An unscheduled meeting between Prime minister Boris Johnson and Leo Varadkar prompted GBP to surge this week as it was stated a ‘pathway to Brexit’ had potentially been found. The meeting which took place in a country house on the Wirral saw GBP rise as markets brought into the possibility of a Brexit breakthrough.

Whilst exactly what the common ground or breakthrough of the talks was will remain unknown until the Tories publish their new plan this week. It does however potentially mark a turning point in negotiations but could remain yet another false dawn.

The meeting between Johnson and Varadkar was followed by the UK’s chief Brexit negotiator Steve Barclay and Michel Barnier which apparently ended well with Barnier stating that a ‘pathway to Brexit’ had been found and that intensive ‘tunnel’ discussions could now begin.

Tunnel negotiations are the name given to secret meetings in which a detailed proposal is fleshed out between the UK and Europe.

Whilst the positive movements were acknowledged by both the UK and EU, Donald Tusk was quick to clarify that whilst the talks were encouraging, no workable solution had yet been provided by the UK.

Despite his more reserved comments, the Pound’s momentum wasn’t quelled and sterling has continued to gain against many of the major currencies, notably the USD and EUR.

Brexit focused Queens speech

Although the outcome of Brexit remains anyone’s guess Tory party members are already setting in motion a number of plans to get the UK back to prosperity. These will include faster access for the UK to medicine, an end of free movement and an environmental bill to dramatically reduce the use of plastic and improve air quality.

The conservatives are also keen to tackle the ever-increasing levels of violence on the UK’s streets, improve construction standards, UK infrastructure and invest in science.

The Labour party has labelled the use of a queen’s speech before a general election as a stunt.

Negotiations continue into the weekend

Clearly time is of the essence and therefore a UK contingent have remained in Brussels to continue discussions on the potential deal. Their aim is to secure a deal in time for the 19th October deadline to avoid requesting an extension. Wednesday (16th) marks the opening of the EU summit where it is hoped that the UK and EU will finalise any outstanding details and seek approval from the other 27 EU nations. Johnson will then have just a few days to get the proposal approved by UK parliament in order to avoid requesting an extension under the Benn act or defy the act and see the UK crash out of the EU.

The pathway leads to Pound strength – for now

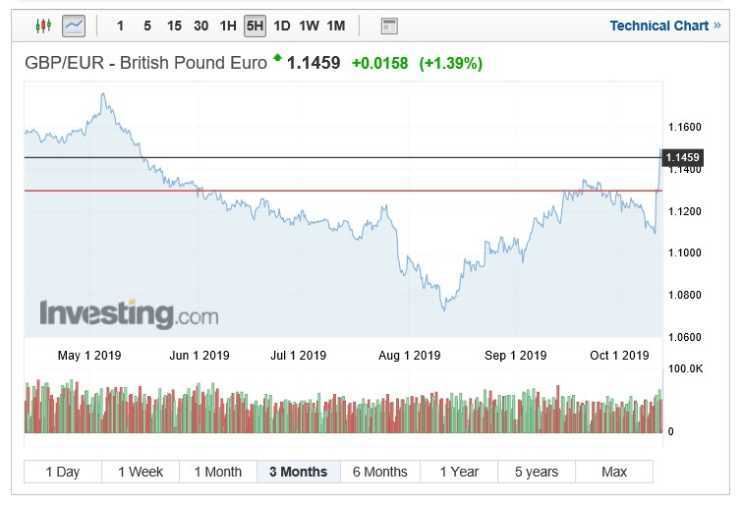

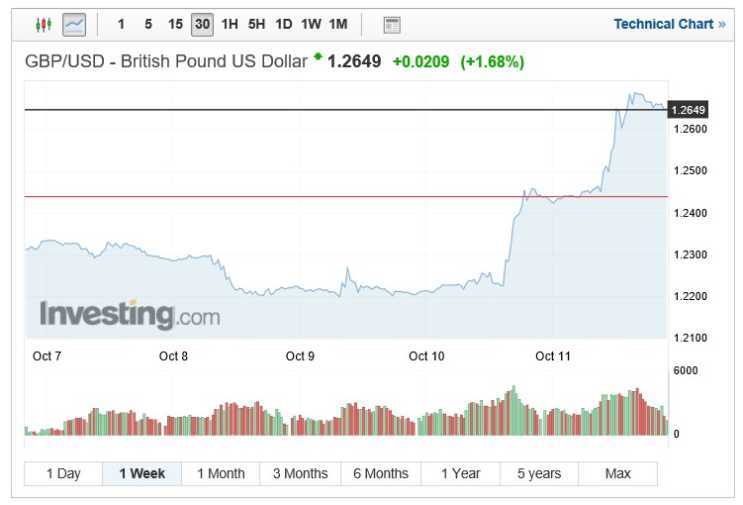

The tangible possibility that the UK may leave the European Union with a deal and solution to the Irish backstop has seen the GBP surge with gains of in excess of 2% seen against the Euro and USD.

The GBP/EUR under a week ago had been firmly grounded, trading at a week low of 1.1092. As has very been the case over the last few years, Brexit talks had met an impasse and No deal appeared the only outcome. The week, as it stands proved fortuitous for Sterling and GBP/EUR, has been propelled to a market close of 1.1459, with the magic 1.15 mark last seen in May nearly breached.

Likewise, the Pound has capitalised against the USD despite encouraging news that the US and China agreed on the first part of a new trade deal. GBP/USD reaching more than a 3-month high and trading at 1.2649. The currency pairs week high approaching 1.27 and rising from the week low of 1.22.

The breakthrough talks bode well for GBP exchange rates, but investors will air on the side of caution and markets will anticipate further volatility, especially as any deal need s to be agreed, ratified and accepted within such a short time frame. If, however, the EU and UK are able to finally get the show on the road it demonstrates that the Pound has legs to accelerate quickly towards 1.18 – 1.20 GBP/EUR range and knock on the door of 1.30 against the Dollar.