The head of the UK central bank Mark Carney has strongly warned that if a no deal Brexit occurs, Britain will face the weakest growth since the 2008 financial crisis.

- Central bank describes a “Brexit fog”

- A no-deal scenario risks at least 2 quarters of negative growth

- 2019 growth forecast cut from1.7% to 1.2%

- BoE tries to steady the ship by holding interest rates at 0.75%

Mark Carney, the head of the Bank of England has dealt another doomy outlook insinuating a no-deal Brexit is increasingly likely. It came at a press conference where he delivered a prediction of growth so weak it would be the same as it was a decade ago during 2008.

The Bank cut this year’s growth forecast to 1.2% – the lowest since 2009 when the economy was in a recession following the financial crisis.

He said: “We would have described a no deal, no transition, as a low probability event a few years ago. I’d describe it now as not the central scenario – so, yes the probability has gone up.”

“We are seven weeks away from Brexit date and the range of outcomes is very wide.”

He added: “There’s still almost as wide a range of outcomes of possibilities as there was the morning after the referendum and what we’ve seen … is that the level of uncertainty and the proximity of Brexit date is having a much bigger impact on business decisions, which is cascading down through the economy.”

Even if there was to be a relatively orderly end to Brexit, the latest quarterly inflation forecast would give a one-in-four chance that Britain would slide into a recession.

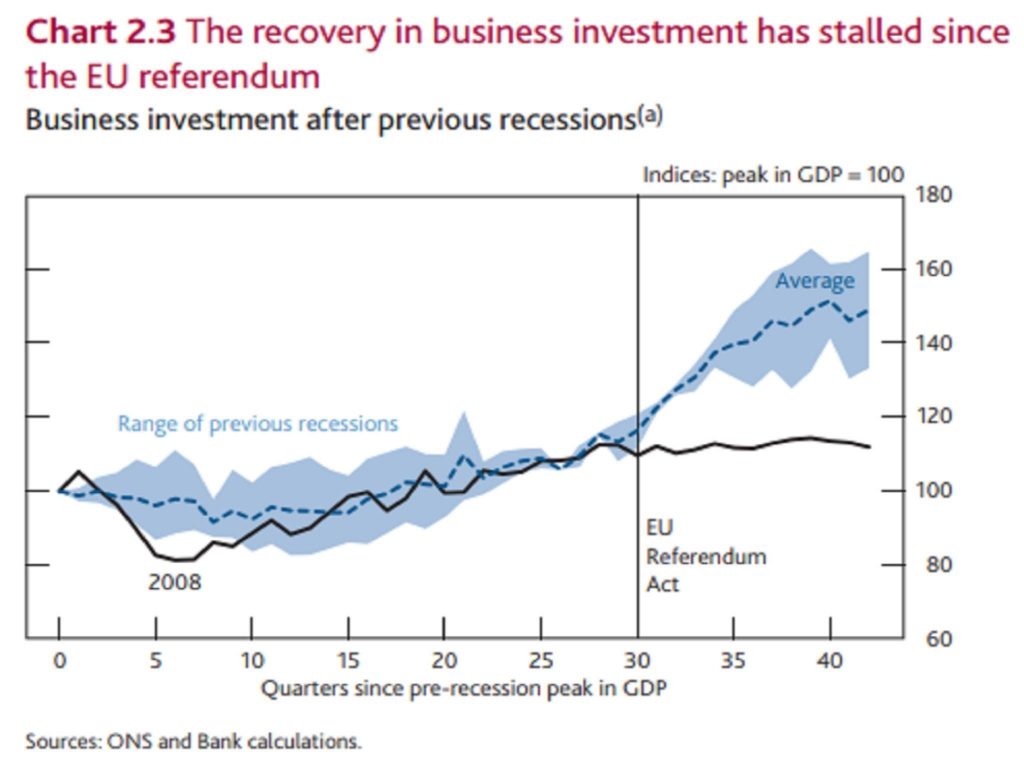

“This slowdown mainly reflects softer activity abroad and the greater effects from Brexit uncertainties at home,” said Carney. He conceded business investment had been considerably weakened due to Brexit cliff-edge fears thanks to a potential no deal.

The dismal future growth outlook came as policymakers on the nine-strong Monetary Policy Committee (MPC) voted unanimously to keep rates unchanged at 0.75%. Financial markets and analysts are now not expecting a rate hike until the middle of 2020 at the very least.

It was back in December the BoE spooked several industries by publishing stress-test scenarios for banks in which a no-deal Brexit could plunge Britain back to the worst recession since the 1920s, with GDP collapsing by 8%. All this news came on the same day as markets fell into the red off the back of weak factory data from Spain and Germany, growth downgrades from the EC all seemingly out of the power of central banks to be able to prevent it. Real fears that Germany could enter recession are growing as they halved their growth outlook for 2019 a significant indicator of slowing global growth.

More U-turns of previous BoE predictions include November 2018 one where the bank had expected business investment to grow by 2% in 2019 but now expects a fall of 2.75%. Its 2020 forecasts are now trimmed from 5% to 2.75%.

Business investment accounts for around 10% of UK GDP and due to the decision of the British people to vote “out” and trigger Brexit, the bank noted that spending had “stalled.”

This a stark turnout from Carney’s bullish UK growth positivity from previously this month when a more seamless Brexit process was looking likely. Sterling lifted nicely after the speech but this week’s reaction meant this result was not to be repeated.

Brexit impact on investment

The latest report from the bank’s network of regional agents states that about half of the 200 firms questioned said they are “not ready” for a no-deal Brexit, even though most had a contingency plan in place. They also added that they expect the economy to shrink and therefore unemployment to rise.

The economic outlook and public sentiment will continue to depend significantly on the nature of the EU withdrawal and the number of trade deals secured and quality of those deals. The to-be agreed trading arrangements between the European Union and the United Kingdom whether the transition to them is abrupt or smooth, will have a material impact on households, businesses and capital markets for the foreseeable.

Mark Carney summarised this point succinctly with the headline of “The fog of Brexit is causing short term volatility in the economic data, and more fundamentally, it is creating a series of tensions in the economy, tensions for business.”

Market reactions, as expected, included a fall for the 10-year British government bond yield to its lowest level so far this year at 1.158%, down 5 basis points on the day, reflecting the BoE’s dovish tone and feeling.

Sterling dipped 0.25% against the dollar (nothing in relative terms of the last 2 years of volatility but quickly recouped those losses, leaving it at a two-week low of $1.2888. Short sterling interest rate futures indicated investors saw a flatter path ahead for interest rates.