Those seeking a Mediterranean destination will be attracted by the opportunity of buying a property in Italy. The country boasts incredible cities, ancient ruins, breath taking museums. Likewise, those looking for jaw-dropping scenery can expect beautiful mountainous backdrops, splendid beaches and beautiful natural scenery.

The property market in Italy

Despite a year of uncertainty and the economic damage caused by the global pandemic, the Italian property market remains optimistic. Many estate agents are confirming that they received a higher demand in 2020. Notably, for properties in more rural locations, local and foreign property buyers sought more space and better value.

The market appears to have been boosted in 2020, and the new Mario Draghi led government continues to try and breathe life into the Italian economy.

Interest rates remain at historic lows, which has also assisted the appetite to buy in Italy. The view is that rates will stay at these historic lows for at least a year as Italy recovers from the pandemic.

Whilst property market increased have been modest so far in 2021, growing just 1% this year and falling 2.5% from the final quarter in 2020. However, many expect prices to rebound over the coming months as travel returns and lockdowns gradually end.

Despite the attraction of moving to more rural locations, city property prices have triumphed, with Milan increasing by 20%, Turin 5% and Rome 2%, respectively.

Should you buy or rent in Italy or both?

Buying or renting will be a choice that your circumstances and budget will define. Those that have long term plans on living in Italy will almost certainly prefer to buy in Italy. Additionally,

servicing a mortgage at these low-interest record rates, when combined with a 30% deposit, can be a more economical way of living in Italy.

Renting will be more popular with those unsure of the area they wish to buy a property in. Many opt to rent for a year and ensure that the town or city fits their family’s needs. Renting will also be the preferred route if you are working on a time-limited work contract and are unsure how much time you will spend in Italy.

Alternatively, the ‘rent to buy process can be suitable for those unable to choose whether to rent or Buy. Essentially a prospective owner agrees on a price for the property with the vendor. The new owner pays a pre-agreed amount to rent the property with an additional fee to purchase once the tenancy concludes. This additional amount is deducted from the final sale price but offers the exclusivity to buy the property. Typically a more modest deposit of 5 to 10% is agreed upon before the property is rented or purchase to hold both parties accountable.

Rent to buy example

Agreed property sale price: € 200,000

Monthly rental payments: € 600 (€ 300 rental price + € 300 deducted on the whole property price)

Initial property down payment (10% of the agreed price): € 20,000

Amount accumulated after 5 years: € 30,800 (€ 20,000 down payment + € 18,000 “saved” in 5 years)

Balance: € 169,200 to pay upon completion.

Best places to buy in Italy

Here are the best places that we feel you should take a look at when buying a home in Italy:

Bologna: as yet Bologna remains relatively untouched by foreign property buyers. However, demand is growing, and many experts expect prices to follow. Lonely Planet voted the region of Emilia-Romagna as a top place to visit in 2018. In culinary terms, the area is known for its famous Ragu, prosciutto and balsamic vinegar.

Bologna’s property prices aren’t far behind many of Italy’s main cities, with two bedrooms apartments starting at around €200,000.

Savona, Liguria: Best known for its picturesque villages surrounding the shores of The Cinque Terre. This area is generally out of many second homeowners price range. More affordable properties can be sourced in apartment complexes that often have shared pools. The coast offers sandy beaches at almost every village, and other worth considering include Alassio, Pietra Ligure and Spotorno. Spotorno is also boasting a Marina for those who wish to moor a boat.

Savona’s property prices begin at roughly €50,000 for a small one-bed rustic property in need of modernisation. A two-bedroom apartment in good order starts at €175,000.

Italian lakes, Lombardy: Among the most popular tourist destinations in Italy are the Italian lakes in the Lombardy area. The most popular being Maggiore, Garda and Como. This long-running appetite has fuelled property development around these lakes, and abundant villas, apartments and houses can be found on the market.

The most desirable of all the lakes is Lake Como which attracts the rich and famous. Properties in Como with a lake view begin at around €70,000, but these properties will need a vast overhaul. Two-bedroom properties with a view of the lake will start at roughly €110,000.

Venice: Popular with holiday homeowners and expats, Venice offers something unique. Over one hundred islands for the city, collated together in the district, with alleys, canals and bridges knitting them. Venice boasts a mass of galleries, museums and restaurants. Property in desirable areas can be amongst the most expensive of in all of Italy. However, the city is still accessible, with two-bedroom apartments available for around €200,000.

