The Euro to Dollar Exchange Rate lost momentum slightly following yesterday’s ADP Nonfarm employment data. The ADP data comfortably exceeded expectations and was shortly followed by US Preliminary GDP which also indicated better than expected GDP growth. The news providing some much-needed positivity following the worrying events in North Korea and more importantly the terrible conditions in Houston where many have tragically lost their lives.

ADP Non-Farm Employment Change Exceeds

As the jewel of the US economy and the key instigator for further Interest rate rises any data relating to employment is always heavily scrutinised. Viewed positively by markets the data assisted the USD appreciation with the Euro to Dollar Exchange Rate losing around 0.55% and falling from a high last seen in early 2015.

Financial markets had expected the ADP employment change figures to reach 187,000 new roles created, but the data over achieved reaching 237,000.

Typically used to gauge soon to be released US employment data the ADP Employment claims figures are derived from 400,000 US companies’ payroll processes and therefore typically forecasts US employment data.

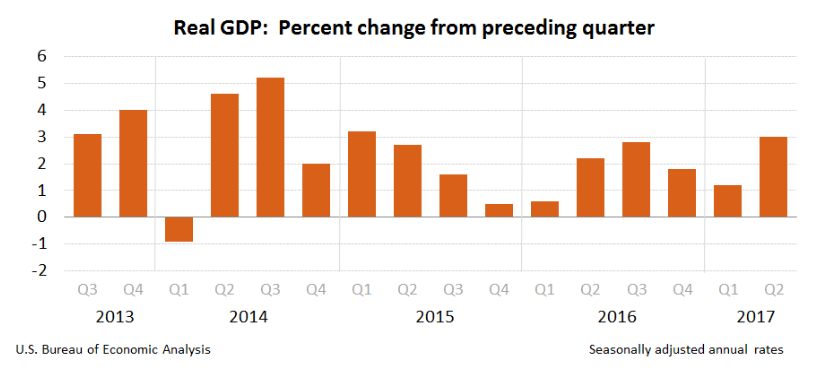

US Preliminary GDP Best in Three Months

Continuing to inconvenience the Euro to Dollar Exchange Rate was the release of the US Prelim GDP figures which provided more support for the US Dollar. Growth of 2.6% was expected by markets. The annualised quarterly figure beat its GDP Forecast reaching 3.0% and continuing the US Dollars gains.

The figure demonstrates that the US economy is growing at its fastest pace since Q1 2015 with household consumption, government spending and private inventory investment contributing to the GDP growth increase.

How Was the Euro to Dollar Exchange Rate Effected?

Following the positive US jobs and growth data, the US Dollar gained against a handful of currencies. Movement effected Euro to Dollar Exchange Rates, USD To Yen, and CHF to USD.

Over recent months the Euro to Dollar Exchange Rate has enjoyed prolonged rallies with the Dollar being a victim of Geo political scenarios as well as the current risk of sentiment. Following the release of the ADP Employments claims forecast and US preliminary GDP the US Dollar was able to fight back. The gains allowed the USD battle back against a Euro To Dollar Exchange Rate high, last seen in early 2015.

Currently, the Euro to Dollar Exchange Rate sits at around 1.1845 far away from the week high of 1.2063 no doubt assisted by recently released German Retail figures which fell very short of expectation.

The USD to JPY Exchange Rate also enjoyed gains provided by the data. Following the releases, the USD to Yen Exchange rate strengthened from 1.0848 to 1.0978 with the currency pair continuing to appreciate.

Elsewhere the USD to CHF rose almost 0.5% with the currency pair moving from a week low of 0.9435 to 0.9676. The weeks low signalling a two-year USD to CHF low.

US Dollar data released this week

The final few days of the week will provide more US data. Following Tuesdays US Consumer Confidence and yesterdays ADP Employment claims and Preliminary GDP Data many will be willing the Dollars to continue.

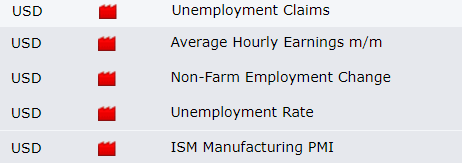

The next pieces of key US Data will be provided by:

- US unemployment Claims – Predicted to reach 237,000

- Average Hourly earnings, anticipated to decline from last month 0.3% to 0.2%

- Non-Farm payroll (employment change) – expected to decline from last month’s reading of 208K to 180k.

- The US Unemployment Rate which markets anticipate remaining static at 4.3%

- ISM Manufacturing PMI which is expected to surpass last month’s reading of 56.3 and come in at 56.5

Providing there aren’t any unexpected political scenarios the USD could well capitalise this week having already benefited from up beat consumer confidence, Unemployment and GDP figures. If as many expected the Non-Farm and unemployment claim data continues to be positive the USD could relieve itself of a lot of pressure. However, with the Dollars relieved pressure will come more expectation of a rate rise which could be sooner than many expect.