totally reshuffling the withdrawal agreement’’.

The two European leaders now await concrete proposals from the UK in order to move Brexit negotiations along. The openness to listen to a new backstop proposal was interpreted positively by markets and the Pound rose as the possibility of a deal seemed slightly more plausible.

Tusk won’t cooperate on no deal

During a speech at this weekends G7 summit, Tusk confirmed, like Macron and Merkel that the EU was open to listening to Boris Johnson’s ideas providing they were realistic. Whether Europe is now softening its approach or willing to be more flexible awaits to be seen, however, the very fact they are willing to consider a backstop alternative, a key hurdle in the negotiations would appear to be positive, especially as the view is apparently shared by the EU.

Tusk did also shoot a warning to Boris Johnson saying that he would be remembered as ‘’Mr No-Deal’’ if talks stall to which Johnson replied that Mr tusk would be remembered as ‘Mr No Deal Brexit’’. He also confirmed that he would not cooperate with No Deal negotiations at the G7. The pair are due to meet today in order to continue discussions.

Trump backs Boris and is keen on UK-US trade deal

Amongst the attendees of the G7 was one Donald Trump who heaped praise on Johnson, the pair clearly feeding off each other’s persona. Trump described the UK’s departure from the EU as losing an ‘’anchor from around its ankle’’. He also promised a very big trade deal with the UK, bigger than any previous with the nation.

Boris Johnson did warn that the US would have to open its markets if a UK – US trade deal was to happen. Despite this, it’s clear once the UK leaves the EU the US will be amongst one of the 1st nations to open talks with the UK.

A few months ago, when asked about the US taking over the NHS Trump stated that everything was on the table. This weekend, when asked Boris, made it crystal clear that the NHS was not up for discussion.

Johnson seeking advice on 5-week parliament closure

Whilst conversations with Europe have improved Johnson is still preparing for all eventualities. Notably looking at pushing a No Deal Brexit through via the path of least resistance. Its been reported that Johnson is now looking into the legal implication in shutting down Parliament for 5 weeks in order to stop MP’s revolting and forcing another Brexit extension. The report states that Prime minister Johnson has requested that Attorney general Geoffrey Cox looks into the legal plausibility of a shutdown. It would appear that a parliamentary shutdown or prorogation is possible unless a legal case is already in courts to block such a move.

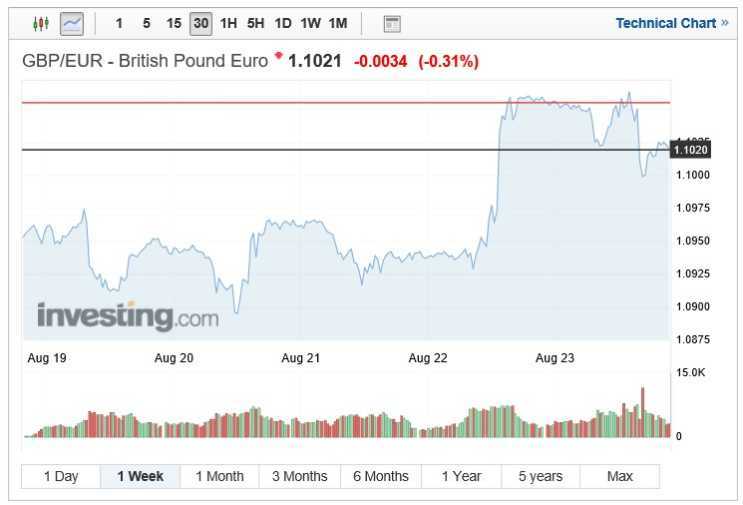

Pound-Euro jumps above 1.10

The apparent softening of stance from Europe allowed GBP to rise further this week as the feasibility of a deal appeared ever so slightly more possible. GBP has enjoyed positive movements following encouraging CPI, Retail and Earnings figures. Following on from this GBP/EUR topped 1.1050 following the progress made by the leaders.

The GBP/EUR did slip slightly on Friday, however, the pair are still close to a 3 week high. The pound was the best performer this week, gaining against a basket of major currencies. The longer-term gain will, however, depend on a concrete plan from Johnson and acceptance from the EU and eventually parliament.

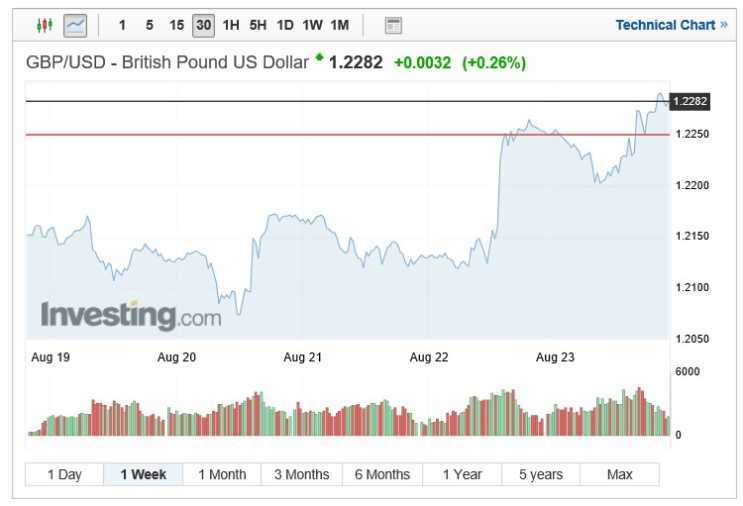

The Pound also enjoyed gains against the Dollar which has been heavily suppressed by Trump and the FED locking horns. New potential tariffs have also done little to help and this has been refelected in both a turbulent USD and stock markets. GBP/ Trump USD appreciated to a week high of 1.2290 a range which had held steady before the market close.