Cefalu, Sicily: as one of the most affordable parts of Italy, the Cefalu area of Sicily was known as an area where houses could be found for one euro. Despite this perceived value, Sicily boasts some of the best beaches, pretty towns and historical sites in Italy. Suppose you visit the picturesque port early in the morning. In that case, you’ll stumble across fishermen preparing their vessels for the next day’s catch. The town comfortably fits the bill for tourists and locals alike. The town offers a great choice of cafes, restaurants and bars.

Property prices begin at around the €160,000 level for a small one-bedroom property with a two-bedroom home costing around €245,000.

Perugia, Umbria: Tourists are often attracted to Perugia by rustic properties in hilltop villages. The same can be said for foreign property buyers who search for rustic Italian properties. Located close to Tuscany and just a train ride away from Florence and Rome, Perugia’s popularity is ever-increasing, yet prices remain attainable for many. Close by tourist flock to Lake Trasimeno, surrounded by swimming pools, tennis courts and even a golf course.

Properties start at €15,000 for a small hillside dwelling in need of total renovation. A two-bedroom stone house can still be purchased for €30,000, making Perugia an excellent area for those buying a home on a budget.

Can foreigners buy property in Italy?

The majority of foreigners, both inside and outside of the EU, can purchase in Italy. Buyers outside of the EU will either need a residence permit to live in Italy full time. If not, your country of origin will have to hold a reciprocity agreement with Italy. The US, for example, has this agreement. As for the UK, there remains some ambiguity on the issue; however, Brits can still purchase homes all over Italy.

Those who qualify under reciprocity can stay up to 90days per 180 days in Italy. If you wish to spend more time in Italy, you will have to apply and be granted a visa.

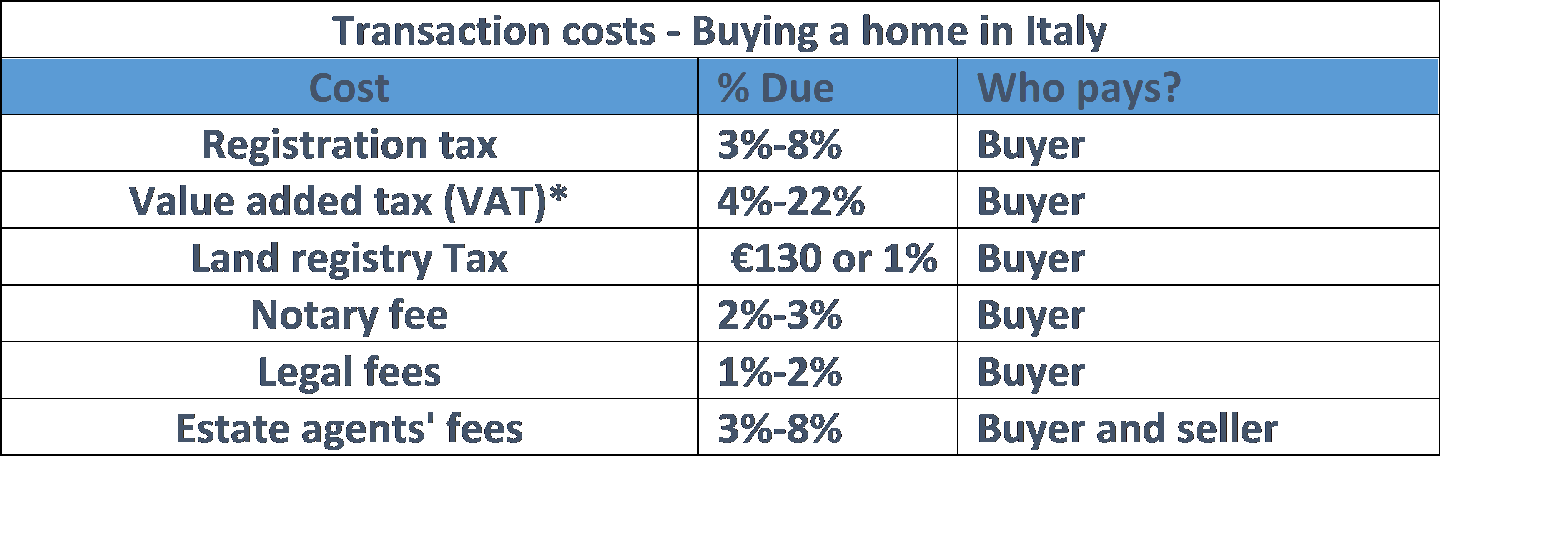

Associated costs of buying in Italy

The main associated buying costs when purchasing a property in Italy include:

- Estate agency fees – typically divided between vendor and buyer-will range from 3-8% of the property value.

