There are many reasons why investors and second home buyers consider buying a property in Cyprus.

Cyprus is a massive favourite for those looking for a second home or living in the sunshine, so it’s hardly surprising that many people have the ambition to move to the Island. Luckily, with a small amount of planning and expertise, making that dream move can become a reality.

You are wondering why Cyprus is such a prominent location for expatriates? Well, considering the great environment, beautiful blue flag beaches, rich heritage and history. Combined with good quality of life, it’s easy to see Cyprus’s attraction. Here are some of the top factors to purchase a home in Cyprus if you need a lot more persuading. Why Buy a property in Cyprus?

The property market in Cyprus

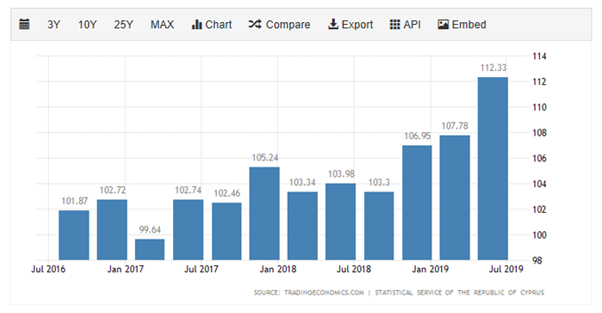

Properties in Cyprus can represent excellent value compared to other countries and have recovered significantly since their 2016 lows. The Cypriot property index has recovered strongly, increasing to 112.33 in the second quarter from 107.78 in the previous.

Investors should feel confident when transferring money to Cyprus. Much of the property market’s strength is derived from a sturdy economy. The Cypriot economy has grown significantly in the last three years, outstripping many of its European neighbours. In 2018 increasing by 3.9%, 4.8% in 2016 and 4.5% in 2015. Whilst the economy’s growth is anticipated to slow next year. It’s still forecast to increase by 2.6% in 2020. The property market, however, is still expected to remain strong due to high demand.

Should you buy or rent in Cyprus?

Whilst statistically foreigners prefer to buy, while residents are more likely to rent a home. Take a closer look at the market, and the explanation is obvious. The Cypriot property market continues to be invested in by both second homeowners and those looking to become more tax-efficient or those looking to relocate and gain citizenship in Cyprus.

However, the choice of renting or buying will probably be defined by your specific situation. If, for example, you are only expected to remain in Cyprus for six months or a year, buying might not be the best option. If, however, your dream has to retire to Cyprus and you’ve visited many times, buying will be attractive, especially if the market continues its appreciation.

Best places to buy in Cyprus

Limassol – Limassol is superb for energetic young families. Limassol is a cultured city, with an outstanding selection of international schools and colleges to choose from. Here, you will find everything you require to lead a comfortable life, with a broad selection of stores, restaurants, bars, and other attractions to choose from. Furthermore, suppose you want to rent your residential property to tenants. In that case, Limassol property benefits from high demand and commands a high price than many other locations. One negative of this higher demand is that living in Limassol can be a lot pricier than in other parts of the Island.

Paphos – Property for sale in Paphos, Cyprus, is extremely attractive for busy individuals who travel overseas frequently. The main advantage being an airport located close by with outstanding international transport links. It is generally believed that owning property in Paphos is less expensive than in some other locations in Cyprus. Many choose Paphos to reduce living expenses and easily travel to Limassol for work every day. Paphos is considered even more of a laid-back environment than Limassol. Most of the properties being sold as individual private dwellings, not flats or rental properties.

Nicosia – Properties available in Cyprus, Nicosia, can be ideal for buyers aiming to rent out their investment. Local rental appetite in property is steady. Many Cypriots work in the capital Nicosia so that long-term rental can be an excellent financial investment. However, Nicosia is located inland and doesn’t have accessibility to the sea. Therefore, it wouldn’t be good to purchase a home in Nicosia for a vacation house or short-letting possibility.

Ayia Napa – The town has been substantially improved recently and now provides much more of a family-focused ambience. For example, the high-end marina consists of 600 berths, retail outlets and premium private beach club, a variety of high-end homes. Visitors, as well as residents alike, benefit from Ayia Napa’s 500m Blue Flag Nissi coastline as well as surrounding cliffs.

Residential property buyers in an area like Famagusta will undoubtedly have the ability to count on rental income, which is why apartment or condos command a higher premium.

Larnaca – if you love the beach and a slower speed of life, Larnaca will deliver on your expectations. Larnaca is close to an identically named airport. It’s located close to the sea and has budget-friendly residential or commercial property prices compared to Limassol or Paphos. While Larnaca is little, the city is thought about to be an undervalued investment possibility. Perfect for those who are hoping for eventual capital appreciation.

Can a foreigner buy a property in Cyprus?

European Union nationals can buy as much property as they desire and face no restrictions.

