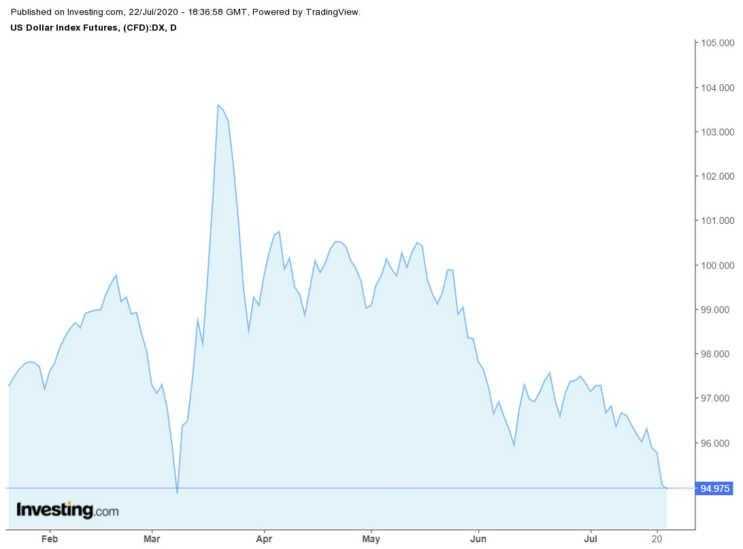

After four days of negotiations, the EU leaders agree to a €1.8 trillion package to haul the bloc out from its worst recession, weakening the USD exchange rate.

US Exchange Rate Affected with Rising Euro

The package comprises of a €750 billion recovery plan and a €1.074 trillion budget to be spread over the next seven years. Sticking points that caused much uproar in the summit talks included the grant amount for countries worst hit by the coronavirus and the control over the funds. The US dollar rate against the euro is at 0.8643.

The US Dollar saw a weakening with growing concern on the outcome of its fiscal stimulus. The Republicans and Democrats do not see eye-to-eye on various aspects of another round of economic stimulus measures. In the US, existing home sales are at 4.72 million, the previous reading being 3.91.

The US Dollar has seen a relentless fall. Though the equity markets see an upward frenzy, the greenback continues to weaken. The US real yield has seen a fall into negative territory. The US Dollar continues to find key support at 95.00. A break below this major support will pave the path for a downward journey towards 92 and 93. On Wednesday, it slid lower to 94.88 at 4.55 pm GMT. This is the weakest level since Oct 2018. However, the Euro continues to see strength, especially with the package agreed upon last weekend, at the summit.

USD/CAD Continues Downtrend

Canada’s retail sales were better, but missed forecast. Retail sales at 18.7%, has fallen below estimates of 20.2%, and core reading plunged by 22.0%. Canada’s inflation data for June will be released on Wednesday.

The US Dollar exchange rate against the CAD pair has been on a downtrend for July. It touched a high of 1.3648 on 14 July, the highest level this month. The USD/CAD pair has seen a steep fall for the past three days, falling from 1.3601 on Monday to 1.3398 on Wednesday, a sharp fall within a matter of three days.

Vaccines Give a Ray of Hope

Three COVID-19 vaccine trials have been successful in bringing in a wave of optimism across countries. Coronavirus infections across the globe have topped 14.7 million. Death levels are above 6 million, according to data from John Hopkins University. The USD exchange rate continues to be rattled by COVID-19 deaths, as it recorded 1,000 deaths on 21 July.

USD/GBP Expects Positive Brexit Talk

The sterling gains strength with the agreement reached in the EU summit. Brexit talk expectation breathes fresh air of optimism into the currency.

The US dollar exchange rate against the Sterling, which saw a strong up move in March 2020, however, declined just as sharply with the COVID-19 pandemic spreading across the globe. Throughout July, it has seen a steady decline from levels of 0.8163 which it reached in the last week of June. Currently, the pair is trading at 0.7851 on Wednesday. If it breaches yesterday’s low of 0.7989, the pair may continue its downward trajectory.

US-China Tensions

Tensions escalated between the two giant economies when China’s foreign ministry revealed that China was abruptly asked to close its consulate, located at Houston on July 21.

China’s yuan weakened below 7 per dollar, after the news about the consulate closure was reported. This has triggered profit-taking and escalates the US-China tensions. The USD exchange rate saw a slight gain but continued its fall downward.

USD/EUR

The massive stimulus package agreed by the European leaders has boosted the euro to hit its 18-month high. It touched levels of $1.1547.

The US Dollar rate against the euro was at its lowest ebb in early March when the pandemic first hit the US. It touched levels of 0.8700. The next day it touched a high of 0.9401. From this level, it is seeing a gradual decline. On Tuesday, 21 July, it went down below the low of 0.8700. On Wednesday, it further weakened to touch lows of 0.8620 at 4.55 pm GMT. The strengthening Euro is another reason for the US dollar to weaken.

AUD/USD

The Australian dollar saw a weakening in its currency. It touched new highs of $0.7182 on Wednesday against the USD exchange rate. However, it later retreated lower to touch $0.0.7112 levels. It touched lows of 0.6312 on 16th March and has been climbing uphill steadily to reach current levels.

The Australian dollar saw a rise, though lockdown measures were re-introduced in Melbourne. Further, reports that the country’s GDP for the third-quarter will grow by just 0.75 points has not dampened the strength in its currency.

USD/JPY

The Japanese yen held against the dollar gaining support at the 50% Fibonacci levels of 106.69. However, if it declines further, the next support is at 106.00, which however presents a negative outlook for the market. The USD exchange rate against the yen touched lows of 106.64 on 10 July and has been skirting this region to-date, which does not provide a healthy picture.