What Are Forex Signals?

Forex signals help forex traders to decide on a buy or sell strategy on a currency pair. It is an alert for a trader to enter or exit his position. The trader has to make the ultimate decision to act on the forex signals. Learn forex trading by using simple trading strategies. Have minimum trading indicators and signals for successful trading.

Beginners and experienced traders use the signal systems for a profitable trading experience. Forex strategies help in the analysis of the market and execute a trade using risk management techniques.

How Do Forex Signals Work?

The signals transfer information electronically, which the trader receives through email, text, or SMS. They are available on social media platforms too. Incorporate trading signals through personal analysis for decision-making.

Forex signals work on an automated forex robot or through human analysis. As a trader, you can anticipate price movements and place your trade based on the trade signals using your own trading strategy. Learn forex trading by using simple trading strategies. Have minimum trading indicators and signals for successful trading.

It includes critical information on when to jump into the trade and the direction of the forex trade. It also suggests “stop loss” and “take profit” levels.

How Signals Can Help Your Forex Trading Career

Users should learn to use forex signals, as they help to determine the entry and exit levels. They guide you to use strategies at the right time. Generating signals can be automatic or manual.

- Stop Loss: You can set stop losses (SL) on stochastic oscillators and RSI.

- Take Profit: Identify the Take Profit Levels (TP) while trading.

- Current Market Price: CMP is the current market price that helps you track the current price of the currency pair in the forex market.

If you receive a forex signal with “Sell USD/CAD at CMP 1.2324 – SL 1.2365 – TP 1.2307”, you should know to break down the signal message. It is a “sell” signal, and the pair in question is “USD/CAD”. The “CMP” is the current market price listed at 1.2365 and the “stop-loss” at 1.2365. The “take profit” level is at 1.2307.

It is an abbreviated signal that has many numbers. You should know how to decode the signal. With basic forex knowledge, you can understand forex signals and indicators.

Types of Signals

Signals are automatic or manual forex signals. They are subscription-based or automated. You can receive signals through text messages, email, or other social platforms. You can also receive free signal forex telegram. It is a popular messaging app that is fast and secure.

Free forex signals help traders get market movement tips. Professionals provide the best trading signals so that traders can follow them in real-time on the forex currency exchange.

Signal Options:

- Free Signals: They are unpaid signals that are available as a voluntary service. Beginners can use forex trading free signals while investing and trading. There are many educational materials to understand more about forex trading free signals. It will prevent them from losing money on the foreign currency exchange.

- Paid Signals: Signal providers give suggestions to traders on a currency pair for a subscription, done through automated robots or human analysts. Experienced traders can choose paid signal providers. You may have to pay a minimum deposit for getting the signals. They are available in many ways.

- Subscription for paid signals

- From a provider through algorithmic or manual analysis

- From cumulative signal sources

- From trading software

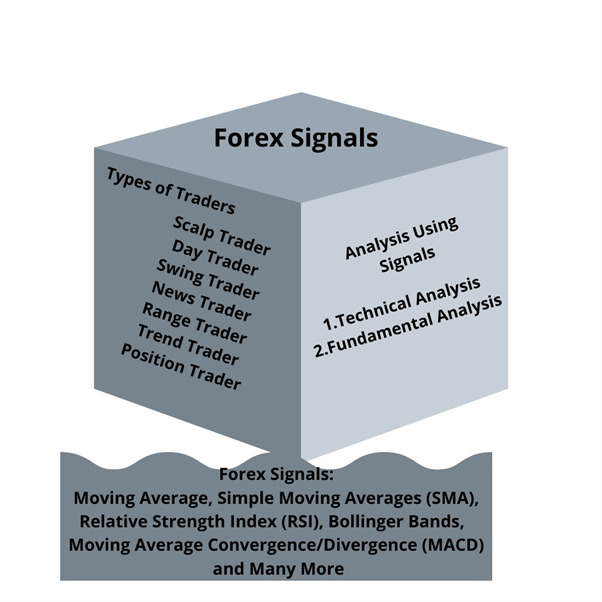

Analysis Using Signals

- Technical analysis studies the past price movements along with mathematical calculations.

- Fundamental analysis keeps its focus on current events and political decisions.

There are a multitude of forex signals that make use of Moving Average, Simple Moving Averages (SMA), Relative Strength Index (RSI), Bollinger Bands, and Moving Average Convergence/Divergence (MACD)

Most traders make trading decisions based on technical analysis and a study of price charts. It is common for traders to ignore forexnews on fundamental factors. Forexnews such as earnings reports, inflation, and changes in interest rates impact the markets.