Non-EU foreigners can buy two homes in Cyprus and are entitled to hold land on a freehold basis. If they purchase through a company there is no limit. A property permit to register a property must be obtained from the government. Still, it can easily be sourced through a local lawyer dealing with the property purchase.

Associated costs of buying in Cyprus

The buying cost in Cyprus can vary subject to the type of property you buy. These are the typical associated costs when purchasing a home in Cyprus –

Estate agencies fees – Cypriot estate agent’s minimum charge will equate to 3% of the property amount. However, buyers should budget on paying roughly 5% of the property value.

Legal fees – typically will represent approximately 1% of the properties value. A solicitor’s consultation is highly advisable but not compulsory.

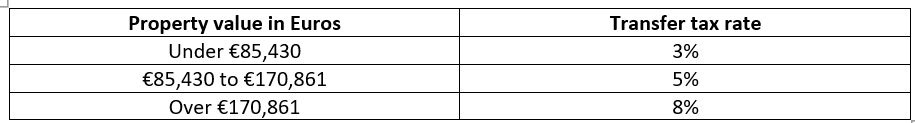

Property transfer taxes – property tax increases incrementally with the property’s value and doesn’t apply to new build properties.

* currently the Cypriot government are offering international investment incentives, meaning the transfer taxes and reduced by 50%.

VAT on new build properties – Buyers that opt for a new property should be conscious of VAT charges which equate to 19% of the property value. These are typically included in the property price.

First-time buyers can benefit from a reduced rate which shrinks to 5%. However, the dwelling must be used as a primary residence. No VAT is chargeable for resale homes in Cyprus.

Newbuild property or resale?

Whilst there are arguments for and against newbuild or resale property in Cyprus, some of the pro’s and cons won’t be immediately obvious.

Newbuild property pros and cons

- Work with an established credible developer

- Amend or tweak the layout of your dream home

- Pay in stage payments – ensuring the build progresses

- Avoid any future legal or ownership issues

- Decorate the property to your specific taste

- Access to aftersales care

- Investment can lead to residency when over €300,000

- Incentives can make buying off plan a great value option

- Arguably have a property with less character

- The property could take up to 14 months to complete

Resale property pros and cons

- Title deeds can be obtained quicker than newbuild properties

- You could pick up a bargain and be able to renovate yourself

- Resale property can tend to be cheaper if on a budget

- Move-in once you own the property – no build delays

- The property could need more work than you anticipated

- Documentation might not be up to scratch – many extending properties without local permission

Tax advantages of investing and buying property in Cyprus

Corporate tax rate – Companies in Cyprus benefit from a flat corporate tax rate of 12.5%. This tax can be lowered further using a PO Box or NID (Notional Interest Deduction).

NID – Notional Interest Deductions allows investors to benefit from a further 2.5% deduction on any taxable profit. This vehicle can also be introduced when investing further into the company.

IP Box Regime – this tax provision applies to IP generated, purchased or exploited in Cyprus. Eight per cent of qualifying IP profits will be tax-deductible (20%) and subject to income tax of just twelve and a half per cent. Making the highest possible tax rate just 2.5%

Cyprus Double Tax treaties – Cyprus offers more than 60 double tax treaties. Offering huge advantages for structured investments in Cyprus. The majority of scenarios mean that Cyprus Tax Resident Companies receive gross dividend payments.

Cyprus Holding Companies – Subject to the double tax treaties in place, a Cypriot holding company, receives dividends for its non- Cypriot tax residence or Non- domiciled Cypriot tax resident.

Non-Domiciled Tax Resident – An individual can qualify with either 183- or 60-day rule for tax residency. Meaning the individual can benefit from a 17-year tax exemption on dividends (17%), interest (30%), and property rental income (3%)

Profit of share sales – Profit from shares sales is tax-exempt in Cyprus, providing the company doesn’t possess fixed assets on the island.

Most expensive areas in Cyprus

The most costly areas in Cyprus include –

The average price of a two-bedroom apartment in Cyprus is roughly €176,00. These are the areas that exceed that average price –

- Limassol – €400,000 for a two-bedroom apartment

- Famagusta – €180,000 for a two-bedroom apartment

Least expensive areas in Cyprus

Areas in Cyprus where the price for a two-bedroom apartment falls under the national price average include –

- Paphos – €170,000 for a two-bedroom apartment

- Nicosia – €160,000 for a two-bedroom apartment

- Larnaca – €160,000 for a two-bedroom apartment

Offering potential second homeowners and excellent investor value when looking at buying property in Cyprus.

Most popular areas in Cyprus with expats

The most popular locations for expats or homeowners in Cyprus are the following –

- Nicosia

- Limassol

- Paphos

- Larnaca

- Famagusta

Many choose the areas above for a variety of reasons. These can include the local amenities, proximity to work or expat friends. Some even prioritise blue flag beaches in their area choice. Homeowners and expatriates will have different needs to those buying a second home in the sun.

Top tips for those buying Cyprus

Failing to plan is planning to fail – Make sure you feel comfortable with the area and property or, if not yet constructed, the developer. Those without a plan will find the process of buying a homeless rewarding.

