7 currencies account for over 80% of the volume of the forex market, and the Canadian dollar (known as the “Loonie” because of the appearance of a loon on the back of the C$1 coin as slang) is one of these major currencies, and is the fifth-most held currency as a reserve.

The Canadian dollar’s currency (CAD) ranks 10th in the world but relatively low on the list of major economies in terms of population, yet it is the 11th largest export economy in the world, according to the Observatory of Economic Complexity hosted by MIT.

All of the major currencies in the forex market are supported by central banks. For the Loonie it’s the Bank of Canada. The Bank of Canada’s core job is to find a balance between policies that will promote employment and economic growth while containing inflation, as is normal for a central bank. Despite the significance of foreign trade to Canada’s economy, the Bank of Canada adopts a relaxed approach in relation to the currency – the last intervention was in 1998.

The economics behind the Canadian dollar

Ranked 10th in terms of GDP (measured in $USD) in 2017, Canada has enjoyed relatively strong growth over the last 20 years with two recessions in the early 1990s and 2008. Canada famously navigated the later recession thanks to better fiscal policy and an improved current account balance have led to lower budget deficits, lower inflation and lower inflation rates. The structure of Canada’s financial market i.e. more regulation, helped the country avoid many of the problems with toxic subprime mortgages. That said, major technology companies are less significant to Canada’s economy, meaning less growth during the tech boom in the USA in the 1990s. Also, the commodity boom of the 2000s (particularly in oil) led to an outperforming loonie.

The close and necessary trading relationship between Canada and the United States (they both make up over half of the other’s import/export market). While polar opposites in social policy, certainly at the moment. Events in the USA have a profound effect on CAD. Canada is a meaningful producer of petroleum, minerals (potash), wood products and grains, and the trade flows from those exports can influence investor sentiment.

Key and influential data sets

Major economic data includes the release of GDP, retail sales, industrial production, inflation and trade balances. This information is released at regular intervals, mainly monthly and quarterly as is the case for most of the G7 countries. Investors also take note of employment, interest rates (including scheduled meetings of the central bank), and the daily news flow – natural disasters, elections, and new government policies can all have significant impacts on exchange rates in general. Again, movements in the US have a more profound effect on Canada.

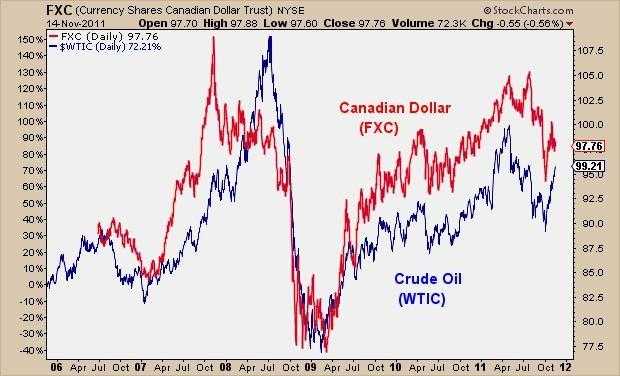

As is often the case with countries that rely on commodities for a sizable portion of their exports, performance of the Canadian dollar is often related to the movement of commodity prices, especially Brent crude and WTI oil. In the case of Canada, the price of oil is particularly significant for currency moves, and investors tend to go long on loonies and short on oil importers e.g. Japan when oil prices are moving up. Against larger economies like China and Europe, fiscal and trade policies have an influence on major importers of Canadian materials.

In summary, the main factors known to influence the value of the Canadian dollar are:

- Interest rates: Relatively higher interest rates in Canada increase foreign investors’ demand for Canadian dollar-denominated securities. At the time of writing its around 1.5% with the Bank of Canada. If foreign investors anticipate a decline in the value of the Canadian dollar, they demand a higher interest rate on Canadian dollar securities.

