Yesterday saw the Euro to US Dollar Exchange Rate hit a year high following comments from Angela Merkel at the European Central Bank meeting.

During the gathering yesterday Merkel blamed the ECB directly for weakening the euro.

Merkel stated in no uncertain terms that the Euro was ‘too weak’ continuing by saying that this was ‘Due to the ECB’s policy and with this, German goods are comparatively cheap’.

Her comments follow comments from the US that German exports had been unfairly benefitting from the weak single currency. A view which President Trump’s cabinet is more than happy to explore with the possibility of levies being placed on German goods.

Many also feel that Merkel’s party supporters also fall in to a demographic which saves money therefore all the more reason for her to entice the ECB to raise interest rates. Especially with German elections taking place shortly.

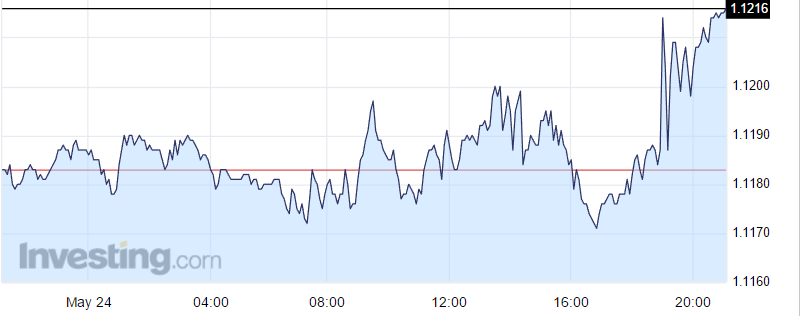

Euro to USD Exchange Rate Following Merkel’s Comments

Following the comments the Euro to USD Exchange Rate jumped to its highest levels in 8 months briefly touching 1.1214. The Euro to USD Exchange Rate benefiting from FOMC comments later on in the trading session.

The EUR/USD has now however retraced its path following a sell most likely due to profit taking.

Merkel’s comments put to one side the Euro did enjoy a raft of positive data releases.

The French flash manufacturing PMI, the only to miss target reaching 54.0 rather than the anticipated 55.2. Contrarily German IFO Business climate registered 114.6 the highest in 6 year (potentially due to the weak Euro) and more positivity through an assortment of German business sectors.

If Merkel’s Christian Democratic Union party were to be voted in for another term you would imagine she would be hoping her fulfilling her duty alongside higher interest rates.

Upcoming Data Which could affect the Euro to USD Exchange Rate

The rest of the week could prove volatile for the Euro to USD Exchange Rate especially with US Preliminary GDP, Draghi Speaking and FOMC all scheduled this week.