Sourcing The Best Forex Signals For You

Trading Time Zone

The forex market operates 24 hours a day, and there is no exact optimal timing for trade. Learn forex trading before you enter live trading on the foreign currency exchange.

Choose a provider who gives trading signals when you are awake. You need to understand your trading strategy and choose the forex market timing accordingly. Beginners refer to forex trading guides for a comprehensive understanding of the forex movement. Daily Forex helps investors make decisions on forex signals.

If you are a day trader, you should identify the trading pattern on each trading day. But generally speaking, the first hour of the forex market is the best for a trading breakout. The first 15 minutes of the day are the most volatile. If you are a newbie, it is best to stay out of this time zone. Volatility and volume are high in the first few minutes of trade. Forex charts depict the price and volume data from which traders study the technical patterns across various time frames.

Get A Free Trial

The best way to understand quality trading signals is to go for the Demo account with a free option. You will not lose real money, and you will understand the basic terms and forex trading strategies. Sign up for a free trial period. Forex trading guides provide insight into the forex market for beginners, which will help them when they start on the free trial. Professionals who are already into forex trade can draw benefits from these tutorials.

Forex Signal Providers

Before choosing a forex signal provider, you have to keep a set of trading goals in mind.

- The experience of the forex provider matters. Check the consistency of the provider’s service over time.

- Consider how many signals the provider offers per day or week. The frequency of his signals should meet your trading needs.

- Make sure you receive your signal through email or SMS. Some providers automate the signal process so that you can apply it in real-time automatically.

- Beginners can choose providers who will improve overall forex trade through live streams, video tutorials, and a trader community to discuss trading ideas.

Learn to Trade Forex Signals

- Choose a currency pair for forex trading.

- Get trading signals from your forex traders on a daily basis. Just click on the plus sign icon to add people automatically to your watchlist.

- Get real-time signals from the provider.

- Configure analytical charts and learn to interpret them.

- Configure it on your Android or iOS to get new updates.

- Have a strong network connection to get the signals on time.

- You can use forex signals for copy trading just by subscribing to such services

- Gain access to feedback pages to improve your knowledge.

Compare Providers

Choose the best FX signal services that suit your trading style. Compare and pick the best one. You can run through the forex signal ranking to make a comparison. Choose from the top-ranking provider. You can also go through reviews to make a comparison. The Daily Forex website is simple and easy to understand and project 90% accuracy, but the accuracy rating is unverified.

Is The Provider Credible?

Signals are completely legal in the forex market. The legal status of any provider has nothing to do with your decision, as you are making use of their advice to buy or sell a currency pair. There are free signal providers as well as those who work for a subscription. Have a forex trading plan before you act on signals. Trading on the forex currency exchange comes with its own challenges. Making a consistent profit is not an easy task. Choose a provider who gives trading suggestions, along with a piece of background information on how signals work.

How to Get Forex Signals?

Forex signals save trading time. Many retail traders have limited trading time as they have other obligations. Forex Signals provider traders with trading suggestions and can effectively use the signals on their online trade.

- Choose the right broker that has a reliable state-of-the-art trading platform. It will ensure the smooth execution of signals.

- Choose a signal provider who can provide quality forex signals with a success rate of around 60%.

- Align yourself to a trader with goals and ambitions and customization capabilities.

- Ascertain the trading performance of the signal provider by utilizing the trial period and backtesting facilities.

Full analysis packages

Traders make forex analysis through a study of market movements and trend study. Forex analysis techniques are fundamental, technical, and sentiment analysis, which come as a full analysis package. Learning forex trading is necessary to understand the market before making forex trades. There are plenty of books, websites, and many other resources to learn forex trading. But nothing beats experience. First, open a demo account to gain experience through dry-run trading. You can gain technical and fundamental knowledge to get used to working on a forex exchange trading platform.

- Fundamental analysis studies the GDP, inflation rate, and interest rate of a country.

- Technical analysis helps to spot entries into the forex market. Multiple time frame and indicators like the Relative Strength Index and MACD helps the trader to spot the best entry into the market.

- Sentiment analysis helps to analyse client sentiment by understanding the overall number of traders having a long or short position.

You need the entire package for market analysis.

Get The Right Forex Signals For Your Strategy

The signals you receive should help you in forex trading and make it profitable. Determine the type of trader you are and get the right forex signal to suit your strategy.