- Commodity prices: The value of the Canadian dollar is correlated to the strength of world commodity prices, specifically crude oil. The development and exportation of commodities such as crude oil, natural gas and lumber represent major sectors of Canada’s economy. A net exporter, in total, exports represent 45% of Canada’s GDP.

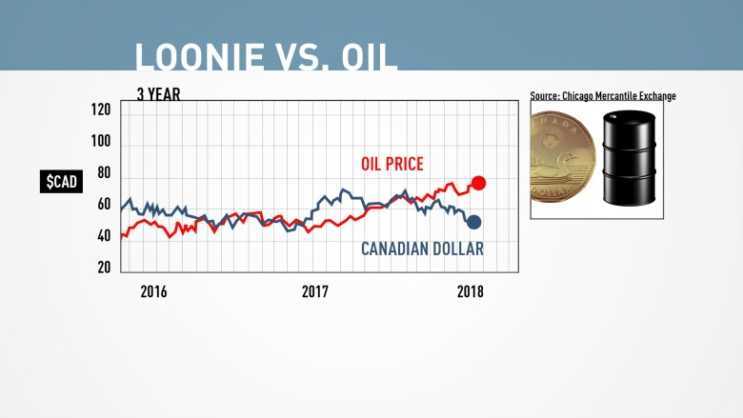

The Canadian dollar’s dependence on commodity pricing proves a relationship between the Canadian dollar to the pricing of crude oil. The decline in crude oil price from the period of August 2014 to January 2015 could be understood as reflecting this relationship between crude oil pricing and the market value of the Canadian dollar. Crude oil prices declined from roughly US$105 per barrel to US$45 per barrel during the period from August 2014 to January 2015. Canada’s overall economy and energy sector was greatly affected. In the last 3 years oil has railed back 300% and in the last 3 months has corrected 30%, WTI trades at just under $51 USD and Brent Crude just under $60 in a volatile time for oil, and the CAD also.

Commodities represent a larger share of exports in Canada compared to the United States and many other countries. When commodity prices rise, Canada’s terms of trade improve because its goods have become relatively more valuable. Since Canada’s effective purchasing power is higher, this movement is usually reflected in a higher exchange rate. The opposite also holds: weaker commodity prices can translate into a weaker Canadian dollar. The graph below demonstrates the classic and usually typical, tight correlation.

- Inflation rates: Inflation is the rate at which the general price of goods and services rise over time. If inflation in Canada were to exceed foreign inflation rates, this would reduce the purchasing power of the Canadian dollar relative to foreign currencies. That reduction would be reflected in a relative decline in the value of the Canadian dollar. The opposite is also true. Therefore, relatively low inflation in Canada has a positive influence on the exchange rate. Currently, a nice balance is being maintained.

- International trade of goods and services and agreements: When a country has a trade surplus, exports exceed imports, putting upward pressure on the exchange rate. When a country has a trade deficit, imports exceed exports, putting downward pressure on the exchange rate. As the news has well covered, numerous political agreements have been left by President Trump and minor, subtle tensions between Prime Minister Trudeau have caused ripped effects in the forex market. Fortunately, major tariffs or changes haven’t occurred. It seems Trump is soon to formally withdraw from NAFTA and after bitter negotiations and negative rhetoric, a new agreement between Canada, Mexico and USA has been somewhat reluctantly agreed and signed. Its these trade wars and political fighting that has caused the few times where the Loonie and oil have an inverse relationship, demonstrating the power of politics on commodity and currency prices:

- Foreign investment and debt payments: Canadian national debt (as per 2014 stats) stood at CAD$1.4 trillion across federal and provincial governments. With the total GDP somewhere around CAD$1.8 trillion, Canada’s overall debt/GDP ratio is around 77%. All national debt for major nations is rising. The US stands at over 20 trillion at the time of writing. Inflows of foreign investment in Canada increase the foreign demand for Canadian dollars, pushing the exchange rate up. A direct investment made by Canadians abroad has the opposite effect. Debt payments made to foreigners push the exchange rate down.