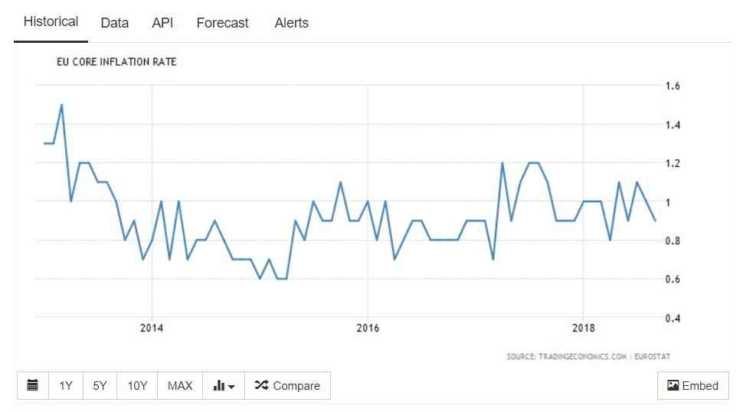

This weeks eurozone inflation dealt a significant blow to the EUR/USD exchange rate as core inflation missed target defying the ECB’s prediction that inflation would begin to slowly pick up. The eurozone core inflation which omits market driven commodities such as food and energy slumped to an annualised figure of 0.9%. Arguably an even bigger issue which followed the data release was the latest Italian budget release whereby the government announced high expectations to slash the countries deficit. However, the proposal apparently contravenes budget guidelines set out by the European Union and could, therefore, see the two parties at loggerheads.

Eurozone core inflation weak

The Eurozone’s core inflation triggered a selloff in the Euro, seeing the single bloc currency fall against many of its peers. Markets had forecast core CPI to edge up to 1.1% and the missed inflation number triggered a Euro sell-off which was exacerbated later in the week by the Italian government announced a budget deficit target three times larger than that of the previous government’s target.

The weak number will almost without a doubt support the ECB’s view that the first rate hike will come in late 2019, however, if the Core inflationary data continues to struggle the historic low interest rates could continue for the foreseeable and could potentially see further monetary policy changes.

Eurozone inflation meets forecast thanks to oil prices

Despite the disappointing core inflation number tumbling, the overall inflationary scenario makes for much more comfortable reading. The headline inflation figure sits above the European Central banks target of 2%, a figure which was achieved last month. The figure being motivated by higher and food energy prices that are progressively increasing with the continued global recovery. Crude Oil prices, for example, increasing over 41% in a year.

Having recently touched $80 a barrel. Oil prices are also predicted to climb higher following OPEC’s reluctance to increase production. Trump has been calling for a significant increase in production in time for the mid-term elections, therefore, allowing him reserves as he looks to impose sanctions on Iran. As part of a strategy to force Iran to negotiate a new nuclear agreement, Trump is calling for importers of Iranian oil to stop importing in order to force Tehran’s hand.

Italian budget triggers market volatility

The announcement from the Italian government regarding their targeted deficit reduction caused volatility across all markets. Italian bond yields climbed 8.62% increasing 33 basis points to 3.216%, the highest level since 31st August. The EUR/USD exchange rate followed suit after the Italian budget announcement falling over 0.5% a trend which investors believe could continue.

The cause of the market volatility was the Italian government announcing a deficit target of 2.4% of the country’s GDP. The target which is three times that of the previous government. Markets had expected an increase in the deficit target, however, had arguably become complacent, expecting a rise to 2% GDP and therefore the announcement triggered market volatility when released by the Italian economy minister Giovanni Tria was announced at 2.4%.

It was rumoured that Tria initially threatened to resign after his call for a deficit target of 1.6% were quickly rejected however this has been denied by Tria.

The European Union are almost certainly to likely to intervene, the union has clear rules that allow a nation to set a deficit target of up to 1.6%, keeping in line with budgetary rules. The disregard for this rule potentially sets a showdown between the Italian government and EU especially if Italy sets out draft plans for its deficit target in October.

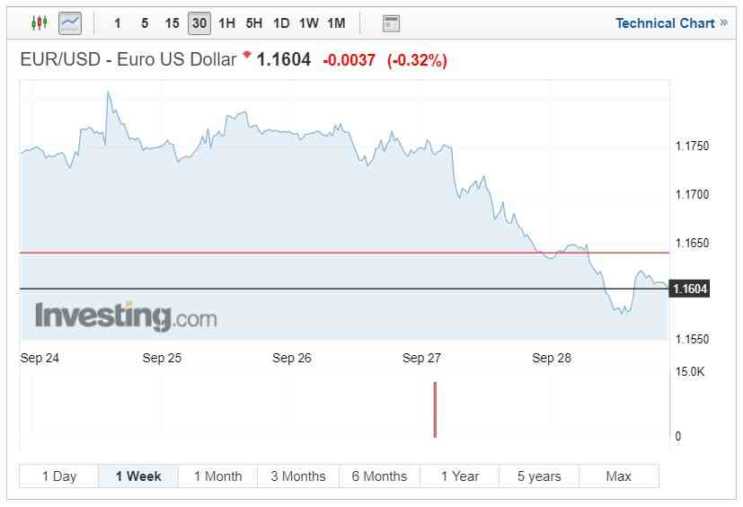

Euro-Dollar exchange rate down

The Euro – Dollar Exchange rates slumped this week following the core inflation figure and Italian deficit announcement. At the beginning of the week at 1.1750 but rallied to a high of 1.1807 however the EUR/USD has slumped to a low of 1.1577 where the pair has languished, markets closing at 1.1604.

The pair quickly headed towards 1.13 with this marker seen as the next support level for further USD progression.

Elsewhere the Euro tumbled to a 4-day low against the Swiss Franc falling to 1.1281, the Euro also fell against the Canadian Dollar, Aussie Dollar and GBP with levels of 1.5078, 1.6055 and 1.1267 being seen in this week’s trading.

Many traders accept no significant upward trend in the EUR/USD, even if the Euro receives support above 1.15 expect no serious positive movements until the level of 1.20 is broken.