Find an independent lawyer – seek an approved lawyer in Cyprus who has a track record of working with foreign clients.

Save with a Foreign exchange company – ensure the FX provider you use is regulated, has an excellent reputation and knows the market. Arranging stage payments at the 11th hour on an app will not help your blood pressure!

Stay in regular contact with your team – ensure you keep track of the sale or construction of your property. Credible lawyers will be happy to provide updates, and constructers will supply pictures and videos as your property takes shape.

Have a plan for future eventualities – If relocating, be cautious of build dates and ensure you have insurance and bank accounts in place before relocating.

Consult with an accountant – A Cypriot account can guide you towards the most cost effective way of investing in Cyprus

Financing a home in Cyprus

Obtaining a mortgage in Cyprus for non-Cypriot buyers is more complicated than financing locally and carries more risks. First, it’s worth sourcing an international mortgage broker that will assist in sourcing the best home mortgage for an overseas home in Cyprus.

Once a specialist Cypriot mortgage broker works to finance your home and the mortgage is approved. You’ll then need to advise your Cypriot lawyer that financing has been gained.

Once you’ve selected your new home and the mortgage has been authorised. Just as you would require a solicitor to get a home in the UK, you’ll need to select one in Cyprus to carry out the pertinent paperwork, including formulating a contract.

You’ll need to supply a down payment which at the very least will be 30% of your Cypriot holiday home value.

Once final agreements are signed, the property will be registered via your lawyer with the Land System Registry in Cyprus. To conclude the transfer, you’ll have to pay the appropriate fees and local taxes.

Transferring money to buy a property in Cyprus

When you have found your dream home in Cyprus and established a bank account, you will need to start transferring money for both the purchase and credit your account. This moment is where a specialist currency provider comes into its own. As specialists who are familiar with buying processes and transferring money to Cyprus, they can add value.

Property deposit – Once you have selected a home and signed a reservation agreement, a deposit of €3000 or 1% of the property value will be expected. We strongly suggest that buyers seek guidance from a solicitor before sending the initial deposit to check the company’s authenticity. Companies such as Rational FX and Currencies Direct can assist with this initial transfer and any other payments needed to complete the purchase. A specialist will also offer the choice of fixing the total amount of Euros you need to complete if the rate is advantageous.

Property Stage payments – shortly after an initial property deposit is sent and contracts are approved, the second payment of 10% for resales and between 20-30% for new builds will be required. They will also discuss the timing of other stage or final payments for you to capitalise from a good rate. New build properties will more likely be paid off in tranches whilst resales will be paid for in full a few days before the completion date.

Regular payments to Cyprus – if you take out a mortgage in Cyprus, it’s likely that you will need to transfer money on an Adhoc basis. Either to top up your account or send money every month to pay a Euro mortgage. A specialist offers the opportunity to fix a rate for up to a year, ensuring the price of your € payments. Rational FX and Currencies Direct allow you to make these payments via telephone, online or by an app.

Opening a bank account in Cyprus to buy a home

The Cypriot financial system has been transformed in recent years, offering both personal and company clients benefit from far better banking solutions. These banking improvements have seen second homeowners and new residents be able to open up an account with a much simpler process, commonly just requiring these simple documents complying with in terms of documents -

- A valid copy of ID.

- Utility bill from the applicant ( less than six months old).

- The selected banking institution gives the completed application.

As soon as your bank account application is approved, you can send money to Cyprus almost immediately. As soon as you transfer money to Cyprus, it should land in your Cypriot bank account within 1-3 days, based on your place.

Leading Banks in Cyprus

The leading banks in Cyprus most used by second homeowners, expats and residents include

- Bank of Cyprus

- Hellenic Bank

- Alpha Bank

- Astro Bank

Finding a home in Cyprus

Using a local specialist such as Del Mar Investments will improve your chances of finding a perfect home in Cyprus. They will guide you thorough the market and hold your hand through to completion. A premium developer will be pleased to provide you with tours of the area and the developments available to buy in your price range.

The property buying process in Cyprus

There will be a good number of similarities with the buying process in the UK and Cyprus for English buyers. Many aspects of Cypriot law are based on the legal process of Britain, meaning the buying process can be easier than in many other countries in Europe.

The general buying process is as follows –

- Find your dream home in Cyprus

- Get an offer for this property accepted

- Appoint a lawyer to overseas the buying process

- Apply for a mortgage if required

- Register with an FX broker

- Pay any required deposit

- Make the final transfer

- Collect keys – becoming the owner

- Become the registered owner on the Cyprus land registry

Subject to your lifestyle and ambitions, Cyprus can be a rewarding area to live and retire to. It remains one of the most cost-effective places to live in Europe and enjoys almost year-round sunshine. While due diligence has to be performed when buying here. If all of the key steps are followed, there is no real reason why moving to Cyrus cannot be a hugely rewarding process for yourself and your family.