- Italian notary fees – exclusively dependant on the properties value represent 2-3% of the purchase price.

- Land registry – This costs €130 for those living in Italy and roughly one per cent of the properties value on second homes.

- Registration tax – payable on completion those purchasing a second home will pay 7%

Summary of Italian property buying costs

Newbuild property or resale?

Those looking for property in old cities will find it challenging to source newbuild property in central locations. Newbuild homes are more readily available in-country locations such as Tuscany. Off-plan properties and constructible land are readily available.

Those considering buying in rural locations will have the option to get local builders to create their dream newbuild property. Purchasing constructible land and then sourcing a local builder to build. When finding a builder seek recommendations from local and expats and lawyers.

Most expensive areas in Italy

Here are the most expensive areas to buy a home and live in in Italy.

- Rome: The largest city in Italy, arguably with the most history and most luxurious properties tops the list. This historic city has the highest demand for rural property. Only 10% of property sales are to foreign buyers.

- Venice : The second most expensive city boasts properties with a square metre price of €15,000. Sales are also 70% foreign buyers, with the French, British and Germans all having an appetite for Venetian property.

- Milan : Arguably one of the worlds fashion capitals, Milan combines history and modernity perfectly. Prices reach €13,000 per square meter in the fashion quadrilateral.

- Tuscany – remains amongst the top destinations for second homeowners and expats. The most desirable place in Tuscany is the Forte dei Marma area, famous for its parks, restaurants and boutiques.

- Lake Como: Now firmly considered the most exclusive location in Italy. Its famous lake views and mountain backdrops attract the super-rich and famous. Como’s proximity to Milan also proves attractive to city workers looking for a weekend retreat.

Least expensive areas in Italy

Significant value areas in Italy where you can retire or own a second home and not break the bank!

- Abruzzo – situated just east of Rome and located on the Adriatic coast. Abruzzo is a popular holidaymaker destination. Expats and potential second homeowners are becoming more aware of the areas charms and their appeal.

- Puglia – Rich in history, Puglia’s towns date back 3000 years. Its architecture takes inspiration from Arab, Balkan and Greek design. Popular with Italian holidaymakers, Puglia is one of the cheapest places to live in Italy.

- Calabria- offering roasting summers when temperature top 100F and freezing winters with mountainous area constantly experiencing snowfall. A far less popular tourist destination Calabria attracts few tourists. Therefore, those wanting quiet hot beaches will be very well catered for.

- Basilicata – Blessed with white sandy beaches on the Ionian and Tyrrhenian seas, tourists largely ignore the area. Take a step back from the shoreline, and mountains surround you. Ideal for those that enjoy the great outdoors, zip-lining, hiking and cycling can all be enjoyed in Basilicata.

Most popular areas in Italy with expats

Some of the most popular areas for expats in Italy include the following destinations:

- Liguria

- Puglia

- Rome

- Umbria

- Abruzzo

The areas above are popular with expatriates for a variety of different reasons. Many will work in the popular cities. Other expats will be retired and enjoying a slower pace of life in rural areas of Italy.

Top tips when buying a home in Italy

Always carefully consider the region: Italy’s 20 regions offer everyone and climate, scenery and accessibility. Temperatures can vary dramatically; for example, Lombardy’s summer height reaches roughly 23c, whereas Calabria can top 32c. If possible, it’s advisable to visit and encounter various seasons, especially if you are considering calling the area home.

A holiday home or full-time residence: If you are considering a holiday home, ensure that it isn’t too far to get to. Where is the closest airport? Can you cheaply and easily rent a car? If you don’t drive, are public transport links adequate? Those looking for employment once in Italy are better to maintain proximity to large towns or cities to increase their chances of employment.

