Are you planning on going on a business trip or a vacation with your family? In that case you’ll need holiday money foreign exchange. You can choose to carry cash, or a forex card, or a travellers’ cheque in various denominations of the local currency as vacation money to spend.

Exchange money at banks in the United Kingdom as they are convenient and less expensive. Exchange rates are lower. Apart from banks, some popular companies perform holiday money exchange services too. Choose the best forex and make an effortless and hassle-free holiday money exchange.

If you are traveling overseas, you need access to foreign funds. To get foreign funds, you have to pay a lot as an exchange rate to get the required currency. When you exchange your currency at the hotel or airport money exchange, or through online currency exchange currency, your exchange fee will be higher.

Take care to convert your currency before starting on a trip from the UK. Get an idea of the currency exchange rate so that you can choose the best method to convert your money. Overseas travellers can exchange their currency at various points during their trip. Trade currency wisely, as it may work out to be very expensive.

Currency Exchange Rate: What is it?

The currency exchange rate is the value the currency of a country has in another country. It is an exchange of the value of one currency against another. The government of each country determines the exchange value. The government of the country has the right to control and set limits on the currency exchange rate. It may be floating, pegged, or hybrid rating. Avoid scams and get the best rate available when you exchange foreign currency in the foreign exchange market in the UK.

Banks are the best options to exchange currency. To convert the British pound into USD or other leading currencies such as the euro, dirham, or yen, the usage of the forex market plays an important role.

The forex market has trillions of dollars exchanged every single day. Online transactions from the UK are performed through the forex market as it is one of the most liquid foreign exchange markets.

Estimates show that around 14% of currency exchanges are through foreign exchange companies. Compare the currency rate offered in various companies and choose the best option.

