Whilst the US dollar endured a slippery slope this week, partly due to the possibility of a new trade deal between the US and China as well as the upcoming mid-term elections, a number of emerging market currencies have profited. Strong gains were seen in the Australian and NZ dealers as well as the ZAR.

Investors began to move away from safe havens such as the dollar with more activity being seen in Asian stock markets and many emerging market currencies have gained ground against the US dollar. The potential of a deal has also provoked volatility in commodity markets and gold in line with the emerging market currencies has also prospered.

Is a trade deal really close?

This week could be a big one for a monumental deal! It appears that after numerous months of back and forth that the UK and EU might have finally found a palatable solution. Likewise, having taken a fraction of the time it appears that market can be optimistic about the likelihood of the US and China signing a new trade deal and potentially avoiding a trade and currency war. But should investors and market be so confident?

It had been reported this week a deal was close with the US officials having been requested by the Trump administration to prepare a draft agreement, however just days later a handful of senior US officials briefed CNBC that a deal was far from imminent; later on Trump’s key economic advisor Larry Kudlow stated that no such draft deal had been requested.

The mixed messages from the US will do little to help stabilise the US stock market which has continued to be unpredictable with many believing it could be tipped in to bear territory. Whilst its understood that both parties have reported progress a deal doesn’t appear to be imminent. Its understood that Trump and President Xi Jinping will meet at the next G-20 summit in Argentina with further trade discussions firmly on the agenda.

Many have been surprised by Trumps sharp change of stance on a potential trade deal withChinaa. It is worth recalling that only a few weeks ago his administration was drawing up tariffs for the remaining goods imported from China. Many believe the motivation for stating an agreement is close could simply be to calm volatile stock markets. In turn, a stable stock market will be reflected positively for the upcoming mid-term elections.

Australian dollar exchange rates surge

The comment, although mixed have allowed the Australian dollar to surge with aggressive gains seen against the US dollar. Australia’s close ties to China and the supply of commodities to the superpower ensured that the AUD experienced its largest one day again against the greenback, since March 2017.

The AUD/USD was propelled from 0.72 to 0.7254 having enjoyed good gain over the week. The pair touching a month low of 0.7025 and rocketing to a 5-week high of 0.7254.

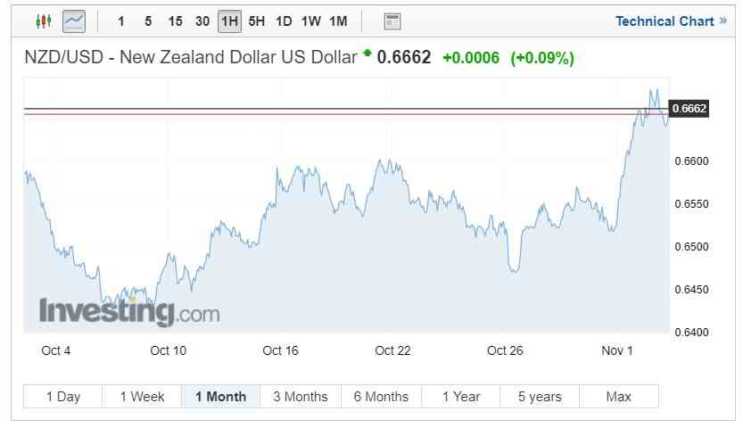

The NZ dollar also took advantage of the rumours jumping from 0.6653 to 0.6683 against the US dollar on Friday.

Whilst the gains are unlikely to be sustained if talks were to progress emerging markets could be back in vogue and climb back from the bleak place they are. Especially if investors become reliant on the USD a safe haven.

Whilst one would have to estimate that the conclusion of a trade deal between China and the US will be as drawn out as the USMCA deal the fact that Trump is going to Argentina with a plan could give markets more confidence. After all, if there is one area where Trump professes to excel it’s the art of deal-making, it won’t be imminent but global pressure should ensure it happens, eventually.