Ensure you have your finances in order: it’s well worth getting your money in order before committing to a viewing trip or make a formal offer. A currency transfer specialist will be able to provide you with solutions to maximise your currency in Euros. Putting together a plan for you to capitalise from positive FX market movements whilst protect yourself against adverse movements. Suppose you are financing the property with a mortgage its worth getting a feasibility study beforehand.

Financing a home in Italy

Italian property mortgages are typically capped at around 60% loan to property value. Some mortgage lenders will extend this to 80% of the Italian properties value in exceptional circumstances. Meaning buyers should account for a deposit of between 20 to 40% of the properties value. Also bear in mind the associated cost with will be on top on this deposit.

What’s more, mortgages in Italy tend to be over a 15-year term meaning monthly mortgage payments may have been more than anticipated.

Transferring money to buy a property in Italy

Setting up your currency account should be amongst the first things you look to do before making an offer on your home in Italy. A specialist provider can assist with managing your budget and look to maximise your base currency, meaning you have more euros to invest. Reputable providers have several tools to protect you against market fluctuation and allow you to capitalise if the rate moves in your favour. When you need to transfer money to Italy, they will have several solutions to ensure the payment of your overseas home goes smoothly.

Setting your account up requires little or no paperwork, and an account can typically be opened in a few areas. Your currency transfer specialist can also assist with small money transfers to Italy, including foreign salary or pension payments.

Opening a bank account in Italy to buy a home

Italy’s banking is relatively straightforward, and if your documents are accepted, the account can work on the same day. Other great news is that non-residents can open an account. For the most part, this process will need to be done in person, so it’s advisable to combine it with a property viewing trip. Occasionally some Italian banks might have a location in your home nation. The application can be made in the overseas branch.

Paperwork required for Italian bank account

- A valid form of ID

- Italian tax code (Codice fiscale)

- Anti-money laundering document (AML) – the bank will go through this with you

Subject to the bank capacity, you may have to fix an appointment rather than just turning up.

Finding a home in Italy

For those buyers who are time short or looking for a more unique and rare property in Italy, you may wish to enlist the services of a specialist property buying agent. This agent will typically work on a retainer basis and present you with the best options available, both “on and off-market”, in your desired location. This agent will then provide you with property valuation and bidding advice- and assist you with financing and legal matters through to sale completion. Buying agents typically operate at the more expensive end of the market on properties over €1,000,000 and profess to negotiate at least their fee off the property’s final price. Therefore, providing buyers with access to properties that are not for sale on the open market. This is an excellent service, particularly for those unable to travel due to work commitments or unfamiliar with the local property market and buying process.

The property buying process in Italy

A rough guide to the process of buying a property in Italy.

- Get a fiscal code and open a bank account. A ‘Codice Fiscale’ can either be sourced online or the local tax office.

- Contact a reputable realtor in the area of your choice. Always ensure google reviews are mainly positive and that the agent has been in business for at least 3-5 years. Make sure the realtor is also registered with the chamber of commerce.

- Begin viewing properties that suit your criteria. Once you’ve found your dream home, agree on a buying price.

- The Notary will then create and oversee the sales contract with the vendor and buyer. The buyer pays for the Notary’s services.

- Your Lawyer, who operates separately, will then perform all legal checks and ratify the ‘compromesso’ contract to purchase. After both parties sign, a deposit of €5000 is then required.

- Arrange financial services – at this stage, you should have already enquired with a mortgage broker and opened a currency exchange account to pay the deposit.

- The buyer and vendor signed the deed to purchase – the final contract or ‘atto notarile’. The last money transfer is made, or mortgage finance received, and the buyer takes ownership of the new property.

Moving into your home in Italy

Once the ‘atto notarile’ meeting is complete, and you are now the legal owner, you can move into your home in Italy.

Your removal company can now unload your personal effects, and you can settle into your new home.

Suppose you are moving into a city home or apartment complex. Ensure you have the needed permits and use the proper parking facilities not to upset your new neighbours.

Buying land in Italy

Land sales are frequent in Italy, but you have to make sure that the land you are purchasing is classed as building land by the council or ‘comune’. The lands viability can be confirmed at the local panel on their general land plan. There can be limits on the size, whether a pool can be installed, so always ensure that you check before buying.

.