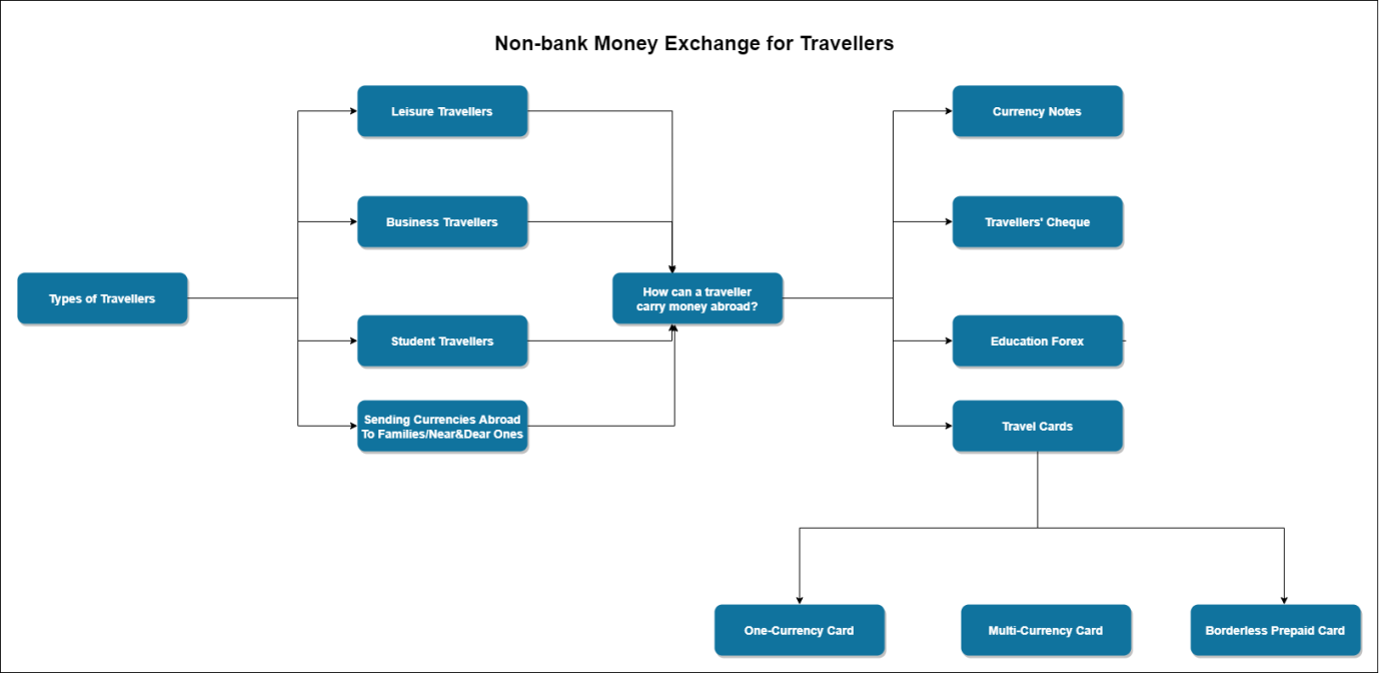

Travellers Who Need Foreign Money Exchange

You can get travel money from banks, authorized dealers, and money changers, who are licensed to provide foreign exchange for your trip abroad. You would need foreign currency notes or a forex travel card to spend on vacation. You can purchase forex online from various forex dealers. Make an informed buying choice by comparing the current exchange rates offered by forex dealers USA.

- Leisure Travellers: When you take time off from regular life and go on a vacation, you need the foreign currency to meet financial requirements. You will require the local currency change of the place you plan on visiting for entertainment, tours, souvenirs, flights, holiday resorts, and other expenditures. You can take a multicurrency forex travel card. You can also take your debit or credit card as a backup option.

- Business Travellers: When travel is for business purposes from the UK, to attend an international conference or seminar, training, or a study tour, you need money to carry abroad for food, flight tickets, hotel stays, and miscellaneous expenses for which you can exchange currency online.

- Student Travellers: Students who go abroad to study need currency to pay their tuition fees and to meet other expenses. You can take prepaid forex cards, foreign currency demand draft (FCDD), Wire transfer, or Travellers’ cheque. Students can contact the best forex brokers USA to spend upon their arrival in the United States, the UK, Australia, New Zealand, or other countries.

- Sending Currencies Aboard to Families/Near and Dear Ones: Send currencies through online fund transfer, branch-based transfers using foreign currency, demand draft, or wire transfer through currency change through forex brokers USA.

How Can a Traveller Carry Money Abroad?

Carrying all your money in cash is not safe. Typically, travellers from the UK take the required amount required as incidental expenses such as taxi, metro, restaurant bill, etc. You can meet other expenditures using a credit card or debit card. You can also get it delivered to your doorstep. You can save on conversion charges with the best forex brokers, when you exchange foreign currency.

- Currency Notes: You can buy forex currencies in big and small denominations. You can also encash the foreign currency that goes unspent. Get them at the best exchange rates with the best payment options to be spent during your vacation.

- Travellers’ Cheque: When people vacation in foreign countries, they generally use travellers’ cheque. They are pre-printed cheques of a fixed amount. They are widely accepted, and you can keep track of your expenditure. They are signature-based transactions.

- Education Forex: As a student studying abroad, you need forex currencies to meet tuition fees and maintenance expenses. You can get a forex card in one or more foreign currencies, travellers’ cheques, or prepaid net banking.

- Travel Cards: It is a travel prepaid card that you can load with the local currency of the country you are going to visit. You can use it for all transactions, just like another debit or credit card.

- One-Currency Card: With a single card, you can load up to eight currencies for use as vacation money. It is chip and PIN protected and provides access to merchant establishments and ATMs. You will not face currency fluctuations.

- Multi-Currency Card: These travel prepaid cards are best when you need a large sum of money. You can load more than ten different currencies and allows top-up from many locations. It is protected by a security pin and a chip. You also get SMS alerts for your transaction. The card is accepted at merchant outlets and ATMs. By exchanging money, you can convert the British pound to USD or the yen or the euro, or other major currencies.

- Borderless Prepaid Card: If you are traveling to multiple countries, the borderless prepaid card is the best travel card. Nine different currencies can be loaded. You don’t have to carry multiple forex cards. You can hold many different currencies and like your debit card while making a purchase. You can also use ATMs to take out local cash. You can use an online currency converter to check the current exchange rate you get. You can check rates from different providers.

Access to Exchange Foreign Currencies

- Banking Exchange Services

- Non-Bank Exchange Services

Banking Exchange Services

When you plan to go abroad from the United Kingdom, ensure that you get cheap access to foreign currencies. When you need access to foreign currency, you may have to pay high foreign fees. While purchasing foreign currencies, consider a few tips.

