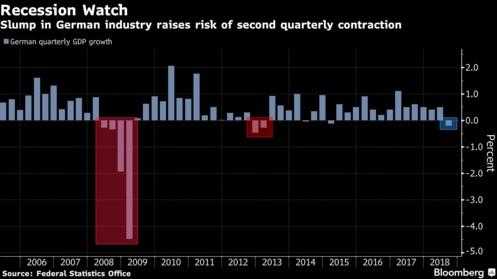

- The German industry shocked everyone as it plummeted by -1.9% in November

- Economists say Europe’s largest economy may enter a recession

- Production slumped to -4.6%, the worst since 2008

- An unstable Germany could further affect fragile Italian and Greek markets

Europe’s largest and strongest economy, Germany is potentially falling into recession as industrial production unexpectedly stunned traders and this week this week when it plummeted more sharply than expected. A recession is generally accepted as two-quarters of negative growth (or contraction) in a row.

Industrial production fell by -1.9% in November – a year-on-year low of -4.6%. The drop continues to spook macro investors of a slowing global economy. More importantly, a recession in the 4th largest economy could have ramifications on already fragile Greek and Italian economies.

‘Yesterday’s manufacturing data in Germany provided alarming evidence of a much more severe slowdown in the second half of last year than economists had initially expected.’ Claus Vistesen of Pantheon Macroeconomics commented. He said the economy had been rocked by a ‘perfect storm across all sectors.’

The collapse was so swift that Vitesen initially told his clients he did not believe the data was accurate.

He told clients: “The crash in the year-over-year rate is far in excess of anything remotely believable, at least using survey data as a yardstick.”

The worry with analysts is that Germany faces its lowest industrial production since 2008. Evidence that the eurozone recovery lost more momentum than anticipated is increasing as more lagging data is compiled and released. Unemployment across Europe had been falling steadily from a peak of 12.1% in 2013 as the region recovered from the global financial crisis. As the recovery has gradually taken place the vast level of government debt in a number of countries such as in Greece and Spain a source of continual concern.

The German economy contracted by a quarterly rate of 0.2% in the third quarter of 2018 but it largely attributed to one-off factors like new car emissions standards, another drop in the fourth-quarter drop would mean Germany will have entered a recession officially. Weakness is thought to be across everything from consumer goods to energy – giving repercussions for the euro area, where separate numbers on Tuesday showed economic confidence has fallen to the lowest in almost two years.

Germany’s central bank said Tuesday its “looking through the volatility of monthly economic data” and doesn’t comment on individual indicators. Interestingly, due to a hot summer and mild winter, low water levels on Germany’s longest river, the Rhine, have slowed deliveries, while production was paused due to the timing of public holidays. Moreover, struggles among carmakers in adapting to new emissions-testing procedures have failed to fully wear off.

There is underlying strength still in the German economy. Unemployment remains extremely low in Germany at 3.3%, in sharp contrast to the rates still seen in those economies that were at the cause of Europe’s debt crisis. Greece’s unemployment rate, though down from its peak, was still 18.6% in September.

The euro slipped 0.4% to $1.1434 as of 3:30 p.m. Frankfurt time. European stocks in the equity markets bounced as optimism about U.S-China trade talks outweighed the surprising German release.

The effects outside of Germany

Just next door, France, the Eurozone’s second-largest economy, is also facing difficulties. The country’s statistics agency INSEE revealed Wednesday that consumer confidence also plunged in December to a 4 year low on the back of yellow vest protests during the Christmas period across the whole of France. Data showed a 1.3% fall in industrial output in November, which left production down an annual 2.1%.

As always, ongoing trade tensions between the U.S. and China have the potential to cause a softer global economy while Britain’s impending exit from the EU coming in 2 months could be another negative. If the UK crashes out with a decent deal and falls in WTO trading rules the uncertainty and turmoil will continue further.

It furthers the problems for European Central Bank President Mario Draghi, who last month said Europe has enough underlying momentum to justify a decision to stop adding monetary stimulus. The ECB said it plans to leave rates unchanged through the summer of 2019.

“The latest data, even assuming a bounce back in December, mean industrial output probably contracted in the fourth quarter. The decline is big enough to have a meaningful impact on GDP growth, and creates a risk that the economy shrank again.” Jamie Murray from Bloomberg Economics commented. “For every bit of bad news, you get a bit of better news, and on balance I don’t see this creates risks that shift the balance of risks.”

Some optimism

Economists generally see the Germany situation as a blip and part of “a perfect storm”. The French situation, US-China tensions, a volatile Oil price on top of an uncertain Brexit all have confounded macroeconomics across Europe. ING says private and public consumption has the potential to offset recession forces, and order books look healthy. Commerzbank argues recent manufacturing numbers point to a potential stabilization.

Predictions see economic expansion of 1.6% this year, matching the pace of 2018. “Carmakers are likely to catch up on their production, the ECB’s monetary policy remains investment-friendly, and China’s economic stimulus program is likely to boost the local economy, which will also benefit the German economy,” said Commerzbank analyst Marco Wagner.