After 14 months of negotiations, personal attacks and twitter rants it would appear that the US, Canada and Mexico are going to approve a ‘new NAFTA’ deal renamed the USMCA deal. Although every nation appears to have made concessions we take a look a key parts of the deal and what they might offer each nation and how they could benefit their respective economies.

The US trumps on automotive agreements and Canadian dairy

Trump hailed the new agreement between the three nations as a “truly historic”, although many have dubbed the new agreement as evolutionary rather than revolutionary. In terms of benefits for the US economy any vehicles assembled within the agreement must have 75% made by the region in order to qualify for tariff-free movement, theoretically, this should increase overall production in North America.

The automotive element of the agreement has also agreed to raise the minimum wage of 40-45% of the engineers working on a car to be raised to $16 per hour, bridging the difference to the wage of $22 per hour earned by a US worker. This was stipulated by the Americans in order to dissuade all manufacturers automatically using Mexican assembly lines.

The US also stuck to its guns with regards to the Canadian Dairy market which has granted the USMCA 3.6% of its domestic market. Whilst the US initially demanded more, even requesting the Canadian supply chain be dismantled. The new agreement also scraps the recently introduced milk-pricing policy that affected New York state and Wisconsin.

As the US ramps up tariffs on China and potentially the EU this new association with Canada and Mexico demonstrates real solidarity with its neighbours. Overall they have improved terms and received access to markets they wished to be involved in.

Canada protects its dairy market and its economy

Although Canada made concessions on their Diary market many believe that they may have got away lightly. The Trump administration was initially calling for the disassembly of the Canadian Dairy supply management system which could have spelt the end of the Dairy. Whilst the Dairy Farmers Group of Canada believes the new deal marks nothing but the beginning of the end, the Canadian prime minister Justin Trudeau has ensured they will be compensated accordingly.

Canadian online shoppers will also enjoy some perks with duty-free transactions on US goods being raised from C$20 to C$150, sales tax limits will also be increased by C$20 to C$40.

Canada by sealing a deal with the other nations has also afforded itself certainty. The continual wrangling with the Trump administration had provided a lot of economic uncertainty for the nation. The omission on auto tariffs is a major plus and the renewed association should see an increase in business investments and naturally the export market. The agreement offers all parties 16 years of ongoing trade which can be reviewed every 6 years.

Mexican labour rates will increase, and new opportunities may arise

Mexican workers in the automotive industry will see wage increases with the agreement as the minimum wage ruling will ensure 40-45% of the workers on any vehicle will have to be paid a minimum wage of $16 per hour.

By sealing the agreement Mexico will almost certainly bank future goodwill from the US, pre and post trump general rhetoric has been far from positive and their medium-term collaboration will almost certainly ease the rift. Especially as Mexico awaits its new president AMLO to take office.

Mexico will almost certainly receive investment from other non-market economies that want to benefit from the previously mentioned wages rises. Therefore, Mexico will be perceived as the most cost-effective way to actively trade with the US and will eventually see growth in affected sectors.

Canadian Dollar and Mexican Peso reaction

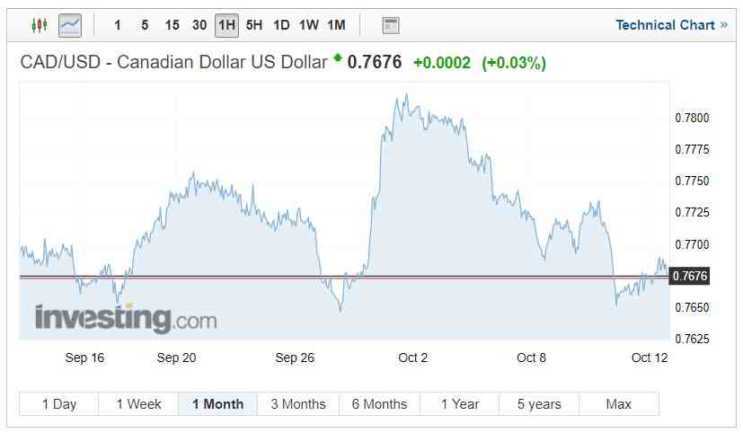

At the beginning of the months following the announcement of the ‘new NAFTA’ or USMCA deal the Canadian dollar soared, appreciating significantly against its US counterpart. The CAD/USD jumping from 0.7744 to 0.7788.

The Loonie has been unable to hold onto its gains against the rampant USD partly due to the dollar strength but also due to inconsistent Canadian Crude prices which have slumped to under $20 per barrel this week. Closely linked with oil the CAD exchange rate correlates closely with the commodities pricing.

The MXN reacted in a very similar fashion against the Dollar as the CAD did. Initially enjoying rather more modest gains, which have since been erased.

The MXN suffered tremendously after the last FED announcement and has struggled to make ground since. These losses were further compounded as the US released its ISM manufacturing figures. Following the Announcement of the ‘new NAFTA’ deal, the USD/MXN has traded as low as 18.517 and as high as 19.195.