- Overseas ATMs: Have an account with a bank that has a foreign affiliate, so you can withdraw easily from their ATMs. Your withdrawal fee will be lower.

- Purchase from your local bank: Get foreign currencies from your local bank. It will help you to avoid unnecessary fee payments while exchanging money.

- International Debit Card: When you plan to go abroad, you can get a debit card from the bank that holds your account. If you use your domestic debit card while traveling abroad, your exchange fee will be high. An international debit card can be obtained from your bank. It will offer benefits and discounts and other services such as lounge access service in airports, discounts on various products, air travel insurance, and lost baggage insurance.

Non-Bank Money Exchange Services

Travellers from the United Kingdom can exchange their currency at various venues or forms, apart from banks. There are money changers that are more convenient than banks. Forex brokers USA offer competitive exchange rates and fees. Their services are easily accessible as they are conveniently located, and have more forex market hours. Many companies provide holiday money exchanges.

Non-Bank Exchanges Provide Easy Service

- Select the currency and the denomination that you want to carry for your travel from the UK.

- Enter travel details and the option for delivery such as doorstep delivery or branch pick up.

- Make online payment.

- Get your order confirmed.

Choose Reliable Forex Service Providers in the UK

- Safety and Security of Transaction: Ensure that there is transparency in every step of your purchase. Live tracking, status updates at regular intervals, and rate alerts are some ways of ensuring safety and security in your transaction.

- Online Rates: When you track currency rates, you can buy forex at the most competitive prices quoted by the foreign exchange market. Forex brokers in the USA give you competitive rates.

- Block Rates in Advance: You can block rates by paying a very small percentage in advance of the transaction value and pay the remaining in a day or two.

- Forex Limit: You can have forex up to a particular limit while traveling abroad. Before 180 days of your travel date, you can get your foreign currency exchanged through an authorized dealer. You can also carry local currency in the form of cash, travellers’ cheque, travel cards, etc.

- Activate Card: You can activate your debit or credit card for using it during your travel abroad. A transaction fee will be charged to them.

Popular Companies Providing Non-Bank Money Exchange Services

If you need travel money, the most convenient service in the United Kingdom is through the post office, which provides the best holiday money exchange. It prevents all types of forex scams. The convenience of location, preference and clear correlation are the chief features of supermarket providers. Avoid forex scams and protect your money.

1. Post Office Holiday Money

The Post Office is the most used holiday money exchange in the United Kingdom. There are more than 3,000 post office branches in the United Kingdom. They are found in towns and large villages and provide holiday money exchange facilities.

- Click and Collect Service: You can pre-book and pick up foreign currency through the Click and Collect service.

- There are around 3,000 branches that provide over-the counter-collection.

- With a travel money prepaid currency card, you can exchange your currency.

- Branch Collection and online order and delivery provide a free next working day delivery if the foreign currency is booked by 3 pm. The currency can be collected in just a couple of hours after ordering.

2. Sainsbury Holiday Money Services

- It is a supermarket that provides services such as providing travel money cards, foreign currency collection, and delivery. If you are a Sainsbury Nectar cardholder, you can receive improved rates.

- There are around 260 stores that provide a fair currency change. You also get the advantage of £5 off on travel insurance if your Sainsbury holiday money order is more than £500.

- You can opt for wallet technology, by which you can add multiple currencies along with your holiday money passport. It can hold currencies like US dollars, the euro, the Australian dollar, the Swiss Franc, the Canadian dollar, the South African Rand, and many more. If you are a frequent flyer, you can make use of this opportunity.

3.Tesco Holiday Money

- Tesco is the UK’s largest supermarket chain, which also has a Tesco holiday money sector. It offers various financial services through its Tesco Bank brand. You can say that it is not a strict non-bank provider, which operates in-store, and not like other classic banks.

- There are around 300 stores that operate with 100 customer service desks. As a shopper, you can collect your Tesco travel money in a majority of the stores.

- You can make use of the click and collect service to get home delivery. But you do not get the travel money card facility. If you are in a rush to catch a place, you can avail the click and collect service by booking two hours before collection.