Scalp Trader: The EMA indicator is best for the scalping trader. It responds best to recent price changes. FxPro, Swissquote, and FP Markets are the best brokers for scalping forex. Learning forex trading begins with knowing to close your trade and get out of the market when it goes against your direction of trade. Forex trading guides give you better knowledge on the strategy to be taken in any prevailing situation in the forex market. Daily Forex Signals is a provider with an expert team of professional traders that guides investors and traders in the forex market.

Day Trader: A day trader opens and closes trade within the same day. If you are a day trader, you can consider the 50 pips a day forex strategy. It usually works for major currency pairs like GBP/USD and EUR/USD. Traders start and close positions rapidly with a 50 pips a day forex strategy. It captures 50% of the range traded in a single day, using the candlestick chart. Forex charts track the movement of currency pairs across the global market.

Swing Trader: Swing traders are short-term forex traders. You can get the buy or sell signal, which depends on price movement for a particular length of time. It may last for a few days to weeks. You can also choose the MACD crossover swing trade. It determines trend direction and reversal with forex swing trading, considered the best forex trading strategy.

Forex News trader: Forex news economic reports like inflation, interest rates, unemployment rates, and GDP are the best forex indicators of the economy, which influence the forex markets. By trading on forexnews releases, traders can strengthen their trading strategy.

Range Trader: When prices approach a support level, it gives a buy signal, and at resistance level, it is a sell sign. The currency pair moves within a range, and the forex investor makes profits using the range-bound movement.

Trend Trader: Simple moving averages (SMA) and Moving average convergence/divergence (MACD) signal past price movement applicable to current market conditions. Momentum indicators like the RSI and Stochastic oscillator identify exit or entry points.

Position Trader: Traders hold their position for a couple of weeks or years as a long-term trading strategy. They apply fundamental analysis as the best forex indicators to identify market conditions.

Forex Trading Using Indicators and Strategies

Traders use technical tools like moving averages and momentum indicators when using signal forex. Fundamental tools analyse price movement through macro and micro-economic indicators. You can get the latest forex news updates for trading analysis on websites like Daily Forex. Forex currency exchange is the trading of one currency to another. Traders utilize market movement based on the economic calendar that gives a detailed appraisal of financial events and announcements of a country as forexnews.

- Pin Bar Forex: The pin bar candle is a candlestick price par that reveals the sharp reversal of prices. The pin bar candle has a shadow or wick. The tail of the pin bar forex indicates its rejection price area. A bullish pin bar has a lower tail, showing that prices will rise shortly.

- Volume Forex Indicator: It is a tool that forex traders use to identify the high or low demand for the instrument. The volume indicator forex is free for MT4, and it comes with the software. The simple scalper uses volume forex indicator and price action analysis as a one-minute scalping technique.

- Price Action: The stock price action allows you to read the market and make trading decisions, depending on the price movements. To predict market behaviour, you can choose a price action trading system. Traders can read the market based on actual price movement instead of relying on technical indicators. The relative price performance of currency pairs is available on forex charts.

- Forex Trendline: Forex trendline is a good strategy to examine past price action. It identifies the support and resistance levels. For short-term strategies like day trading and stocks scalping strategy, the forex trendline plays an important role.

- Trading News Forex: Trading news forex helps to assess the economic news. The monetary policy of a country impacts forex prices. The hawkish attitude by the central bank pushes currency pairs higher, while the dovish attitude lowers currency pair prices. Technical analysis along with real time feedback from forex forums, keep traders updated on forex news. You get to converse with peers and friends in the trading communities, involved in forex activities.

- Moving Average: The Moving average in forex is a trading indicator in a strongly trending market. The 5, 10, and 20-day moving averages are best for short-term trades. The 50, 100, and 200-day moving average in forex is best for long-term trading.

- SMA and EMA: The simple moving average forex is the best leading indicator for scalping. Exponential moving average or EMA forex is another indicator used in scalp trading.

- Algorithmic Trading: Traders make use of forex algorithmic trading to execute orders. It is a pre-programmed instruction that specifies price, volume, and timing. High-frequency traders use the forex algorithmic trading strategy.

- VWAP Indicator MT4: The volume-weighted average price (VWAP) is a technical indicator available for MT4 and MT5 platforms, free of charge.

- Backtesting Forex: it is a strategy that helps you assess the viability of a forex strategy, as it analyses its performance using historical data.

- Expert Advisor: Expert advisor or EA is a program that you can install into the platform. It automatically follows your instruction and acts according to the criterion mentioned.

