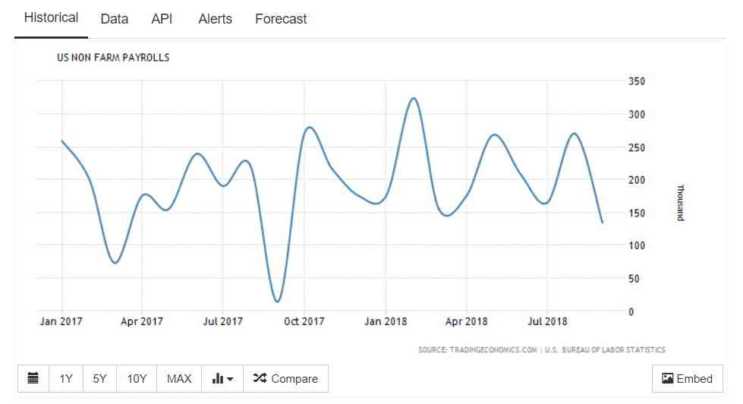

This month’s Non-farm payroll numbers fell well short of market forecast showing just 134,000 additional jobs roles added to the US economy last month. Markets had anticipated a number closer to 185,000 and equated to the lowest monthly job growth of 2018. Despite this, other elements of the US job market continued to prove more than robust with unemployment reaching the lowest number since 1969.

Non-farms disappoints

Although many would have looked negatively upon this month’s figures many in Virginia and the Carolinas experienced challenges working during the recent hurricane. Last month it was estimated that 299,000 were unable to work during hurricane Florence, whilst of those that were able to work roughly 1.5 million were only able to work part-time.

Whilst the effects of Hurricane Florence will be far less impactful than hurricane Harvey employment figures have been impacted in this area. Despite this set back overall employment is up significantly year on year. In 2017 average job growth grew by 182,000 per month, 2018 has demonstrated a marked improvement with the average monthly job number increasing by 206,000.

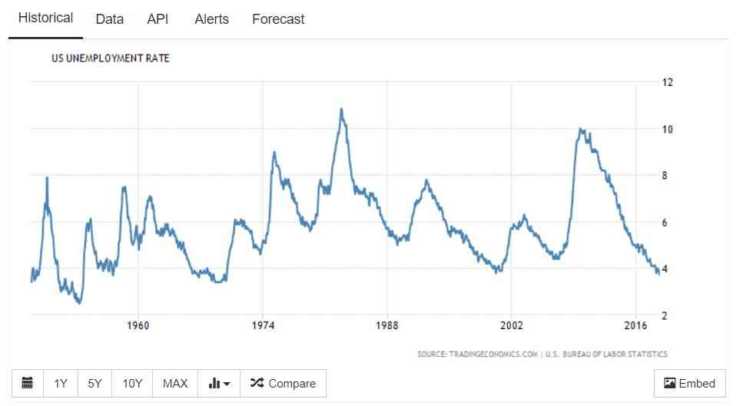

Despite the knock-on effect of the hurricane, Florence US unemployment rates have hit historical lows of 3.7% the lowest since the late sixties.

US unemployment rate lowest in 49 years

Regardless of the disappointing non-farm numbers, the unemployment rate has continued to drop in the US touching 3.7% this month. As Trump has often elaborated on, black and Hispanic unemployment continued to drop falling to 6% and 4.5% respectively.

US wage growth reached 2.9% in August signifying the largest increase in more than 9 years, although the annualised growth dropped to 2.8% this month the figure still supports the FED’s tolerance level in line with the FED’s 2% inflation target. In turn, this should support optimism for a further interest rate rise by the end of the year.

US jobs market now at capacity

Recently we reported many were beginning to believe that the US jobs market was fast approaching capacity. This could, therefore, create another issue whereby employers scrabble for the most talented employees who are presumably offered improved wages. A by-product of this is a potential increase in inflation. The fears would then be that the economy continues to strengthen, unemployment continues to fall, and inflation continues to grow. If this as expected is the case interest rate rises become a necessity, therefore, the current economic landscape remains ripe for interest rate rises.

Dollar and gold reaction

One of the largest movements following this month’s jobs numbers was the movement in Gold, the spot price rising 0.3% and rising to over 02 an ounce. In total, the commodity gained 0.6% over the week.

Currency wise the Euro gained a small and brief gain against the US Dollar following the publication of the latest non-farm payroll numbers touching 1.1536 before falling upon the release of the low unemployment rate erasing the brief gain. Over the last calendar week, the EUR/USD tumbled to a low of 1.1434 upon concerns surround the Italian economy and despite calming words from the economics minister the euro remains weakened.

GBP also enjoyed gains against the Dollar predominantly driven by hopes the UK and European Union may be able to cobble a deal together by November. This rhetoric has allowed the pair to remain above 1.30 and recently test the 1.32 level, reaching a high of 1.3175.

US Dollar forecast

This week the US dollar has the chance to add further support further gains a handful of data releases including the Producer Price Index which is forecast to increase by 0.2%. This release was accompanied by a Core PPI figure which excludes food and energy which can account for up to 40% of the PPI figure and arguably cloud the reading. Tuesday John Williams an FOMC member speaks at a central bank forum with the topic of monetary policy being covered. Questions are welcomed and therefore markets will almost certainly look for clues towards the FED banks sentiment.