- If you chose the delivery option, you get smaller travel cash amounts for a charge of £3.95. If the exchange amount is more than £500, it is delivered free of charge. You get better rates when your purchases are between £800 and £2,500 in foreign currency.

4. M&S Holiday Money

- There are around 120 stores that provide M&S holiday money exchange services online and by click and collect service too.

- When you use the click and collect service, you get a better exchange rate than through online or over-the-counter service.

- If you are a credit cardholder, you receive a 55-day interest-free service while purchasing foreign currency from one of their money exchanges.

- If you have a credit card or a debit cardholder of M&S, and you avail of the click and collect service, you get a better rate.

5. Thomas Cook Holiday Money

It is one of the most used travel money services that holidaymakers prefer for exchanging money.

- Thomas Cook is the 7th most popular company in the United Kingdom to offer counter holiday cash. It offers options like a travel money card, Thomas Cook holiday money, and a reserve, and collect in-store.

- The travel money card is from LYK, which can hold up to foreign currencies.

- The overseas ATM withdrawal fee varies with the currency. Holidaymakers in the United Kingdom prefer currencies like the US dollar and the euro, whose charges are $2.50 and €1.75, respectively.

6. Travelex

It is a giant in the international payment sector for holiday money, though it reaches only 5% of the travel money market.

- Travelex, prominent in the UK and the US, has several sizable providers with a sizeable market share. It covers transport locations, airports, high streets, and city bureaux of importance.

- Its retail stores located in over 60 countries perform over 800,000 transactions.

- Key activities performed are in travel money, international payments, and remittances.

- It offers online cash orders and deliveries in various countries.

- They charge fair rates. £2.99 is the rate for cash delivery, for an amount above £600.

- Many pick-up locations include malls, railway stations, and airports.

- You can reload your prepaid currency card through apps or online. The cards can hold up to 10 currencies that allow for global coverage.

Convenience in Non-Bank Holiday Currency Exchange Services

Leading companies offer foreign currency exchange services for international payments to customers who cannot exchange currencies from banks.

I. Airport

II. Bureau de change

III. Click and Collect holiday money

IV. Travel Card

i. Airport collection: Currency exchange at the airport is convenient but expensive, though forex market hours are high. Exchange rates are high, and the fee charged is high. If you did not get your currency exchanged beforehand, get it done at the airport, though it will be expensive as it will come with an upfront fee or hidden fee. If you do not plan properly, you will be stuck with poor exchange rates and, it will reduce your spending capacity. Airport kiosks may charge up to 20% as a fee. Travelers can avoid airport kiosks.

ii. Bureaux de change: It is a currency exchange where customers can exchange their currency for a foreign currency. Holiday money exchange services are available at these outlets, located at various tourist locations such as airports and other areas. When you are traveling and need some extra money, there will be a bureau do change available nearby. They are usually available across the globe in most countries. Exchange rates vary from one bureau de change to another, as rates are determined independently.

iii. Click and Collect Travel Money: How it Works

- Identify the country you are visiting and the currency of that country. Select the local currency and the amount required.

- Confirm your order to get the foreign exchange rate.

- You can select a date and the time slot to collect your currency according to your convenience. Information is provided through automated emails to tell you that the local currency is ready to be collected.

- If you want the payment through a bank transfer or debit card, it will be processed once they get clearance for the funds.

- Your processed currency order gets transferred to the main branch, and it will prevent forex scams.

- You will receive a notification that your currency is ready for pick up. Keep your debit card/credit card/payment card and ID proof such as license or passport.

iv. Travel Card: It is a prepaid card designed for travel to a country of your choice. You can use it just like a debit/credit card.

Advantages:

- It is a very convenient means of spending abroad. Check all your transaction details online. You can also get your card recharged in foreign currency.

- You can save on transaction charges.

- If you have a leftover balance in the travel card, you can encash it and get it back in pounds. It is valid until the expiry date of your card.

- When you use the card at a merchant establishment, you will not incur any charges. However, when you use it at an ATM for withdrawal or balance inquiry, you will be charged a fee for reloading.

If foreign exchange services from banks are not available, use alternate options to enjoy your vacation. There are financial risks to be considered when you travel internationally. Take extra precautions when you exchange currency.