Additional Forex services

If you are a newbie to forex, you need to understand the forex market. Choose providers who provide additional services for free, leading to a better understanding of the forex movement.

- Additional services include educational material to know more about forex trading, stocks, and crypto.

- Demo trading with fake money helps an investor to get the feel of the market.

- Some provide interactive charts, live messaging, or stream media as additional services.

- BabyPips is a website that provides a short training course for free. Learning forex trading becomes easier with a detailed explanation about automation and other strategies, which helps new traders.

- Forex Factory is a robust website that covers the current economic forexnews, which affects daily trade. Data comes in a color-coded system to indicate the severity of the prevailing conditions in the economy. Learning forex trading requires a study of the economic conditions that are currently affecting a country. Forex factory gives a brief account of global economic activities and events. Traders apply their strategies according to data available on Forex Factory regarding economic events such as employment news, inflation, consumer sentiment, etc.

- Videos, forums, webinars, strategies, and education systems are easily accessible for traders for effective trading activities.

Best Free Forex Signal Providers

Free signal forex provides trading suggestions to help you place buy and sell orders. The providers scan the markets and look for the best forex price action strategy for trading. Forex trading guides help investors gain forex market knowledge and forecast market conditions.

Users learn to identify the entry and exit points of trade, place stop-losses, and use the best strategy in the forex environment.

- What2Trade provides free signal forex, futures, and cryptocurrency trading. Its daily publications keep traders updated.

- Forex Signal Factory offers trading signals for free on the forex market.

- Learn2Trade is best for overall signal service.

- eToro provides automated copy trading for forex traders.

- 1000pip Builder is best for newbies who need mentoring in the fx market.

Best Subscription Forex Signal Providers

- 1000PipBuilder provides forex signals for a subscription.

- Chart Viper provides subscription services to investors and traders.

- com allows low spreads and a wide range of account types. You can join with a low minimum deposit.

Best Forex Signal Providers 2021

- Autochartist is the best provider with technical analysis tools, signals, and other relevant features.

- Forex signals.com provides forex trading strategies from professional traders along with powerful tools. Beginners can use the educational tools available to gain basic knowledge.

- BuySide Global helps traders make use of automated trading systems. You can also take part in community chatrooms for a membership fee.

What To Consider Before Selecting Forex Signal Providers

Before selecting forex signal providers, you have to focus on the type of trade that suits you. Choose the best forex strategy to reap consistent profits. Have realistic profit targets and do not invest more than 5% of your capital for trade.

- The forex signal provider should have a track record of more than three years in managing the signal. Consistent signal providers are the best choice.

- Choose providers who research the market before they provide signals.

- Choose a signal provider who trades in single lots. Your investments will get exposure to lower risks.

- Observe the number of pips that your signal provider makes and his overall profits.

- See if you want manual signals or automated signals. Choose providers skilled in signal sharing according to your need.

How Signals Help You Trade Effectively

Foreign exchange is a marketplace to exchange national currencies, and signals help in effective forex trading.

- Trade signals help the trader to make forecasts accurately for profitable trade with minimum risk.

- You can learn new strategies with trading signals. Once you start applying these signals, you can avoid mistakes and losses.

- Signals are great learning tools that give you a wealth of information for a profitable trade.

- Monitor the Entry Price, Stop Loss, Take Profit, etc., as they are critical levels.

- Make use of charts and indicators and apply them to your strategy.

How To Use Different Types Or Forex Signals

There are some secrets that make forex trading for beginners profitable. Pay attention to support and resistance levels. Practice risk management to preserve your capital. Your technical analysis on the forex market must be simple, as forex trading for beginners is tough work until you understand the basics.

- Choose the right forex signal according to the type of trading strategy you prefer.

- Forex signals are worth it, only if you have the right provider. Choose authorized signal providers for this purpose.

- Read the signals delivered by the provider and choose the ones that suit your strategy.

- Don’t be too ambitious in profit booking.

Taking Profit And Loss

If you have a low capital for trade, forex trading in foreign currencies is the best choice. Most forex traders choose forex day trading strategies and swing trading in the currency market, as they are short-term trading methods that are profitable. Learn to book profit or loss immediately. Do not get deep into trouble.

If you are making profits, make sure that you take profits. Some traders see profits but are not able to book the profit. Greed is an enemy that you have to overcome in the forex market.

You can shift the entry point and stop loss when unpredictable events take place. Similarly, if you are not sure of the direction of the trade, you can change the entry and exit points.

Success and failure are a part of forex market trading. But don’t wait for the worst scenario to happen. Choose the best forex strategy.

Forex trading for beginners is not easy in the initial stages. Until traders master the complexities of the forex market, it will be a tough ride. As it involves very small investments, forex trading for beginners is a good investing frontier.

Signals And Trade Size – Getting Harmony

If you are a beginner in the forex trading system, you can choose a micro lot which is just 1% of the standard lot. A standard lot in the forex market is 100,000 units. The lot size depends on the risk factor of the trader. It is best to follow the 1% rule.

With experience, you can choose the right trade size, an ideal trading plan, and the best forex trading strategy as they are crucial for successful trading in the forex currency exchange.

Correlation

In the forex market, currency correlations show the relationship between the forex currency pairs.. Active traders study forex charts to analyze short-term currency movements. Some currency pairs move in tandem with each other, while some move in opposite directions in the foreign currency exchange.

Positive Correlation: Currency pairs like the GBP/USD and the EUR/USD are positively correlated. Buying the GBP/USD and selling the EUR/USD creates a hedge. Usually, there is a strong positive correlation between the Euro and the British Pound against the US dollar. However, correlations are never stable in the foreign currency exchange.

Negative Correlation: Currency pairs like the USD/CAD and AUD/USD are negatively correlated. Traders apply forex hedging strategies while buying these currency pairs on the forex market.

Signals in Forex Trading

- Price Action Trading

- Copy Trade and Social Trade

- Scalping Trading

As a trader, choose the best forex strategies to suit your experience levels and goals. Understand the basic concepts of these forex strategies, benefits and drawbacks, and your ideal fit. Choose signals that suit each strategy.

Copy Trades And Social Trades

Traders prefer to view trades of successful signal providers displayed at the top. Under copy trading, you click the “copy trader” button. It will copy all the actions of the other trader, as it is an automated system. Copy-trading services make use of trading signals of successful traders. You can subscribe by paying a fee for the signal providers.

Social trading allows you to trade based on information provided by other successful traders. But the ultimate trading decision is yours.

Price Action

They are price action forex patterns used to predict market behavior. Professional traders spot these signals by recognizing shapes and patterns plotted on the price chart. Generally, the support and resistance levels are leading indicators of the price action forex.

The support and resistance levels play an important role as price action indicators. Traders use the stop loss and target levels to enter and exit the trade under price action trading. Some methods used to identify support and resistance levels are Fibonacci retracement, indicators, oscillators, candle wicks, and trend identifications.

Forex price action strategy helps in predicting future price movements.

Scalping Using Forex Signals

A scalping trading strategy helps traders to buy or sell a currency pair. Traders hold the currency pair for a very few minutes and try to make quick profits from five to ten pips per trade under the stock scalping strategy.

A beginner fx scalper can use one-minute scalping as the best scalping strategy for trade. Scalping forex is making large investments in short-lived positions. The fx scalper makes profits by just a few pips each time.

While using forex hedging strategies, the trader can minimize losses by opening two opposite positions. It is a method to safeguard your portfolio.

Forex scalping strategy and hedging forex are techniques used on the forex market frequently.

Avoiding Signals Scams

Forex traders should avoid signal scams. Fraudulent emails and text messages are some forex scams that traders should avoid. Do not share personal information, such as account number, password, Social Security number, etc., with anyone. Do not open an attachment or click on a link that looks suspicious.

Summary of forex signals

Forex signals reliable because the signals work on technical and fundamental analysis. However, you have to analyze the signals before deciding to trade on the forex.

Avoid false signals and do not put your entire trading fund based on these signals because each analysis comes with its own risks.

Forex signals are not a quick-fix approach to the forex market. The forex trading system is risky, as trading pairs see wild swings. You have to understand the related risk tolerance while making decisions and avoid forex scams.

Forex traders make profits, but a vast majority of them lose money. Forex signals provide trading suggestions. Have a forex trading plan to choose the best signal for trade. Day trading and swing trading in the currency market are some profitable ways of trading.

Signals offer suggestions, but they are not trading advice that you should act upon. The choice to make use of the trade signal is up to you. Day traders and technical analysts refer to forex charts before making trading decisions. Keep your decision streamlined and effective for a profitable trading strategy.

The forex market involves a significant risk of loss. It is a complex market where even experts have difficulty in predicting the currency movement. Forex signals are reliable only if you do your research before choosing the right strategy.